David Garofalo, Chairman and CEO of Gold Royalty, commented, "Gold Royalty’s portfolio of long-life, high-quality assets saw several significant advancements in the first quarter of 2023. The organic growth within our portfolio is coming to fruition, fueling increased revenue and cash flow as key development stage royalties enter production over the coming years. Odyssey is ramping up production in 2023; Côté is on track to commence production in 2024; and Ren continues to grow as a key high-grade extension of the Goldstrike Mine. With a strong balance sheet and access to capital, we enter 2023 well-positioned to deliver long-term shareholder value through our significant organic growth profile."

Highlights for the three months ended December 31, 2022, include:

- Total Revenue and Option Proceeds of $1.1 million for the three months ended December 31, 2022, an 11% increase from the three months ended December 31, 2021. "Total Revenue and Option Proceeds is a non-IFRS Measure. See "Non-IFRS Measures".

- With approximately $35 million in available liquidity, inclusive of a $15 million accordion feature in its credit facility (available subject to certain additional conditions), the Company is positioned well for further growth.

- The Company forecasts between $5.5 million and $6.5 million in Total Revenues and Option Proceeds in 2023.

- Gold Royalty now holds 216 royalties with a focus on the top ranked mining jurisdictions in the Americas (Fraser Institute Annual Survey of Mining Companies 2021 Investment Attractiveness Index).

- Gold Royalty declared its fifth consecutive quarterly dividend in 2022, yielding over 1.8% at current share prices.

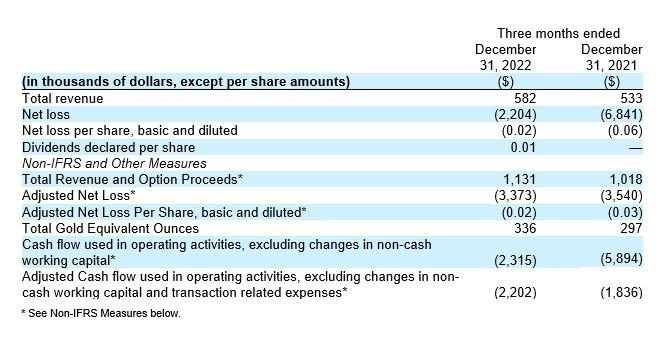

The following table sets forth selected financial information for the three-month transition period ended December 31, 2022 and the three months ended December 31, 2021, respectively:

For further detailed information, please refer to the Company’s audited financial statements and management’s discussion and analysis, for the three months ended December 31, 2022, copies of which are available under the Company’s profile at www.sedar.com and www.sec.gov.

Outlook

Gold Royalty expects to receive $5.5 million and $6.5 million in Total Revenues and Option Proceeds in 2023 based on the production guidance published to date by the operators of the properties underlying the Company’s existing royalties and a forecasted gold price ranging from $1,700 per ounce to $2,000 per ounce and expected payments on optioned properties. The Company expects to incur $7.0 million to $8.0 million in recurring cash operating expenses in 2023, a midpoint decrease of 30% compared to fiscal 2022. Gold Royalty is poised to generate net free cash flow in 2024 when a number of its growth projects ramp up in production, including the long-life cornerstone mines at Cote and Odyssey.

The foregoing projected outlook constitutes forward-looking information and is intended to provide information about management’s current expectations for the Company’s 2023 fiscal year. Although considered reasonable as of the date hereof, such outlook and the underlying assumptions may prove to be inaccurate. Accordingly, actual results could differ materially from the Company’s expectations as set forth herein. See “Forward-Looking Statements”.

In preparing the above outlook, the Company assumed, among other things, that the operators of the projects underlying royalties will meet expected production milestones and forecasts for the applicable period and that operators of optioned properties will elect to make all expected option payments over the period. This section includes forward-looking statements. See “Forward-Looking Statements”.

Portfolio Update

- Odyssey Project (3.0% NSR royalty over the northern portion of the project): On February 16, 2023, Agnico Eagle Mines Limited ("Agnico Eagle") disclosed that the Canadian Malartic mine and the Odyssey mine will now form the Canadian Malartic Complex. Initial production from the underground Odyssey mine commenced in March 2023, with production ramping up through the remainder of the year. Infill drilling continues to expand and upgrade mineral resources. 102,000 metres of exploration drilling is planned for 2023 at Odyssey with four key objectives: conversion of resources to higher confidence at East Gouldie; testing the extents of East Gouldie; converting extensions of the Odyssey South deposit; and further exploration of additional internal zones at Odyssey.

- Côté Gold Project (0.75% NSR royalty over the southern portion of the project): On February 16, 2023, IAMGOLD Corporation ("IAMGOLD") disclosed that, as of December 31, 2022, the Côté Gold project was estimated to be approximately 73% complete. It further disclosed that IAMGOLD believes that the aggregate proceeds from the sale of its interest in the Rosebel mine, the anticipated proceeds from the sale of the Bambouk assets and funds to be provided by Sumitomo under the joint venture for the mine will meet the estimated remaining funding requirements for the completion of construction at the Côté Gold Project based on the current schedule and estimate. IAMGOLD further stated that the Côté Gold project is expected to commence production in early 2024 when it is expected to become Canada’s third largest gold mine by production.

- Ren Project (1.5% NSR royalty and 3.5% NPI): On February 15, 2023, Barrick Gold Corporation ("Barrick") announced its 2022 results, including updates on the Carlin Complex and updated resource estimates for Ren as at December 31, 2022. At Ren, indicated mineral resources increased to 62 koz of gold (0.17 Mt at 11.04 g/t) and inferred resources increased to 1,600 koz of gold (7.4 Mt at 6.6 g/t), an increase in inferred ounces of roughly 33% compared to the 2021 maiden mineral resource estimate for the project. Barrick expects further exploration success and resource growth at Ren in 2023.

- Fenelon Gold Project (2.0% NSR royalty over the majority of the project): On January 17, 2023 Wallbridge Mining Company Limited (“Wallbridge”) announced an updated mineral resource estimate with an effective date of March 3, 2023 for the Fenelon Gold project that outlined indicated resources of 2,370 koz of gold (21.7 Mt at 3.40 g/t) and inferred resources are 1,720 of gold (18.5 Mt at 2.89 g/t). The updated mineral resource estimate is expected to form the foundation for Wallbridge’s upcoming preliminary economic assessment of Fenelon, which is expected to be completed in the second quarter of 2023.

- Granite Creek Mine Project (10.0% NPI): On March 14, 2023, i-80 provided an update and recap of progress at the Granite Creek Mine Project during the 2022. Multiple underground levels have been developed, especially on the Ogee Zone, and i-80 continued to extend the decline to depth, with the goal of initiating access to the new South Pacific Zone located immediately below and to the north of the underground mine workings. i-80 targets to complete underground drilling and bring the newly discovered South Pacific Zone into the Granite Creek mine plan in 2023. In the upper parts of the mine, high-grade gold mineralization was being defined in the Otto, Adam Peak and Range Front horizons, while from the lower levels drilling was focused on defining mineralization in the Ogee Zone that is expected to be the primary zone in the near future.

- Jerritt Canyon Mine (0.5% NSR royalty & PTR): On March 20, 2023 First Majestic announced it is taking action to reduce overall costs by reducing investments, temporarily suspending all mining activities and reducing its workforce at Jerritt Canyon effective immediately. During the suspension, First Majestic intends to process approximately 45,000 tonnes of aboveground stockpiles through the plant. Exploration activities are expected to also continue throughout 2023 with several additional plans for optimization of the asset. As a result of the suspension, First Majestic’s previous production and cost guidance for Jerritt Canyon can no longer be relied upon. First Majestic’s revised consolidated production and cost guidance, including capital investments, are expected to be published in July. Gold Royalty notes that Jerritt Canyon accounts for less than 2% of its portfolio net asset value based on consensus estimates.

Investor Webcast

An investor webcast will be held on Tuesday, March 28, 2023 starting at 11:00 am ET (8:00 am PT) to discuss these results. Management will be providing an update to interested stakeholders on the Company’s quarterly results including key recent catalysts that have been announced on the assets underlying the Company’s royalties. The presentation will be followed by a question-and-answer session where participants will be able to ask any questions they may have of management.

To register for the investor webcast, please click the link below: https://www.bigmarker.com/vid-conferences/GoldRoyalty-Mar-2023-Results-Webcast

About Gold Royalty Corp.

Gold Royalty Corp. is a gold-focused royalty company offering creative financing solutions to the metals and mining industry. Its mission is to invest in high-quality, sustainable, and responsible mining operations to build a diversified portfolio of precious metals royalty and streaming interests that generate superior long-term returns for our shareholders. Gold Royalty’s diversified portfolio currently consists primarily of net smelter return royalties on gold properties located in the Americas.

Gold Royalty Corp. Contact

Peter Behncke

Manager, Corporate Development & Investor Relations

Telephone: (833) 396-3066

Email: info@goldroyalty.com

Qualified Persons

Alastair Still, P.Geo., Director of Technical Services of the Company, is a "qualified person" as such term is defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects of Canadian Securities Administrators and has reviewed and approved the technical information disclosed in this news release.

Non-IFRS Measures

We have included, in this news release, certain performance measures that do not have standardized meanings prescribed under International Financial Reporting Standards ("IFRS"), including: (i) Total Revenue and Option Proceeds, which is determined by adding proceeds from option agreements to revenue; (ii) Adjusted Net Loss, which is determined by deducting transaction-related expenses, share of loss and dilution gain in associate, impairment, changes in fair value of derivative liabilities and short-term investments, gain on loan modification, foreign exchange gain/(loss) and other income from net income (loss); (iii) Adjusted Net Loss Per Share, which is determined by dividing Adjusted Net Loss by the weighted average number of common shares for the applicable period; (iv) cash flows from operating activities, excluding changes in non-cash working capital, which is determined by excluding the impact of changes in non-cash working capital items to or from cash used in operating activities; (v) cash flows from operating activities, excluding changes in non-cash working capital and transaction related expenses, which is determined by deducting transaction-related expenses from cash flows from operating activities, excluding changes in non-cash working capital; and (vi) Gold Equivalent Ounces, which are determined by dividing revenue by the average gold price for the applicable period. Each of these are non-IFRS measures. The presentation of such non-IFRS measures is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The Company presents such measures as it believes that certain investors use this information to evaluate the Company’s performance in comparison to other royalty companies in the precious metals mining industry. Readers are advised that other companies may calculate such measures differently. The presentation of these non-IFRS measures is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. For additional information, including a numerical reconciliation of such non-IFRS measures, readers should refer to the section titled "Non-IFRS Measures" in the Company’s management’s discussion and analysis for the three months ended December 31, 2022, which is incorporated by reference herein and available under the Company’s profile at www.sedar.com.

Notice to Investors

Disclosure relating to properties in which Gold Royalty holds royalty or other interests is based on information publicly disclosed by the owners or operators of such properties. The Company generally has limited or no access to the properties underlying its interests and is largely dependent on the disclosure of the operators of its interests and other publicly available information. The Company generally has limited or no ability to verify such information. Although the Company does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate.

Forward-Looking Statements:

Certain of the information contained in this news release constitutes ‚forward-looking information‘ and ‘forward-looking statements’ within the meaning of applicable Canadian and U.S. securities laws ("forward-looking statements"), including but not limited to statements regarding: estimated future Total Revenues and Option Proceeds; expectations regarding the development of the projects underlying the Company’s royalty interests; expectations regarding the Company’s growth and statements regarding the Company’s plans and strategies. Such statements can be generally identified by the use of terms such as "may", "will", "expect", "intend", "believe", "plans", "anticipate" or similar terms. Forward-looking statements are based upon certain assumptions and other important factors, including assumptions of management regarding the accuracy of the disclosure of the operators of the projects underlying the Company’s projects, their ability to achieve disclosed plans and targets, macroeconomic conditions, commodity prices, and the Company’s ability to finance future growth and acquisitions. Forward-looking statements are subject to a number of risks, uncertainties and other factors which may cause the actual results to be materially different from those expressed or implied by such forward-looking statements including, among others, any inability to any inability of the operators of the properties underlying the Company’s royalty interests to execute proposed plans for such properties or to achieved planned development and production estimates and goals, risks related to the operators of the projects in which the Company holds interests, including the successful continuation of operations at such projects by those operators, risks related to exploration, development, permitting, infrastructure, operating or technical difficulties on any such projects, the influence of macroeconomic developments, the ability of the Company to carry out its growth plans and other factors set forth in the Company’s Annual Report on Form 20-F for the year ended September 30, 2022 and its other publicly filed documents under its profiles at www.sedar.com and www.sec.gov. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

Telefon: +41 (71) 354-8501

E-Mail: mo@resource-capital.ch

![]()