Highlights:

– 48.9 m @ 3.0 g/t AuEq in 550 m step out from Apollo (2.0 g/t Au, 0.64% Sb) from 182 m in hole SDDSC049, at the “Golden Dyke” shoot west of Apollo, including

– 13.7 m @ 9.4 g/t AuEq (6.6 g/t Au, 1.79% Sb) from 201.3 m, including

– 2.7 m @ 20.9 g/t AuEq (10.4 g/t Au, 6.59% Sb) from 204.4 m, and

– 2.3 m @ 27.9 g/t AuEq (24.7 g/t Au, 2.01% Sb) from 211.0 m

– Broad zone of mineralization, coupled with extremely high grades at Apollo in SDDSC045

– 89.5m @ 1.9 g/t AuEq (1.8 g/t Au, 0.04% Sb, no lower cut applied) from 97.4m, including

– 0.4 m @ 52.5 g/t AuEq (52.4 g/t Au, 0.04% Sb) from 174.7 m

– 0.3 m @ 362.6 g/t AuEq (362.5 g/t Au, 0.04% Sb) from 184.3 m

– First hole in NW-SE orientation demonstrating continuity of high-grade mineralization and shows the true thickness of the Apollo shoot (up to 50 m, with higher grades over 20 m – 40 m).

– Third drill rig mobilized, with SXG now drilling three areas along an 800 m strike of known surface mineralization

– Three holes are in geological processing, and three holes in progress

– The deepest drilling to date undertaken

– Of particular interest is drill hole SDDSC050 now at 770 m down hole, designed to drill the Rising Sun shoot (between Apollo and Golden Dyke) in a previously untested west to east orientation

– Mawson owns 60% of Southern Cross Gold

Ivan Fairhall, Mawson CEO, states: “The stellar drill results just keep coming from Sunday Creek. High grades continue at Apollo and show ever-increasing continuity and predictability. Excitingly, we now see the new zone discovered at Golden Dyke and a compounding of the discovery success on the property – first observed as Apollo was extended down plunge, and now along strike 800 m to Golden Dyke.

Mawson shareholders benefit from exploration opportunity on multiple properties – here, via Mawson’s 60% ownership of SXG with three rigs now operating, at Mawson’s Skellefteå Swedish 85% earn-in, and most importantly in Finland, where down-plunge and regional opportunities look to build on the recent Rajapalot PEA which highlighted a post-tax NPV5 of US$211m for the 1moz AuEq Rajapalot discovery.”

Results Discussion

Golden Dyke

Holes SDDSC047 and SDDSC049 are SXG’s first drill test under the most productive historic mining area (Golden Dyke) at Sunday Creek. These results are an extremely significant result as it demonstrates that multiple mineralized areas exist over a 700 m strike, including:

- Golden Dyke drill hole SDDSC049 reported here: 48.9 m @ 3.0g/t AuEq (2.0 g/t Au, 0.64% Sb) from 182 m (no lower cut) including

- Rising Sun, drill hole SDDSC046 located 210 m east from SDDSC049: 21.5 m @ 15.0 g/t AuEq (12.2 g/t Au and 1.7% Sb), and

- Apollo, drill hole SDDSC033 located 550 m east from SDDSC049: 119.2 m @ 3.2 g/t Au and 0.4% Sb (3.9 g/t AuEq).

SDDSC049 was drilled 35 m beneath historic workings at Golden Dyke and 160 m below the shallow historic drill hole CRC020 54.0 m @ 1.9 g/t AuEq (1.5 g/t Au, 0.3% Sb) from 0 m, including 3.0 m @ 17.9 g/t AuEq (16.2 g/t Au and 1.1% Sb). SDDSC049 intersected

- 1.4 m @ 6.8 g/t AuEq (0.3 g/t Au, 4.09% Sb) from 195.8 m, including

- 0.4 m @ 22.97 g/t AuEq (0.7 g/t Au, 14.10% Sb) from 195.8 m

- 13.7 m @ 9.4 g/t AuEq (6.6 g/t Au, 1.79% Sb) from 201.3 m, including

- 2.7 m @ 20.9 g/t AuEq (10.4 g/t Au, 6.59% Sb) from 204.4 m, and

- 2.3 m @ 27.9 g/t AuEq (24.7 g/t Au, 2.01% Sb) from 211.0 m

SDDSC047 drilled 30 m east of SDDSC049, and also reported here, demonstrates a wide zone of arsenic anomalism from 177.6 m to 206 m (28.4m), with lower grade gold including 10.2 m @ 0.9 g/t AuEq (0.9 g/t Au, 0.01% Sb) from 192.8 m, including 0.3 m @ 5.1 g/t AuEq (5.1 g/t Au, 0.02% Sb) from 197.8 m and is considered a near miss.

Apollo

Drill hole SDDSC045 intersected a very broad zone of mineralization from 97.4 m – 186.8 m downhole (89.5m @ 1.9 g/t AuEq (1.8 g/t Au, 0.04% Sb, no lower cut applied)) coupled with extremely high grades, including:

- 6 m @ 1.6 g/t AuEq (1.6 g/t Au, 0.01% Sb) from 97.4 m

- 4 m @ 3.6 g/t AuEq (2.8 g/t Au, 0.56% Sb) from 126.8 m, including

- 3 m @ 8.1 g/t AuEq (7.0 g/t Au, 0.71% Sb) from 127.1 m

- 3 m @ 5.8 g/t AuEq (4.3 g/t Au, 0.95% Sb) from 131.3 m

- 2 m @ 1.1 g/t AuEq (0.8 g/t Au, 0.14% Sb) from 154.0 m, including

- 6 m @ 9.9 g/t AuEq (6.5 g/t Au, 2.17% Sb) from 163.4 m

- 8 m @ 2.8 g/t AuEq (2.8 g/t Au, 0.01% Sb) from 168.9 m, including

- 4 m @ 52.5 g/t AuEq (52.4 g/t Au, 0.04% Sb) from 174.7 m

- 8 m @ 28.9 g/t AuEq (28.9 g/t Au, 0.01% Sb) from 183.0 m, including

- 3 m @ 362.6 g/t AuEq (362.5 g/t Au, 0.04% Sb) from 184.3 m

Drill hole SDDSC042, drilled 40 m above SDDSC045 intersected a very broad zone of mineralization from 111.9 m – 146.9 m down hole (36.1 m @ 1.4 g/t AuEq (1.2 g/t Au, 0.08% Sb no lower cut applied)):

- 0 m @ 1.3 g/t AuEq (1.2 g/t Au, 0.03% Sb) from 111.9 m

- 0.2 m @ 12.3 g/t AuEq (0.9 g/t Au, 7.21% Sb) from 137.5 m

- 3 m @ 4.7 g/t AuEq (4.1 g/t Au, 0.35%Sb) from 137.5 m

- 0.6 m @ 16.6 g/t AuEq (16.4 g/t Au, 0.10% Sb) from 143.3 m

Drillhole SDDSC045 graded 3.8 m @ 28.9 g/t AuEq (28.9 g/t Au, 0.01 % Sb) from 183.0 m, including 0.3 m @ 362.6 g/t AuEq (362.5 g/t Au and 0.04% Sb) and 0.4 m @ 52.5 g/t AuEq (52.4 g/t Au, 0.04 % Sb) from 174.7 m.

SDDSC042 graded 6.3 m @ 4.7 g/t AuEq (4.1 g/t Au, 0.35 % Sb) from 137.5 m including 0.6 m @ 16.6 g/t AuEq (16.4 g/t Au, 0.10 % Sb).

Importantly, both holes form part of a cluster of higher-grade intersections within a 60 m x 30 m x 30 m area in the Apollo shoot (Figures 3 and 4). These exceptionally high-grade results are the first drill test undertaken in a NW-SE orientation across the NNE-trending Apollo shoot, demonstrate continuity of high-grade mineralization and show the true thickness of the Apollo shoot (up to 50 m, with higher grades over 20 m – 40 m). Multiple holes within this area drilled in various orientations have now demonstrated significant grades and widths

Update on Current Drilling

SXG has three rigs drilling at Sunday Creek at Sunday Creek at the Golden Dyke, Rising Sun and Apollo prospects. Three holes (SDDSC048A/51/52) are being geologically processed and analyzed, with three holes (SDDSC050/53/54) in drill progress (Figure 2).

SXG reports of particular interest is drill hole SDDSC050, designed to drill the Rising Sun shoot in a previously untested west to east orientation. A preliminary visual geological log of SDDSC050 indicates the Rising Sun shoot was intersected around 350 m with multiple zones of mineralization occurring from 393 to 763 m with visible gold noted in certain restricted zones (Photos 1-3). This appears to be the thickest intersection of mineralization seen to date, pending assays. The hole remains in progress at 770 m down hole depth and is the deepest hole on the project by 251 m (previous deepest hole was MDDSC026 at 519.2 m).

Sunday Creek Overview

Mineralized shoots at Sunday Creek are formed at the intersection of the sub-vertical to shallower dipping 330 degree striking mineralized veins and a steep east-west striking, north dipping structure hosting dioritic dykes and related intrusive breccias. The dimensions of each shoot will be uncovered with further drilling, but typically:

- In the down plunge orientation (80 degrees towards trend of 020 degrees), high grades show a linear continuity to at least 400 m from surface and remain open.

- 20 m to 30 m wide in the up-dip/down-dip orientation but can blow out to be wider (i.e. around SDDSC033), and;

- A true thickness of up to 50 m, with higher grades between 20 m and 40 m in the cross section of the shoot but further drilling will be required to establish a more accurate average.

Sunday Creek has a 10 km mineralized trend that extends beyond the drill area and is defined by historic workings and soil sampling which have yet to receive any exploration drilling and offers potential future upside. Historic drilling extends mineralization 500 m west of Golden Dyke to the historic Christina mine. The 10 km NE direction covers historic mining areas at Leviathan, Consols, Aftermath and Tonstal, all held within SXG 100% exploration tenure (Figure 5).

Figures 1-4 show project location and plan, longitudinal and cross section views of drill results reported here and Tables 1–3 provide collar and assay data. The true thickness of the mineralized intervals is interpreted to be approximately 60% – 70% of the sampled thickness of high-grade mineralization. All drill results quoted have a lower cut of 0.3 g/t Au cut over a 3.0 m width, with higher grades reported with a 5 g/t Au cut over 1.0 m, unless otherwise indicated.

Technical Background and Qualified Person

The Qualified Person, Michael Hudson, Executive Chairman and a director of Mawson Gold, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed, verified and approved the technical contents of this release.

Analytical samples are transported to the Bendigo facility of On Site Laboratory Services (“On Site”) which operates under both an ISO 9001 and NATA quality systems. Samples were prepared and analyzed for gold using the fire assay technique (PE01S method; 25 gram charge), followed by measuring the gold in solution with flame AAS equipment. Samples for multi-element analysis (BM011 and over-range methods as required) use aqua regia digestion and ICP-MS analysis. The QA/QC program of Southern Cross Gold consists of the systematic insertion of certified standards of known gold content, blanks within interpreted mineralized rock and quarter core duplicates. In addition, On Site inserts blanks and standards into the analytical process.

Gold equivalent “AuEq” for Sunday Creek is = Au (g/t) + 1.58 × Sb (%) based on assumed prices of gold US$1,700/oz Au and antimony US$8,500/metal tonne, and total year metal recoveries of 93% for gold and 95% for antimony. Given the geological similarities of the projects, this formula has been adopted to align to TSX listed Mandalay Resources Ltd Technical Report dated 25 March 2022 on its Costerfield project, which is located 54 km from Sunday Creek and which historically processed mineralization from the property.

For previously reported exploration results, refer to the following:

- May 4, 2020 CRC020

- March 8, 2022 SDDSC021

- May 30, 2022 SDDSC033

- October 4, 2022 SDDSC046

Refer to Mawson’s announcement 20 October, 2022 for full disclosure relating to the results of the Rajapalot PEA. Gold equivalent grades (AuEq) and ounces for Rajapalot are to align to the PEA metal prices of $1,700/oz Au and $60,000/t Co and recovery assumptions of 95% Au and 87.6% Co. (AuEq2 = Au g/t + Co ppm / 988).

About Mawson Gold Limited (TSX:MAW, FRANKFURT:MXR, OTCPINK:MWSNF)

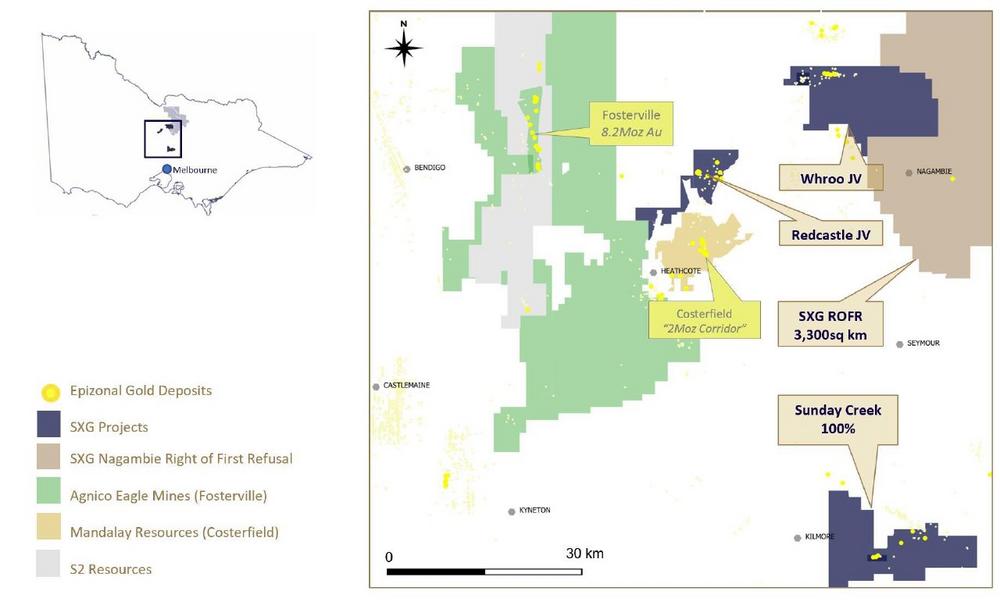

Mawson Gold Limited is an exploration and development company. Mawson has distinguished itself as a leading Nordic Arctic exploration company with its 100% owned flagship Rajapalot gold-cobalt project in Finland, and right to earn into the Skellefteå North gold project in Sweden. Mawson also owns 60% of Southern Cross Gold Ltd (ASX:SXG) which in turn owns or controls three high-grade, historic epizonal goldfields covering 470 km2 in Victoria, Australia.

About Southern Cross Gold Ltd (ASX:SXG)

[email=https://www.southerncrossgold.com.au/]Southern Cross Gold[/email] holds the 100%-owned Sunday Creek project in Victoria and Mt Isa project in Queensland, the Redcastle and Whroo joint ventures in Victoria, Australia, and a strategic 10% holding in ASX-listed Nagambie Resources Limited (ASX:NAG) which grants Southern Cross a Right of First Refusal over a 3,300 square kilometre tenement package held by NAG in Victoria.

On behalf of the Board,

"Ivan Fairhall" Ivan Fairhall, CEO

Further Information

www.mawsongold.com

1305 – 1090 West Georgia St., Vancouver, BC, V6E 3V7

Mariana Bermudez (Canada), Corporate Secretary

+1 (604) 685 9316 info@mawsongold.com

Forward-Looking Statement

This news release contains forward-looking statements or forward-looking information within the meaning of applicable securities laws (collectively, "forward-looking statements"). All statements herein, other than statements of historical fact, are forward-looking statements. Although Mawson believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Mawson cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, Mawson’s expectations regarding its ownership interest in Southern Cross Gold, capital and other costs varying significantly from estimates, changes in world metal markets, changes in equity markets, the potential impact of epidemics, pandemics or other public health crises, including the current pandemic known as COVID-19 on the Company’s business, risks related to negative publicity with respect to the Company or the mining industry in general; exploration potential being conceptual in nature, there being insufficient exploration to define a mineral resource on the Australian-projects owned by SXG, and uncertainty if further exploration will result in the determination of a mineral resource; planned drill programs and results varying from expectations, delays in obtaining results, equipment failure, unexpected geological conditions, local community relations, dealings with non-governmental organizations, delays in operations due to permit grants, environmental and safety risks, and other risks and uncertainties disclosed under the heading "Risk Factors" in Mawson’s most recent Annual Information Form filed on www.sedar.com. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Mawson disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +41 (71) 354-8501

E-Mail: mo@resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()