Taronga is First Tin’s 100% owned Australian subsidiary, Taronga Mines Pty Ltd (“TMPL”).

Highlights

- Twin diamond drilling: 1,657.5m in 14 drillholes

- Twin RC drilling: 664m in 6 drillholes

- First Tin can now use the significant database of historical Newmont data, in combination with the findings from its extension and infill drilling, to deliver an updated resource estimate for inclusion in the Definitive Feasibility Study (“DFS”).

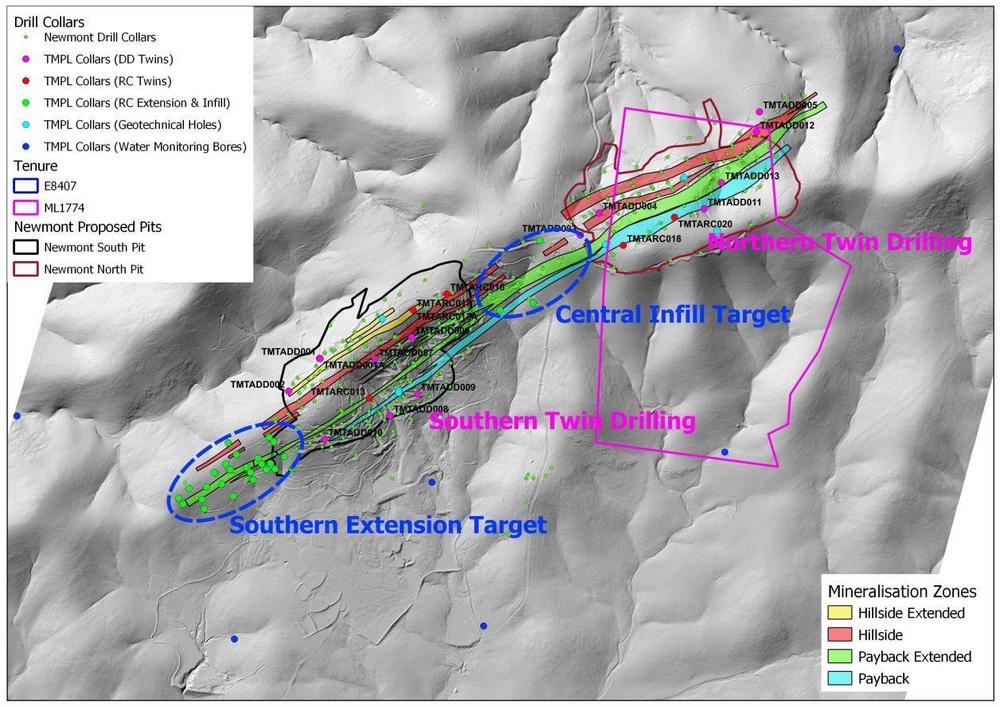

In total, 11 of Newmont’s diamond drillholes were twinned by First Tin diamond drillholes, two of Newmont’s percussion drillholes were twinned by First Tin diamond drillholes and 5 of Newmont’s percussion drillholes were twinned by First Tin RC drillholes as shown on Table 1 and Figure 1. Two drillholes were abandoned due to difficult drilling conditions.

Grades are generally comparable and acceptable for the style of mineralisation. Of the 31 intercepts reported, only 3 are considered to be outside reasonable error limits. Two of these are considerably higher grade than the Newmont intercepts and examination of the core shows exceptionally thick veins with very coarse cassiterite (SnO2, the main tin bearing mineral) suggesting a “nugget effect”. The third interval is lower grade than the Newmont intercept and may suggest the same effect in reverse.

Overall agreement between the TMPL and Newmont assay data is statistically good and shows no bias (Figure 2). It is therefore valid to use the historical data in combination with the new TMPL data.

Details of all drilling data are shown as Table 2 in Appendix 1 and a JORC “Table 1” is included as Appendix 2.

First Tin CEO Thomas Buenger said, “We are pleased with these drilling results which confirm the expectations we had of this impressive asset, following previous Newmont drilling. We can now confidently use the significant amount of historical Newmont data to provide an updated resource estimate which will include our extension and infill drilling. We expect to undertake this updated estimate in the coming months and we look forward to updating shareholders once completed.

“The DFS continues at pace and the range of workstreams underway are progressing positively. We look forward to providing results from our world-class Taronga project as we advance it further.”

Notes to Editors

First Tin is an ethical, reliable, and sustainable tin production company led by a team of renowned tin specialists. The Company is focused on becoming a tin supplier in conflict-free, low political risk jurisdictions through the rapid development of high value, low capex tin assets in Germany and Australia.

Tin is a critical metal, vital in any plan to decarbonise and electrify the world, yet Europe has very little supply. Rising demand, together with shortages, is expected to lead tin to experience sustained deficit markets for the foreseeable future. Its assets have been de-risked significantly, with extensive work undertaken to date.

First Tin’s goal is to use best-in-class environmental standards to bring two tin mines into production in three years, providing provenance of supply to support the current global clean energy and technological revolutions.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()