- Highly attractive portfolio of three projects at a late stage of development, with grid connections and permits secured, as well as advanced procurement of key components

- Delivery of the three Norfolk Offshore Wind Zone projects off the UK’s East Anglia coast will be part of RWE’s Growing Green investment and growth plans

- Agreed purchase price corresponds to an enterprise value of £963 million

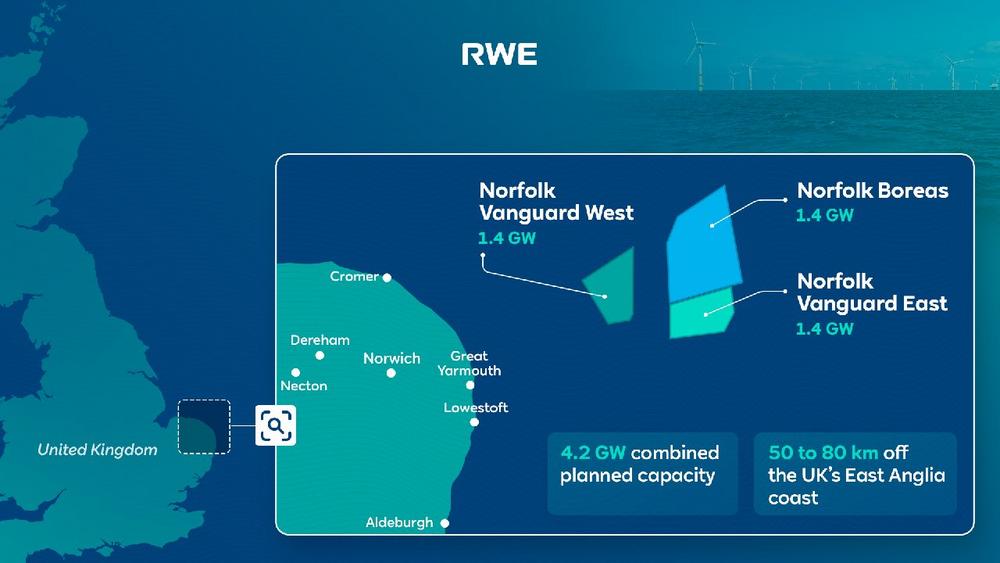

RWE, one of the world’s leading offshore wind companies, will acquire the UK Norfolk Offshore Wind Zone portfolio from Vattenfall. The portfolio comprises three offshore wind development projects off the east coast of England – Norfolk Vanguard West, Norfolk Vanguard East and Norfolk Boreas.

The three projects, each with a planned capacity of 1.4 gigawatts (GW), are located 50 to 80 kilometres off the coast of Norfolk in East Anglia. This area is one of the world’s largest and most attractive areas for offshore wind. After 13 years of development, the three development projects have already secured seabed rights, grid connections, Development Consent Orders and all other key permits. The Norfolk Vanguard West and Norfolk Vanguard East projects are most advanced, having secured the procurement of most key components. The next milestone in the development of these two projects is to secure a Contract for Difference (CfD) in one of the upcoming auction rounds. RWE will resume the development of the Norfolk Boreas project, which was previously halted. All three Norfolk projects are expected to be commissioned in this decade.

Sven Utermöhlen, CEO of RWE Offshore Wind: “With the acquisition of the Norfolk Offshore Wind Zone portfolio, we are taking over three well-advanced offshore wind projects from Vattenfall. I am very happy that we will work with Vattenfall towards facilitating team continuity to ensure the successful handover and further development of the projects. Equally I am looking forward to continuing the work with the supply chain companies. We will deliver these as part of our Growing Green investment and growth programme.“

Tom Glover, RWE’s UK Country Chair: “The UK has been one of our most important core markets for decades. We are delighted that we can now further contribute to achieving the UK’s ambitious build-out targets for offshore wind. The timely and efficient deployment of offshore wind is essential to ensure the UK’s domestic energy security, as well as achieving our net zero targets. We very much welcome the UK government’s recent decisions on future offshore wind auctions which provides us with the confidence to invest and represents a positive step in maximising the UK’s clean energy potential, ensuring sustained and lowest prices for consumers and creating good quality jobs.”

At its Capital Markets Day 2023, RWE announced plans to invest €55 billion worldwide in the years 2024 to 2030, to grow its green portfolio to more than 65 GW by 2030. This is backed by RWE’s extensive development pipeline and its strong financial headroom. The Norfolk portfolio will be part of RWE’s Growing Green investment and growth programme. Its acquisition will add three highly attractive projects to RWE’s project pipeline. RWE’s net capacity target to add more than 30 GW by 2030 remains unchanged.

The agreed purchase price to acquire the Vattenfall portfolio is based on an enterprise value of £963 million. The majority of the purchase price relates to expenses spent to date.

Closing of the transaction is subject to approval by The Crown Estate and regulatory approvals, and expected for the first quarter of 2024.

The UK plays a key role in RWE’s strategy to grow its offshore wind portfolio

RWE is a leading partner in the delivery of the UK’s Net Zero ambitions and energy security, as well as in contributing to the UK build-out target for offshore wind of 50 GW by 2030. RWE already operates 10 offshore wind farms across the UK. Including the acquisition of the three Norfolk offshore wind projects from Vattenfall, RWE develops nine offshore wind projects in the UK, representing a combined potential installed capacity of around 9.8 GW, with RWE’s pro rata share amounting to 7 GW. Furthermore, RWE is constructing the 1.4 GW Sofia offshore wind project in the North Sea off the UK’s east coast. RWE’s unparalleled track record of more than 20 years in offshore wind has resulted in 19 offshore wind farms in operation, with a goal to triple its global offshore wind capacity from 3.3 GW today to 10 GW in 2030.

Forward-looking statements

This press release contains forward-looking statements. These statements reflect the current views, expectations and assumptions of management, and are based on information currently available to management. Forward-looking statements do not guarantee the occurrence of future results and developments and are subject to known and unknown risks and uncertainties. Actual future results and developments may deviate materially from the expectations and assumptions expressed in this document due to various factors. These factors primarily include changes in the general economic and competitive environment. Furthermore, developments on financial markets and changes in currency exchange rates as well as changes in national and international laws, in particular in respect of fiscal regulation, and other factors influence the company’s future results and developments. Neither the company nor any of its affiliates undertakes to update the statements contained in this press release.

RWE is leading the way to a green energy world. With its investment and growth strategy Growing Green, RWE is contributing significantly to the success of the energy transition and the decarbonization of the energy system. Around 20,000 employees work for the company in almost 30 countries worldwide. RWE is already one of the leading companies in the field of renewable energy. Between 2024 and 2030, RWE will invest 55 billion euros worldwide in offshore and onshore wind, solar energy, batteries, flexible generation, and hydrogen projects. By the end of the decade, the company’s green portfolio will grow to more than 65 gigawatts of generation capacity, which will be perfectly complemented by global energy trading. RWE is decarbonizing its business in line with the 1.5-degree reduction pathway and will phase out coal by 2030. RWE will be net-zero by 2040. Fully in line with the company’s purpose – Our energy for a sustainable life.

RWE Aktiengesellschaft

Altenessener Straße 35

45141 Essen

Telefon: +49 (201) 5179-0

Telefax: +49 (201) 5179-5005

http://www.rwe.com

Presse RWE AG

Telefon: +49 (201) 12-22088

E-Mail: stephanie.schunck@rwe.com

Pressesprecherin

Telefon: +49 (201) 12-15140

E-Mail: vera.buecker@rwe.com

![]()