Drilling continues to define sizeable widths and good grades on the veins, particularly on the northern section of the extensively mined Animas vein corridor. The Company is also highly encouraged by the results of sampling on the Cordon del Oro corridor, the next vein corridor to the west of Animas. Cordon del Oro has never been drilled and is essentially unexplored yet is demonstrating thick vein widths and high grades. Vizsla’s review of data generated over the past months has determined that this corridor offers an excellent opportunity to make significant discoveries. With more than $2.5 million in cash, Vizsla is well-funded for this work and looks forward to reporting results as soon as possible.

Drilling Highlights

- 35 metres at 275 g/t silver equivalent (208.5 grams per tonne (“g/t”) silver and 0.83 g/t gold) in hole AMS-20-08 – Honduras Vein including;

- 556 g/t silver equivalent (432.0 g/t silver and 1.55 g/t gold) over 1.0 metres

- 6 metres at 232 g/t silver equivalent (150.6 g/t silver and 1.02 g/t gold) in hole AMS-20-12 – Honduras Vein including;

- 461 g/t silver equivalent (294.0 g/t silver and 2.09 g/t gold) over 0.7 metres

Note: All numbers are rounded, and widths represent downhole lengths. True widths are estimated at between 57-82% of downhole lengths. Silver equivalent is calculated by multiplying the gold grade by 80 and adding it to the silver grade. All calculations assume 100% metallurgical recovery.

Sampling Highlights

- 2 metres at 1,365 g/t silver equivalent (44.1 g/t silver and 16.52 g/t gold) at Mojocuan 2 prospect on Cordon del Oro Vein including;

- 3,131.8 g/t silver equivalent (75.8 g/t silver and 38.2 g/t gold) over 1.0 metres

- 9 metres at 273.4 g/t silver equivalent (140.0 g/t silver and 1.67 g/t gold) at Rosarito prospect – Animas Vein including;

- 6 g/t silver equivalent (249.2 g/t silver and 3.84 g/t gold) over 2.9 metres

- 2 metres at 479.9 g/t silver equivalent (229.7 g/t silver and 3.13 g/t gold) at Napoleon 4 prospect – Napoleon Vein including;

- 1,467.0 g/t silver equivalent (655.0 g/t silver and 10.15 g/t gold) over 1.2 metres

Note: All numbers are rounded and widths represent true widths. Silver equivalent is calculated by multiplying the gold grade by 80 and adding it to the silver grade. All calculations assume 100% metallurgical recovery.

Vizsla continues to aggressively explore the Panuco project with a systematic program of vein prospecting, detailed surface and underground mapping and sampling, and discovery-oriented drilling. Drill holes AMS-20-08 and AMS-20-12 at the Honduras Vein show the continuation of high-grade mineralization from surface though the specific geometry of mineralization to depth is not yet well understood. Vein prospecting has generated several new areas requiring immediate follow up while detailed mapping has generated spectacular assays that upgrade targets along the Cordon del Oro and Napoleon vein corridors.

CEO Michael Konnert stated “The Panuco silver district continues to offer excellent results and significant discovery potential. Detailed mapping has still only been completed on 19% of the cumulative vein strike length and both Vizsla and historical drilling on 10%, demonstrating the impressive scale of this silver district. The Cordon del Oro and Napoleon veins have never been drilled. These two veins will be the first targets drilled when drilling resumes. The Concordia district, where Panuco is located, is fortunate to have no COVID-19 cases. The Company is working with local authorities to recommence drilling in mid to late May if infection rates remain low”

Drilling Detail

Drill holes AMS-20-08 through AMS-20-14 were drilled from two drills pads to test the Honduras vein which is located just to the north of the town of Panuco. The Honduras vein is a near vertical vein that saw limited shallow mining in the late 1800’s. These drill holes tested beneath the northern part of those mines and further north along strike.

Very encouraging surface values were reported in the Company’s press release on 9 March, 2020. AMS-20-08 was the first test hole and returned 4.35m at 275 g/t silver equivalent (208.5 g/t silver and 0.83 g/t gold). That intercept included 556 g/t silver equivalent (432.0 g/t silver and 1.55 g/t gold) over 1.0m approximately 70m below surface. The mineralization was in a massive quartz vein with irregular patches of very fine-grained argentite. AMS-20-09 was drilled 50m to the north and returned 86.2 g/t silver equivalent over 0.5m. Drill holes AMS-20-10 and 11 were drilled 50m to the south and down dip of the first hole and returned no significant intersections.

The next three holes were drilled from a pad 200m to the NNE of the first holes. AMS-20-12 returned 2.6m at 232 g/t silver equivalent (150.6 g/t silver and 1.02 g/t gold), including 461 g/t silver equivalent (294.0 g/t silver and 2.09 g/t gold) over 0.7m. The mineralization in this hole was mainly massive white quartz with minor fine-grained argentite and minor bands of amethyst. Hole AMS-20-13 was drilled approximately 70m beneath this hole and intersected a wide (12.8m) vein though failed to return significant values. Hole AMS-20-14 was drilled 50m to the south and returned 143 g/t silver equivalent over 0.9m and 136.7 g/t silver equivalent over 0.4m.

Mineralization is open beneath the drilled areas and to the north and further drilling is required to understand the controls on higher grade mineralization.

Detailed Mapping and Sampling

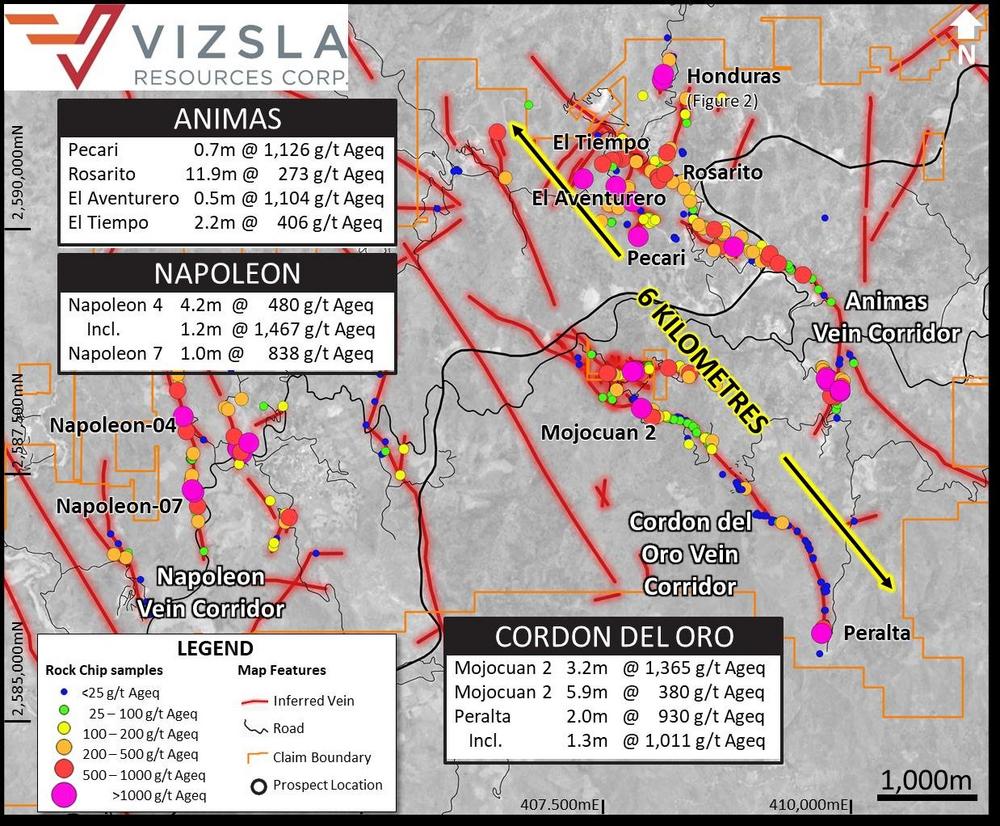

Detailed mapping has continued at the Panuco project to follow-up initial prospecting results at the northern end of the Animas Vein, along Cordon del Oro and along Napoleon. The work has been undertaken to finalise drill targeting and prioritisation.

In the northern end of the Animas Vein Corridor, a number of narrow, but often high-grade, northeast trending veins have been sampled including the Pecari, Chiacates, La Gallina, El Aventurero and El Tiempo. Some of these veins have seen significant underground development.

Where the La Gallina vein intersects the main Animas vein a large mined out area known as the Rosarito mine has been sampled. That sampling has revealed a vein up to 11.9 metres wide with consistent mineralisation. Drilling this target beneath the lowest level of mine workings will be the next target along the Animas vein corridor.

The Cordon del Oro vein has never been drilled and presents as an over six-kilometre-long vein with locally significant widths. The vein dips steeply to the northeast and is interpreted to exploit the opposite side of a graben basin fault to the Animas Vein. Locally it has workings down to 50m below surface in at least three mines. The higher overall elevation and higher gold content indicate it could be a fully preserved analogue to the Animas vein.

Within the Cordon del Oro corridor the Mojocuan 2 prospect returned excellent gold results over a 1.4-5.9m wide vein in systematic sampling. It will be the first target drilled along the trend once man portable drill pads have been constructed. Further along the trend to the southeast zones of mineralization at Mojocuan 1, Cobriza, El Creston and Peralta have a regular periodicity along trend suggesting potential for repeated zones of dilation. In the far south very high grades from Peralta strongly upgrade this target.

Detailed mapping and the compilation of historic sampling from the Napoleon 7 mine have refined drill targets along the corridor. The Napoleon vein locally splits into two 0.5-2m wide veins with locally very high grades that remain open at the lowest level of the mine. Drilling at the Napoleon 7 and Napoleon 4 prospects has been prioritised and will be the first targets drilled on upon resumption of the program.

COVID-19 Update and Restart of Drilling Program

In compliance with government requirements, work on the Panuco project has been on hold due to the COVID-19 pandemic. The government of Mexico has announced municipalities with no or a very low number of COVID-19 cases can transition back to work beginning on the 18th of May. The Concordia municipality has yet to record a COVID-19 case, and as such the Company is planning to recommence drilling next week. The Company will start with one drill rig and supporting crew and then will safely ramp up to prior levels.

The Company plans on adding a second rig to the Panuco project to complete the announced 14,500 metre program and is planning for a second drill rig to be operating at the beginning of June. With two drill rigs the Company expects to maintain its previously stated goal of completing its discovery-oriented drilling program in 2020. Resource drilling will be the 2021 focus.

About the Panuco project

Vizsla has an option to acquire 100% of the newly consolidated 9,386.5 Ha Panuco district in southern Sinaloa, Mexico, near the city of Mazatlán. The option allows for the acquisition of over 75 km of total vein extent, a 500 tpd mill, 35 kms of underground mines, tailings facilities, roads, power and permits.

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

Quality Assurance / Quality Control

Drill core and rock samples were shipped to ALS Limited in Zacatecas, Zacatecas, Mexico and in North Vancouver, B.C. Canada for sample preparation and for analysis at the ALS laboratory in North Vancouver. The ALS Zacatecas and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Silver and base metals were analyzed using a four-acid digestion with an ICP finish and gold was assayed by 30-gram fire assay with atomic absorption (“AA”) spectroscopy finish. Overlimits analyses for silver, lead and zinc were re-assayed using an ore-grade four-acid digestion with AA finish.

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s quality assurance / quality control protocol.

Qualified Person

The technical or scientific information in this press release has been reviewed and approved by Stewart Harris, P.Geo. for the Company. Mr. Harris serves as a Qualified Person under the definition of National Instrument 43-101.

Investor Relations

Vizsla would also like to disclose that it has retained Peak Investor Marketing Corp. Peak provides full service marketing and consulting services focused on the junior mining sector. Peak will assist Vizsla Resources Corp. with marketing strategy and planning, corporate communications and public relations, with the goal of increasing market awareness of the company. Under the terms of the Agreement, the Company will compensate Peak Investor Marketing $10,000 per month on a month to month basis. The Company has also issued Peak 175,000 stock options.

Contact Information: For more information and to sign-up to the mailing list, please contact:

Michael Konnert, President and Chief Executive Officer

Tel: (604) 838-4327

Email: michael@vizslaresources.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain “Forward‐Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward‐looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward‐looking statements or information. These forward‐looking statements or information relate to, among other things: the development of Panuco, including potential drill targets; future mineral exploration, development and production including the identification of drill targets and commencement of drilling; and completion of a maiden drilling program

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Vizsla, future growth potential for Vizsla and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold and other metals; costs of exploration and development; the estimated costs of development of exploration projects; Vizsla’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Vizsla’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and Vizsla has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: satisfaction or waiver of all applicable conditions to closing of the Acquisition including, without limitation, receipt of all necessary approvals or consents and lack of material changes with respect to Vizsla and Canam and their respective businesses, all as more particularly set forth in the Acquisition agreement; the synergies expected from the Acquisition not being realized; business integration risks; fluctuations in general macro‐economic conditions; fluctuations in securities markets and the market price of Vizsla’s common shares; and the factors identified under the caption “Risk Factors” in Vizsla’s management discussion and analysis. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although Vizsla has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Vizsla does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()