Highlights:

· SXG to acquire the remaining 30% interest in Redcastle gold-antimony JV for the purchase price of $250,000 (excluding GST) (the “Acquisition”).

· The Acquisition also eliminates any remaining obligations in respect of royalty payments and concludes the JV.

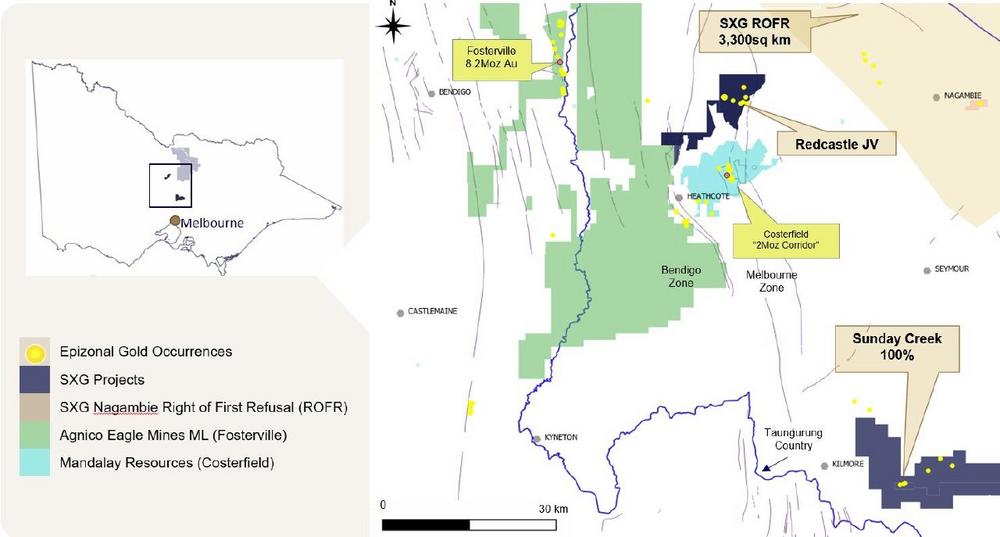

· The Redcastle gold-antimony project is located in the heart of Victoria’s Goldfields, approximately 120 km north of Melbourne. Redcastle is an historically significant goldfield, with high-grade gold production dating back to the 1850s with 17 km of undrilled reef systems that remain to be explored to depth. SXG remains focussed on the 100% Sunday Creek project, while the transaction provides full ownership and control of the Redcastle project.

· Mawson owns 96,590,910 shares of SXG (48.7%), valuing its stake at A$313.0 million (C$287.6 million) based on SXG’s closing price on October 24, 2024 AEDT.

Michael Hudson, Mawson Interim CEO and Executive Chairman, states: “The Acquisition consolidates the ground holding for SXG at Redcastle around high-grade drill results at SXG’s 100% Laura prospect that demonstrated grades up to 704 g/t Au and 24.7% Sb, over thin and targetable structures within a core area where historic mines produced 20,583 oz at 254.6 g/t Au over 2 km strike length, down to a maximum depth of 125 m during 1859 to 1865.

“SXG’s strategic focus remains firmly down the road at the Sunday Creek gold-antimony project, where SXG has five drill rigs operating (going to six in late November). With consolidated ownership, the next steps at Redcastle are to repeat the Sunday Creek strategy to drill to depth beyond high-grade drill holes and old workings, into the 17 km of untested reef systems at Redcastle.”

A summary of the material terms of the Acquisition is set out below in Annexure A.

Annexure A

Summary of material terms of the Acquisition

Currently SXG (via its wholly owned subsidiary SXG Victoria Pty Ltd) owns a 70% beneficial interest in the Redcastle gold-antimony project pursuant to an Option and Joint Venture Agreement with NAG for the Redcastle JV Tenements. Following completion of the Acquisition, SXG will hold a 100% beneficial interest in the Redcastle JV Tenements.

The Acquisition also eliminates any remaining obligations in respect of royalty payments and concludes the JV.

A summary of the material terms of the Acquisition is set out below. SXG will make further announcements as applicable, including regarding finalization of the Acquisition along with technical summaries.

Tenements

The Redcastle JV Tenements comprise Exploration Licence EL5546, Exploration Licence EL007498 and Exploration Licence EL007499. SXG (via SXG Victoria Pty Ltd) holds a 70% beneficial interest in the Tenements and NAG holds a 30% beneficial interest in the Tenements.

Purchase Price

The Purchase Price for the Acquisition is A$250,000 (excluding GST).

Acquisition

At completion of the Acquisition:

- SXG will pay NAG the Purchase Price; and

- SXG will acquire the remaining 30% interest of NAG in the Redcastle JV Tenements; and

- SXG will take control of all mining information in respect of the Tenements; and

- The conditional 1.5% net smelter royalty granted to NAG under the terms of the JV lapses and is of no further force and effect.

Conditions precedent

The Acquisition is subject to and conditional upon:

- The Tenements (including the NAG Interests, or part thereof) not being subject to any encumbrance, or being withdrawn or revoked, at completion.

- The royalty and/or the mining information not being subject to any encumbrance at completion.

- There being no material adverse change or event prior to or at completion which adversely affects, or may adversely affect, the rights and interests proposed to be acquired by SXG (including via SXG Victoria Pty Ltd) pursuant to the Acquisition.

Other terms

- If SXG Victoria Pty Ltd is not registered as the holder of the NAG interests with the Department at completion, NAG shall hold the relevant NAG interests on trust for SXG Victoria Pty Ltd pending such registration and shall put SXG in effective control of the Tenements and facilitate SXG’s plans on the Tenements.

- The Agreement otherwise contains terms typical for arrangements of this kind, including warranties underpinned by relevant indemnities and requirements for the conduct of NAG pending completion.

Technical Background and Qualified Person

The Qualified Person, Michael Hudson, Executive Chairman and a director of Mawson Gold, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed, verified and approved the technical contents of this release.

About Mawson Gold Limited (TSXV:MAW, FRANKFURT:MXR, OTCPINK:MWSNF)

Mawson Gold Limited has distinguished itself as a leading Nordic exploration company. Over the last decades, the team behind Mawson has forged a long and successful record of discovering, financing, and advancing mineral projects in the Nordics and Australia. Mawson holds the Skellefteå North gold discovery and a portfolio of historic uranium resources in Sweden. Mawson also holds 48.7% of Southern Cross Gold Ltd. (ASX:SXG) which owns or controls two high-grade, historic epizonal goldfields in Victoria, Australia, including the exciting Sunday Creek Au-Sb discovery.

About Southern Cross Gold Ltd (ASX:SXG)

[email=https://www.southerncrossgold.com.au/]Southern Cross Gold[/email] holds the 100%-owned Sunday Creek project in Victoria and Mt Isa project in Queensland, the Redcastle joint venture in Victoria, Australia, and a strategic 6.7% holding in ASX-listed Nagambie Resources Limited (ASX:NAG) which grants SXG a Right of First Refusal over a 3,300 square kilometer tenement package held by NAG in Victoria.

On behalf of the Board,

"Michael Hudson"

Michael Hudson, Interim CEO and Executive Chairman

Further Information

1305 – 1090 West Georgia St., Vancouver, BC, V6E 3V7

Mariana Bermudez (Canada), Corporate Secretary

+1 (604) 685 9316 info@mawsongold.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

Forward-Looking Statement

This news release contains forward-looking statements or forward-looking information within the meaning of applicable securities laws (collectively, "forward-looking statements"). All statements herein, other than statements of historical fact, are forward-looking statements. Although Mawson believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Mawson cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, Mawson’s expectations regarding its ownership interest in Southern Cross Gold, capital and other costs varying significantly from estimates, changes in world metal markets, changes in equity markets, the potential impact of epidemics, pandemics or other public health crises on the Company’s business, risks related to negative publicity with respect to the Company or the mining industry in general; exploration potential being conceptual in nature, there being insufficient exploration to define a mineral resource on the Australian-projects owned by SXG, and uncertainty if further exploration will result in the determination of a mineral resource; planned drill programs and results varying from expectations, delays in obtaining results, equipment failure, unexpected geological conditions, local community relations, dealings with non-governmental organizations, delays in operations due to permit grants, environmental and safety risks, and other risks and uncertainties. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Mawson disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()