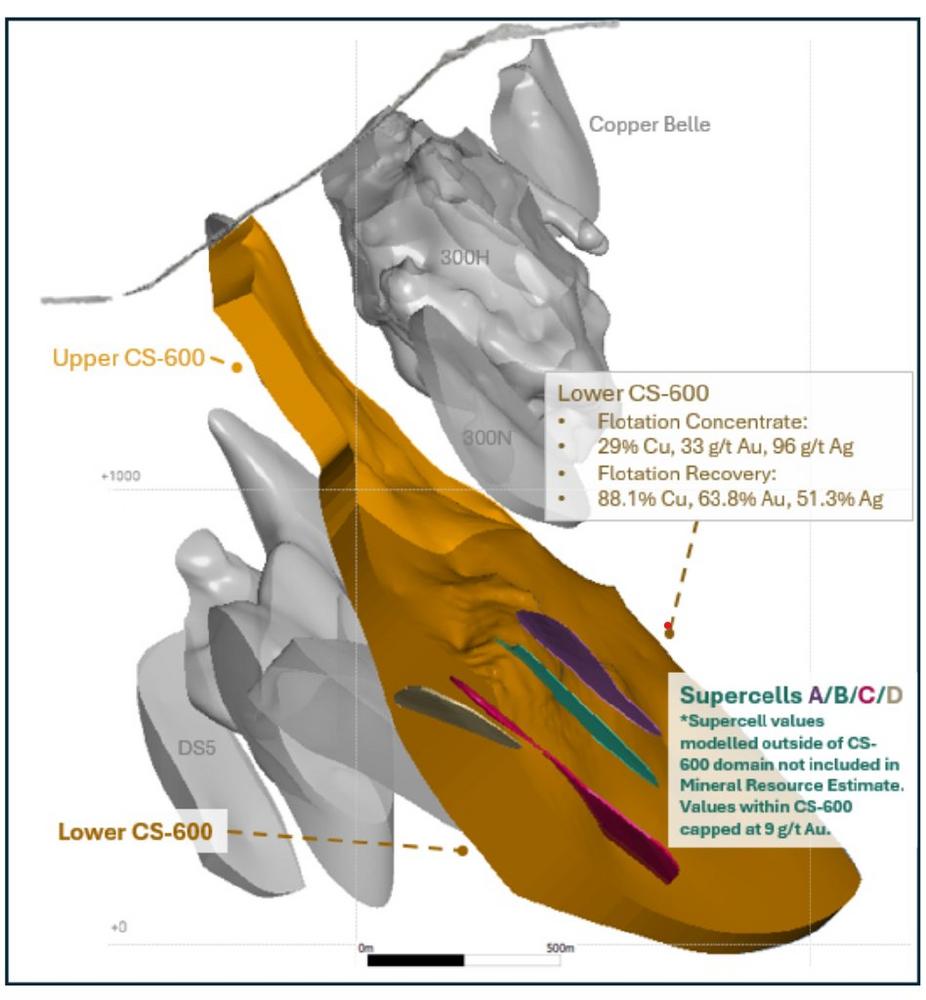

Highlights from the Metallurgical Testing on the Lower CS-600 Sub-Domain include:

- Flotation recoveries within the Lower CS-600 sub-domain totaled up to 88.1% copper, 63.8% gold, and 51.3% silver;

- Flotation testing confirmed that a high-grade copper concentrate with significant quantities of gold can be produced from the Lower CS-600 sub-domain, that exceed 29% copper with significant gold and silver grades of 33 g/t and 96 g/t, respectively;

The flotation program uses a typical copper flowsheet to produce the saleable copper concentrate mentioned above. Further flotation testwork is ongoing to produce a separate pyrite concentrate containing gold and silver. The positive results from flotation, in conjunction with previous oxidative leaching methods (such as Pressure Oxidation or Albion), continue to support the previously reported gold recoveries of 90% for the Lower CS-600 domain. The testing program was designed and executed with sufficient rigor to support a future Preliminary Economic Assessment (PEA).

Commenting on the results, Ken Konkin, President & CEO of Tudor Gold stated, "We are very pleased with the results obtained from the locked-cycle flotation tests from this phase of metallurgical testing on material from the lower portion of the CS-600 Domain (CS-600L). We estimate more than 50% of the CS-600 Domain is located within the lower portion (the CS-600L sub-domain). Through a simple rougher-cleaner flotation process we were able to produce an exceptionally clean, high-grade concentrate with excellent metal recoveries, with over 88% for copper and approximately 64% for gold. The CS-600L sub-domain is located in the same area which hosts the newly discovered Supercell-1 (SC-1) high-grade gold complex. Our engineering team has recommended initial metallurgical tests to be conducted on material collected from the SC-1 drill hole intercepts. The SC-1 composite sample will be shipped to SGS Labs for metallurgical tests.

Our concept is to focus on the high-grade SC-1 to study the possibility of extracting as much high-grade gold as possible while potentially building out the infrastructure to access the CS-600L area. The plan is to utilize the same workings from the Supercell complex to access the CS-600 domain. These latest results from the CS-600L Domain significantly de-risk the Goldstorm project with respect to metallurgical characteristics of the copper-gold mineralization and will be utilized in a future Preliminary Economic Assessment (PEA).

Additionally, two gold-dominant domains, 300H and DS5, have demonstrated high gold recoveries from previous oxidation/cyanidation tests, with results exceeding 94% gold recovery for the Albion process and in excess of 98% gold recovery for pressure oxidation tests. We were very pleased to observe that no deleterious compounds were formed from any of the types of oxidation-leach tests completed, which will allow our technical team to conduct trade-off studies for recovery vs costs for each process. Given the favorable metallurgical test results obtained from this gravity/flotation system for the CS-600L sub-domain, testing and potentially expanding the SC-1 high-grade gold complex will be our primary focus moving forward. Additional tests are also recommended to examine the northernmost part of CS-600 (CS-600N) which has never been tested previously and continued tests on the upper CS-600 (CS-600U). However, the lower portion of CS-600 has enough volume to mine and process 40,000 tpd over 17 years producing a highly desirable copper concentrate with good gold and silver credits. The goal for the Treaty Creek Deposit is to be able to produce at least 500,000 AuEQ ounces per year. Our mineral process engineers can determine the optimal size and type of mineral processing to be considered for advancing the project that will part of the PEA with a series of trade-off studies examining the most economical path forward for the Treaty Creek Project.

GOLDSTORM DEPOSIT – Viewing Southwest (220°/-10°) – Figure 1

Metallurgical Test Work and Results:

Recent metallurgical testing carried out at Blue Coast Research, under the supervision of Tad Crowie, P. Eng. of JDS Energy & Mining Inc. demonstrated that a high-grade copper concentrate could be produced from the Lower CS-600 sub-domain. The locked cycle test achieved recoveries of 88.1% copper, 63.8% gold, and 51.3% silver into a concentrate with grade exceeding 29% copper and 30 g/t Au for the Lower CS-600. A locked cycle test is considered an important step in developing a mineral processing flowsheet which incorporates flotation, as it demonstrates the effects that re-cycle streams will have on the overall process. The tests were completed on samples that are consistent with those used for the previous metallurgical testing and had gold and copper feed grades of 0.91 g/t Au and 0.59% Cu, which are consistent with the grades in the Lower CS-600 sub-domain.

The current flotation flowsheet follows a typical copper flotation circuit configuration, with standard copper flotation reagents, as seen in Figure 2. The primary grind in the current testwork has been reduced from a P80 of 120 µm used in the previous testwork program to a P80 of 75 µm allowing for a higher overall recovery of copper than has been previously achieved. The gold recoveries have achieved similar results to previous flotation testwork.

Locked Cycle Test Flowsheet: Figure 2 – Source: Blue Coast Research (2024)

A rougher concentrate regrind target of P80 of 30 µm allowed the production of a high-grade copper concentrate, exceeding 29% copper with significant gold and silver grades of 33 g/t Au and 96 g/t Ag for CS-600L.

The locked cycle test results for the combined products of last 3 cycles of the test (cycles 4, 5, and 6) can be found in the table below. The locked cycle test achieved stability after the first 2 cycles, which demonstrates that the flowsheet is stable, as well as validating the test results.

Highlights of the 2024 Locked Cycle testing on the Lower CS-600 Sub-Domain: Table 1 – Source: Blue Coast Research (2024)

The high copper concentrate grade, along with high levels of gold and silver, achieved in this test suggests that there are opportunities to pull the circuit harder to increase overall metal recovery.

QA/QP

The metallurgical program was carried out by Blue Coast Research of Nanaimo, B.C., selected to conduct further mineralogical assessment of the Goldstorm sample material. The metallurgical and mineralogical work was conducted under the supervision of Tad Crowie, P. Eng of JDS Energy & Mining Inc., a Qualified Person as defined by NI 43-101. Mr. Crowie has reviewed this news release and agreed to its contents.

Ken Konkin, P.Geo, President and CEO, Tudor Gold, is the Qualified Person, as defined by National Instrument 43-101, responsible for the Project. Mr. Konkin has reviewed, verified, and approved the scientific and technical information in this news release.

Standard QA/QC sampling procedures are maintained by SGS and Blue Coast to ensure accurate and representative testing.

About Treaty Creek

The Treaty Creek Project hosts the Goldstorm Deposit, comprising a large gold-copper porphyry system, as well as several other mineralized zones. As disclosed in the “NI-43-101 Technical Report for the Treaty Creek Project”, dated April 5, 2024 prepared by Garth Kirkham Geosystems and JDS Energy & Mining Inc., the Goldstorm Deposit has an Indicated Mineral Resource of 27.87 Moz of AuEQ grading 1.19 g/t AuEQ (21.66 Moz gold grading 0.92 g/t, 2.87Blbs copper grading 0.18 %, 128.73 Moz silver grading 5.48 g/t) and an Inferred Mineral Resource of 6.03 Moz of AuEQ grading 1.25 g/t AuEQ (4.88 Moz gold grading 1.01g/t, 0.503 Blb copper grading 0.15 %, 28.97 Moz silver grading 6.02 g/t), with a pit constrained cut-off of 0.7 g/t AuEQ and an underground cut-off of 0.75 g/t AuEQ. The Goldstorm Deposit has been categorized into three dominant mineral domains and several smaller mineral domains. The CS-600 Domain largely consists of an intermediate intrusive stock and hosts the majority of the copper mineralization within the Goldstorm Deposit. CS-600 has an Indicated Mineral Resource of 15.65 Moz AuEQ grading 1.22 g/t AuEQ (9.99 Moz gold grading 0.78 g/t, 2.73 Blbs copper grading 0.31%, 73.47 Moz silver grading 5.71g/t) and an Inferred Mineral Resource of 2.86 Moz AuEQ grading 1.20 g/t AuEQ (1.87 Moz gold grading 0.79 g/t, 0.48 Blb copper grading 0.29%, 13.4 Moz silver grading 5.63 g/t). The Goldstorm Deposit remains open in all directions and requires further exploration drilling to determine the size and extent of the Deposit.

About Tudor Gold

TUDOR GOLD CORP. is a precious and base metals exploration and development company with claims in British Columbia’s Golden Triangle (Canada), an area that hosts producing and past-producing mines and several large deposits that are approaching potential development. The 17,913-hectare Treaty Creek project (in which TUDOR GOLD has a 60% interest) borders Seabridge Gold Inc.’s KSM property to the southwest and borders Newmont Corporation’s Brucejack property to the southeast.

ON BEHALF OF THE BOARD OF DIRECTORS OF

TUDOR GOLD CORP.

"Ken Konkin"

Ken Konkin

President and Chief Executive Officer

For further information, please visit the Company’s website at www.tudor-gold.com or contact:

Chris Curran

Head of Corporate Development and Communications

Phone: (604) 559 8092

E-Mail: chris.curran@tudor-gold.com

Or

Patrick Donnelly

Vice President of Capital Markets

Phone: (604) 559 8092

E-Mail: patrick@tudor-gold.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. “Forward-looking information” includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including the completion and anticipated results of planned exploration activities. Generally, but not always, forward-looking information and statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the Company’s planned exploration activities will be completed in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s plans or expectations include risks relating to the actual results of current exploration activities, fluctuating gold prices, possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Company with securities regulators.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()