Highlights: 2024 Updated Mineral Resource Estimate

- Addition of 307koz Au in the Measured and Indicated category (a 36.0% increase) and 223koz Au in the Inferred category (a 44.6% increase).

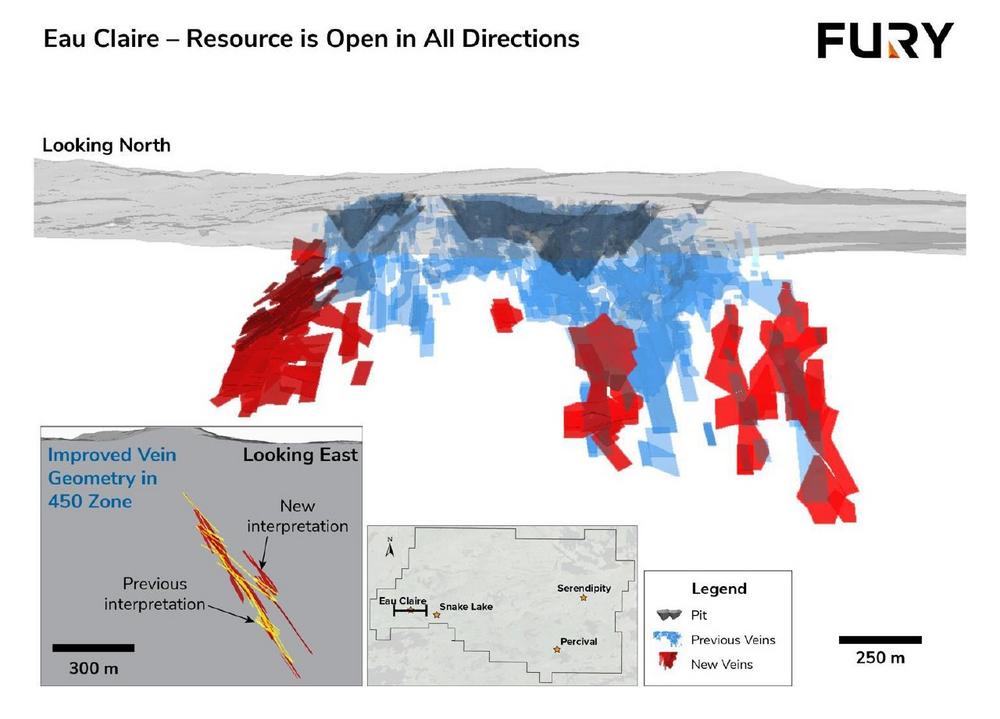

- Eau Claire Resource remains open for further expansion through additional drilling.

- Eau Claire vein geometry steepened in areas with new data and interpretation.

- Percival is one of 15+ anomalies along the Percival – Serendipity trend.

“Today, we are excited to announce our updated Eau Claire Mineral Resource Estimate. These results are the culmination of three years of work that was focused on adding gold ounces and proving out a substantial high-grade gold resource with excellent infrastructure (including hydropower and roads) in the James Bay region of Quebec,” commented Tim Clark, CEO of Fury. “As a recap, we have continued to identify significant potential for new discovery across our broader property, which includes a thirty-kilometer section of the Cannard Deformation Zone. Fifty kilometers to the north, we have also acquired 100% of the Éléonore South property, which is strategically positioned adjacent to Newmont’s operating Éléonore Mine, one of the top-producing gold mines in Canada. In the coming weeks, we will be reporting results from our early 2024 spring program on our Éléonore South property, as well as an additional planned exploration program for 2024.”

At the Eau Claire deposit, the Measured and Indicated gold ounces increased by 32% to 1.16Moz Au and the Inferred gold ounces by 2.4% to 512koz Au with the additional ounces coming from the Hinge Target, Gap Zone, and East Extensions (Table 2; Figure 1). At the Hinge Target, a combination of steep and flat lying stacked gold-bearing quartz tourmaline veins concentrated within a 200 metre (m) wide structurally controlled corridor were modelled based on approximately 21,000 m of drilling. Throughout the Gap Zone and East Extensions, additional ounces came from both extensions of previously modelled veins as well as newly modelled veins. Within the East Extension portion of the resource, vein geometries were remodelled based on additional structural data captured by Fury resulting in veins being steepened from 35 degrees on average to 60 degrees (Figure 1 inset). The Eau Claire deposit remains open to the west, up dip at the Hinge Target, to the east and downdip throughout (Figure 1).

The Maiden Mineral Resource Estimate at the Percival deposit, 14 kilometres (km) to the east of the Eau Claire deposit, contains 211koz Au in the inferred category at a grade of 2.34 g/t Au (Table 3; Figure 2). The Percival resource estimate is based on approximately 15,916 m of diamond core drilling, 7,800 m of which was completed by Fury. Gold mineralization at Percival is hosted within a series of secondary shears running sub-parallel to the regional Cannard Deformation Zone. The host lithologies are folded into an “S-fold” indicating left lateral (sinistral) shearing. The newly completed geological model paired with a better understanding of lithological and structural controls on gold mineralization will aid with further expansion drilling of the Percival deposit as well as targeting to the east of Percival and north to Serendipity.

“When Fury acquired the Eau Claire project in October 2020, we saw a clear pathway for the existing deposit to grow significantly and the potential to define additional deposits within the project area through systematic disciplined exploration. Today’s resource estimate is proof of that concept. Both the Eau Claire and Percival deposits remain open for further expansion. The steepening of the veins in the eastern portion of the Eau Claire deposit has opened additional targets throughout the resource area itself and bodes well for the next stage of the project. Furthermore, the series of targets that our team has developed could lead to additional discoveries within the 55,000 hectare Eau Claire project area. We have yet to realize the full potential of Eau Claire and our team is excited to continue to build upon the current strong resource base and successes to date,” stated Bryan Atkinson, SVP of Exploration at Fury.

Fury will file the accompanying NI43-101 compliant report on our Sedar+ profile within the 45-day allowable limit.

Eau Claire and Percival Deposits Mineral Resource Estimate Notes:Eau Claire and Percival Deposits Mineral Resource Estimate Notes:

(1) The effective date of the Eau Claire project Mineral Resource Estimates (“MREs”), including the Eau Claire and Percival deposit estimates, is May 10, 2024.

(2) The Mineral Resource Estimates were estimated by Maxime Dupéré, B.Sc., géo. of SGS Geological Services and is an independent Qualified Person as defined by NI 43-101.

(3) The classification of the current Mineral Resource Estimates into Measured, Indicated and Inferred mineral resources is consistent with current 2014 CIM Definition Standards – For Mineral Resources and Mineral Reserves.

(4) All figures are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

(5) The mineral resources are presented undiluted and in situ, constrained by continuous 3D wireframe models, and are considered to have reasonable prospects for eventual economic extraction.

(6) Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

(7) The Project mineral resource estimates are based on a validated database which includes data from 1202 surface diamond drill holes totalling 406,431 m, and 426 surface channels (Eau Claire deposit) for 1,345 m. The resource database totals 273,402 drill hole assay intervals representing 267,721 m of data and 2,254 channel assays for 1,316 m.

(8) The MRE for the Eau Claire deposit is based on 280 three-dimensional (“3D”) resource models representing the 450, 850 and hinge zones. The MRE for the Percival deposit is based on 29 3D resource models representing high grade and lower grade halo zones.

(9) Grades for Au were estimated for each mineralization domain using 1.0 metre capped composites assigned to that domain. To generate grade within the blocks, the inverse distance cubed (ID3) interpolation method was used for all domains. An average density value was assigned to each domain.

(10) Based on the location, surface exposure, size, shape, general true thickness, and orientation, it is envisioned that parts of the Eau Claire and Percival deposits may be mined using open-pit mining methods. In-pit mineral resources are reported at a base case cut-off grade of 0.5 g/t Au. The in-pit resource grade blocks are quantified above the base case cut-off grade, above the constraining pit shell, below topography and within the constraining mineralized domains (the constraining volumes).

(11) The pit optimization and base-case cut-off grade consider a gold price of $1,900/oz and considers a gold recovery of 95%. The pit optimization and base case cut-off grade also considers a mining cost of US$2.80/t mined, pit slope of 55⁰ degrees, and processing, treatment, refining, G&A and transportation cost of USD$19.00/t of mineralized material.

(12) The results from the pit optimization, using the pseudoflow optimization method in Whittle 4.7.4, are used solely for the purpose of testing the “reasonable prospects for economic extraction” by an open pit and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the Property. The results are used as a guide to assist in the preparation of a Mineral Resource statement and to select an appropriate resource reporting cut-off grade. A Whittle pit shell at a revenue factor of 0.52 was selected as the ultimate pit shell for the purposes of this mineral resource estimate.

(13) Based on the size, shape, general true thickness, and orientation, it is envisioned that parts of the Eau Claire and Percival deposits may be mined using underground mining methods. Underground mineral resources are reported at a base case cut-off grade of 2.5 g/t Au. The mineral resource grade blocks were quantified above the base case cut-off grade, below surface/pit surface and within the constraining mineralized wireframes (considered mineable shapes). Based on the size, shape, general thickness, and orientation of the mineralized structures, it is envisioned that the deposits may be mined using a combination of underground mining methods including sub-level stoping (SLS) and/or cut and fill (CAF) mining.

(14) The underground base case cut-off grade of 2.5 g/t Au considers a mining cost of US$65.00/t mined, and processing, treatment, refining, G&A and transportation cost of USD$19.00/t of mineralized material.

(15) The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

David Rivard, P.Geo, Exploration Manager at Fury, is a "qualified person" within the meaning of Canadian mineral projects disclosure standards instrument 43-101 and has reviewed and approved the technical disclosures in this press release.

The May 2024 Mineral Resource Estimate has been prepared by Maxime Dupéré, P. Geo., Geologist with SGS Geological Services, a “qualified person” within the meaning of Canadian mineral projects disclosure standards instrument 43-101.

About Fury Gold Mines Limited

Fury Gold Mines Limited is a well-financed Canadian-focused exploration company positioned in two prolific mining regions across Canada and holds a 54 million common share position in Dolly Varden Silver Corp (approximately 19% of issued shares). Led by a management team and board of directors with proven success in financing and advancing exploration assets, Fury intends to grow its multi-million-ounce gold platform through rigorous project evaluation and exploration excellence. Fury is committed to upholding the highest industry standards for corporate governance, environmental stewardship, community engagement and sustainable mining. For more information on Fury Gold Mines, visit www.furygoldmines.com.

For further information on Fury Gold Mines Limited, please contact:

Margaux Villalpando, Manager Investor Relations

Tel: (844) 601-0841

Email: info@furygoldmines.com

Website: www.furygoldmines.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Forward-Looking Statements and Additional Cautionary Language

This release includes certain statements that may be deemed to be "forward-looking statements" within the meaning of applicable securities laws, which statements relate to the future exploration operations of the Company and may include other statements that are not historical facts. Forward-looking statements contained in this release primarily relate to statements that suggest that future work at the Hinge Target or Eau Claire areas will increase or upgrade the estimated gold resources.

Although the Company believes that the assumptions and expectations reflected in those forward-looking statements were reasonable at the time such statements were made, there can be no certainty that such assumptions and expectations will prove to be materially correct. Mineral exploration is a high-risk enterprise.

Readers should refer to the risks discussed in the Company’s Annual Information Form and MD&A for the year ended December 31, 2023 and subsequent continuous disclosure filings with the Canadian Securities Administrators available at www.sedarplus.ca and the Company’s Annual Report available at www.sec.gov. Readers should not place heavy reliance on forward-looking information, which is inherently uncertain.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()