Orders $9.4 billion, +21%; comparable1 +28% Revenues $7.0 billion, +1%; comparable +7% Income from operations $857 million; margin 12.3% Operational EBITA1 $997 million; margin1 14.3% Basic EPS $0.31; 25%2 Cash flow from operating activities -$573 million; cash flow from operating activities in continuing operations -$564 million “ABB has started the year with a promising performance in the face of multiple external uncertainties. I […]

continue readingNotice of ABB’s Annual General Meeting on March 24, 2022

ABB today published the invitation to its Annual General Meeting (AGM), which will be held on Thursday, March 24, 2022. The invitation can be found attached and at www.abb.com/agm. ABB’s top priority remains protecting the health of its shareholders and employees. Despite the recent relaxation of COVID-19 protection measures, the Board of Directors therefore resolved that […]

continue readingABB publishes 2021 annual report

ABB Ltd published its 2021 annual report and filed the annual report on Form 20-F with the United States Securities and Exchange Commission The 2021 annual report is now available electronically at www.abb.com/groupreports. It provides comprehensive information on the company and its strategy, business, governance and financial performance. Shareholders may request a printed copy of […]

continue readingDisclosure of 5 percent holding of own shares

On January 21, 2022, ABB held 103,273,145 of its own shares, which corresponds to 5.03 percent of total share capital and voting rights in the company. This includes 64,813,600 shares purchased for capital reduction purposes as part of its follow up share buyback program launched on April 09, 2021. ABB’s total number of issued shares, […]

continue readingABB Capital Markets Day 2021: Cementing Performance Culture

. Revenue growth target lifted to 4-7% through economic cycle Group Operational EBITA margin target sharpened to at least 15% as from 2023 Sustainable transport supporting mid-term growth story CEO: “Demand has remained robust this far and we anticipate positive market momentum in 2022 but still have to manage supply chain disruptions” Swiss IPO for […]

continue readingABB holds 2.1 percent of own shares following the cancellation of 115 million shares

On June 10, 2021, following the completion of the cancellation of 115,000,000 of its shares, ABB held 43,143,949 of its own shares, which corresponds to 2.1 percent of total share capital and voting rights in the company. This includes 24,960,089 shares purchased for capital reduction. ABB’s total number of issued shares, including shares held in […]

continue readingABB shareholders approve all proposals at 2021 Annual General Meeting

Payout of dividend and Board and Executive Committee compensation confirmed. Shareholders also approved capital reduction through the cancellation of shares repurchased under ABB’s share buyback program. The shareholders of ABB have approved all the proposals by the company’s Board of Directors at its 2021 Annual General Meeting. Due to the extraordinary circumstances and in line […]

continue reading

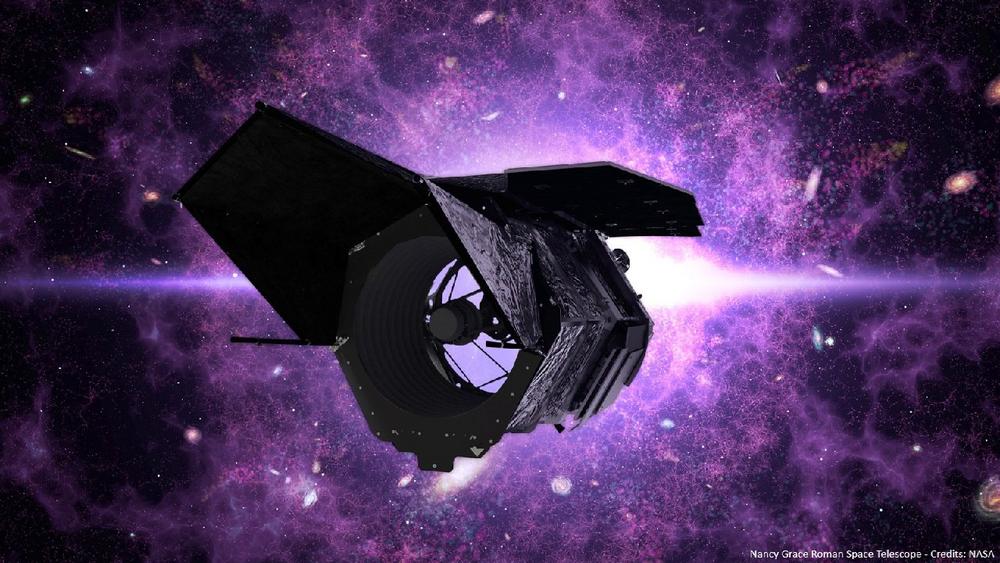

ABB and Nüvü to deliver exo-planet cameras for NASA future telescope

. A two-year contract awarded to ABB from NASA’s Jet Propulsion Laboratory will see key ABB/Nüvü Camēras technology fly onboard the space telescope in 2025, on course to capture the first spaceborne images of planets outside our solar system. The Nancy Grace Roman Space Telescope, NASA’s future space observatory, is due to launch in 2025 […]

continue reading

ABB und Nüvü liefern Kameras für NASA-Teleskop zur Aufnahme von Exoplaneten

ABB und Nüvü Camēras haben vom Jet Propulsion Laboratory der NASA einen Auftrag zur Ausstattung eines Weltraumteleskop mit Schlüsseltechnologien erhalten. Mit dem Teleskop sollen ab 2025 die ersten Aufnahmen von Planeten ausserhalb unseres Sonnensystems aus dem Weltraum heraus gemacht werden. Das Nancy Grace Roman Space Telescope, das künftige Weltraumobservatorium der NASA, wird sich ab 2025 […]

continue readingErgebnis des 3. Quartals 2020

– Auftragseingang -9% auf 6,1 Milliarden US-Dollar, auf vergleichbarer Basis -8%1 – Umsatz -4% auf 6,6 Milliarden US-Dollar, auf vergleichbarer Basis -4% – Ergebnis der Geschäftstätigkeit 71 Millionen US-Dollar, Marge bei 1,1% – Vorsteuererlös von 5,3 Milliarden US-Dollar für Power Grids in nichtfortgeführten Aktivitäten – Operatives EBITA1 von 787 Millionen US-Dollar, Marge1 bei 12,0% […]

continue reading