Highlights from extensional drill intercepts include[1],[2]:

- 0 m @ 3.40 g/t AuEq (2.44 g/t Au and 0.69% Cu) (RDUG611) (Didipio Deeps)

- 6 m @ 4.24 g/t AuEq (2.56 g/t Au and 1.20% Cu) (RDUG465) (Eastern Breccia)

- 0 m @ 2.08 g/t AuEq (1.16 g/t Au and 0.66% Cu) (RDUG467) (Eastern Breccia)

- 0 m @ 1.65 g/t AuEq (0.90 g/t Au and 0.54% Cu) (RDUG466) (Eastern Breccia)

Highlights from resource conversion drill intercepts include1,2.:

- 0 m @ 4.55 g/t AuEq (3.39 g/t Au and 0.83% Cu) (RDUG603) (Northern Monzonite)

- 5 m @ 5.35 g/t AuEq (4.22 g/t Au and 0.81% Cu) (RDUG481) (Balut Dyke)

- 0 m @ 2.23 g/t AuEq (1.47 g/t Au and 0.55% Cu) (RDUG602) (Northern Monzonite)

- 0 m @ 2.30 g/t AuEq (1.52 g/t Au and 0.56% Cu) (RDUG475) (Northern Monzonite)

- 1 m @ 3.51 g/t AuEq (2.90 g/t Au and 0.44% Cu) (RDUG484) (Balut Dyke)

- 0 m @ 1.56 g/t AuEq (1.07 g/t Au and 0.35% Cu) (RDUG492) (Balut Dyke)

- 0 m @ 1.83 g/t AuEq (1.38 g/t Au and 0.33% Cu) (RDUG611) (Didipio Deeps)

- 2 m @ 3.01 g/t AuEq (1.65 g/t Au and 0.98% Cu) (RDUG611) (Didipio Deeps)

Resource conversion drill results are in line with and support historic drilling within the resource model shell.

Gerard Bond, President & CEO of OceanaGold said, “Our 2023 drilling program at Didipio has delivered exceptional results to date, supporting our focus on creating value through near-mine exploration targeting resource growth and conversion. Drilling continues to improve confidence within the Inferred portions of the deposit and supports potential reserve growth and our target to increase underground mining rates to at least 2 million tonnes per year, approximately 20% above current underground mining rates. The drilling has also identified exciting extensions beyond known mineralization at the Didipio Deeps, Eastern Breccia and the Balut Dyke, representing significant upside potential outside of existing resources.”

Overview

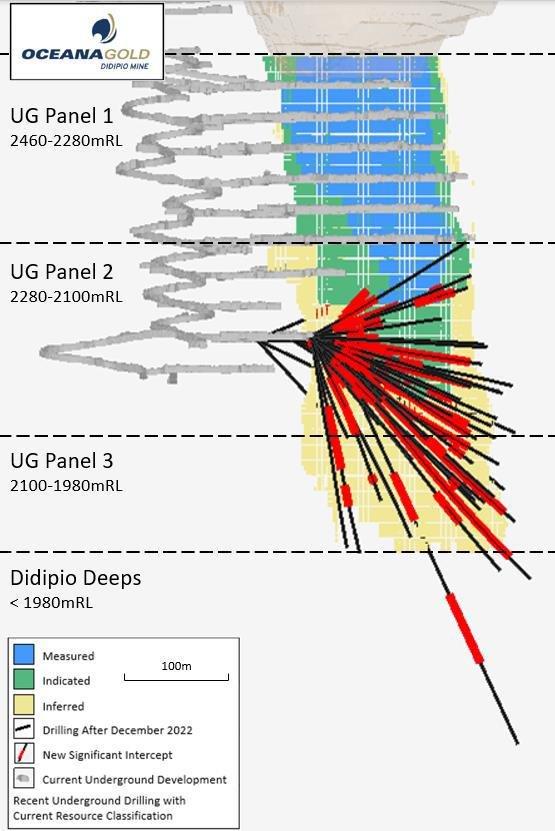

Since December 2022, 9,172 metres of resource conversion and extensional drilling in 45 holes has been completed year to date (“YTD”) and the Company is on track to complete 20,250 metres (“m”) in 2023 (Figures 1 and 2). Extensional drilling has identified new areas of porphyry gold-copper mineralization 100m below existing Inferred Resources within the Didipio Deeps target (previously untested), extensions of the Balut Dyke to the west, and depth extensions of known mineralization within the Eastern Breccia. These targets all remain open for extension beyond the existing resource.

Resource conversion drilling of Inferred Resources, utilising the same holes as extensional drilling, has also successfully returned broad intersections of high-grade gold-copper mineralization within the Balut Dyke, the Monzonite, and the Syenite. These results are in line with and support historic drilling within the resource model shell.

Didipio Deeps

2023 drilling YTD has extended gold-copper mineralization down to a depth of 1860 mRL, which is characterised by chalcopyrite-bornite veinlets and disseminations and remains open at depth. Hole RDUG611 is the deepest hole drilled to date, intersecting several zones of mineralization down hole. The lower zone of 72m at 3.40 g/t AuEq extends mineralization approximately 100m below the current limit of the Inferred Resource shell. Holes RDUG609, RDUG610 and RDUG611 all intersected wide zones of mineralization and will support the conversion of Inferred Resources. Further drilling is underway to better define these zones (Figure 3).

Balut Dyke

2023 drilling YTD of the Balut Dyke below 2200 mRL has returned significant results with similar thickness and grade to previous intercepts extending mineralization along strike to the west (Figure 4). The geometry of the dyke in the west is not adequately defined due to acute drill hole intersection angles for RDUG481 and RDUG484. Definition of the Balut Dyke mineralization and geometry will continue as further underground platforms become available.

Monzonite & Syenite

A wide zone of gold-copper mineralization is hosted by the Balut Dyke, Monzonite and Syenite at the eastern extent of mineralization where drilling supports the conversion of Inferred Resources (Figure 5). Mineralization remains open at depth below 2000 mRL, with the deepest hole (RDUG603) returning the best intercept of 218m @ 4.6 g/t AuEq. Drilling on a similar section down to 1980 mRL is well advanced with a targeted completion by the end of Q3 2023.

Eastern Breccia

2023 drilling YTD of the Eastern Breccia was undertaken immediately below the previously reported intercepts from December 2022 at 2250 mRL level and outside existing Mineral Resources. Three drillholes intersected significant gold-copper mineralization associated with chalcopyrite and bornite veinlets, and pods of chalcopyrite-bearing quartz (Figure 6). This target remains open at depth.

For further information relating to drill hole data for Didipio please refer to the Company’s website at https://oceanagold.com/investor-centre/tsx-asx-filings.

[1] AuEq is calculated as Au g/t + 1.39 x Cu %

[2] Drill results are presented as core lengths (not true widths)

About OceanaGold

OceanaGold is a growing intermediate gold and copper producer committed to safely and responsibly maximizing the generation of Free Cash Flow from our operations and delivering strong returns for our shareholders. We have a portfolio of four operating mines: the Haile Gold Mine in the United States of America; Didipio Mine in the Philippines; and the Macraes and Waihi operations in New Zealand.

Qualified Person Statement

The exploration results in this press release were prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators ("NI 43-101").

Information relating to the Didipio exploration results in this document has been verified and is based on and fairly represents information compiled by or prepared under the supervision of Craig Feebrey, a Member of the Australasian Institute of Mining and Metallurgy and an employee of OceanaGold. Mr Feebrey has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as Qualified Persons for the purposes of the NI 43-101. Mr Feebrey consents to the inclusion in this public report of the matters based on their information in the form and context in which it appears.

QA/QC at Didipio Mine

Exploration diamond core samples at the Didipio mine are typically drilled with HQ core barrel equipment. The HQ samples are then cut, with half of the core retained at the secure core shed facility on site to which access is controlled. In cases where OceanaGold has collected metallurgical samples, a further quarter of the core has been taken with only one-quarter core retained. Following core cutting the half-core sample is submitted for analysis.

Since 2013, all OceanaGold samples have been processed on-site at a laboratory facility operated by SGS Philippines Inc (SGS). After dispatching to SGS, samples are dried at 105 degrees C for 8 to 12 hours, allowed to cool, and then weighed. Within the sample assay workflow, the SGS lab randomly inserts laboratory duplicate and replicate samples as well as certified reference materials for quality control (QC) monitoring. Samples are crushed to produce 500 to 1000g of material for the primary analysis and any lab duplicates. The remaining coarse reject material is retained during the assay process. The sample (and any lab duplicates) are then pulverized to 75% passing 2mm, followed by a subsequent pulverizing to 85% passing 75um. The primary sample is then split down to 200g (with an additional 200g for replicate sampling when applicable). A scoop of 30g is then taken from the 200g sample with the remaining pulp retained.

Gold analysis is by Fire Assay with AAS finish. Copper analysis is either by AAS on a 3-acid digest or XRF. These methods are considered appropriate for the type of mineralisation and expected grade tenor. The quantity and quality of the lithological, geotechnical, and geochemical data collected in the exploration, surface resource delineation, underground resource delineation, and grade control drill programs are considered sufficient to support the Mineral Resource and Ore Reserve estimation.

In addition to the internal SGS QC controls, OceanaGold also monitors laboratory performance with the following processes:

- Inserting duplicate samples;

- Inserting CRM blanks and coarse blanks;

- Inserting CRM standards for Au, Cu, Ag; and,

- Monthly monitoring of SGS duplicate, replicate, and CRM performance.

OceanaGold staff continue to work with SGS laboratory staff to improve analytical performance. SGS is currently accredited with ISO 9001, 14001, and 45001. SGS ISO 17025 accreditation was maintained through 2019 when the site entered operational standby during the FTAA permit renewal process. With the resumption of mining activities in 2021, the SGS lab are working through accreditation renewal requirements with the Philippines government and expect this to be reapplied in mid-2023. Quality Control monitoring by OceanaGold and SGS was undertaken for all the results included in this summary with no issues having been noted.

Technical Reports

For further information, please refer to the following NI 43-101 technical report:

- “NI 43-101 Technical Report Didipio Gold/Copper Operations Luzon Island, Philippines” dated March 31, 2022, prepared by OceanaGold Corporation.

The above document has been filed with the Canadian securities regulatory authorities and is available for review electronically from the Canadian System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com under the Company’s profile.

Cautionary Statement for Public Release

Certain information contained in this public release may be deemed “forward-looking” within the meaning of applicable securities laws. Forward-looking statements and information relate to future performance and reflect the Company’s expectations regarding the generation of free cash flow, execution of business strategy, future growth, future production, estimated costs, results of operations, business prospects and opportunities of OceanaGold Corporation and its related subsidiaries. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those expressed in the forward-looking statements and information. They include, among others, the accuracy of mineral reserve and resource estimates and related assumptions, inherent operating risks and those risk factors identified in the Company’s most recent Annual Information Form prepared and filed with securities regulators which is available on SEDAR at www.sedar.com under the Company’s name. There are no assurances the Company can fulfil forward-looking statements and information. Such forward-looking statements and information are only predictions based on current information available to management as of the date that such predictions are made; actual events or results may differ materially as a result of risks facing the Company, some of which are beyond the Company’s control. Although the Company believes that any forward-looking statements and information contained in this press release is based on reasonable assumptions, readers cannot be assured that actual outcomes or results will be consistent with such statements. Accordingly, readers should not place undue reliance on forward-looking statements and information. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements and information, whether as a result of new information, events or otherwise, except as required by applicable securities laws. The information contained in this release is not investment or financial product advice.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()