Beartrack Property

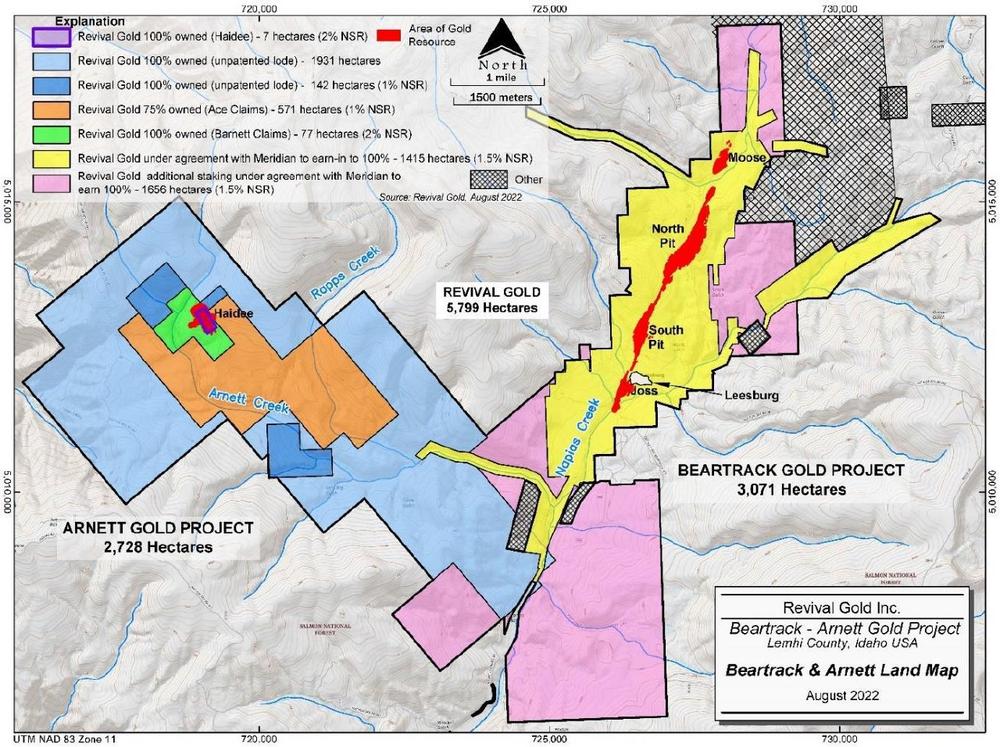

On August 30th, 2022, Revival Gold executed an Amended and Restated Stock Purchase Agreement and Exploration Agreement with Meridian Gold Company (“Meridian”) (a wholly owned subsidiary of Yamana Gold Inc.) under which Revival Gold and Meridian agreed to extend the period of time for Revival Gold to complete earn-in obligations to acquire Meridian Beartrack Co. (owner of the Beartrack property and related infrastructure) by two years to September 29th, 2024. In connection with the extension, Revival Gold has committed to continue to fund certain site operating and management costs (“O&M” costs, estimated to be approximately US$850,000 per year including site bonding surety) and increase the required earn-in exploration spend at Beartrack from US$10 million to US$15 million (of which, approximately US$12 million had been expended as at June 30th, 2022).

The Beartrack property includes an estimated $40-50 million in site infrastructure value and hosts the bulk of Mineral Resources at Beartrack-Arnett. Upon completion of the Meridian Beartrack Co. acquisition (the “Acquisition”), Revival Gold will assume responsibility for site bonding. The current face value of the Beartrack site bond is $10.2 million. Revival Gold will also be required to provide a 1% Net Smelter Return (“NSR”) royalty, an additional NSR royalty of 0.5% (terminating when the payments of the additional royalty total $2 million) and pay the greater of $6 per troy ounce of the total gold Mineral Resources or $15 per troy ounce of proven and probable gold Mineral Reserves after the third anniversary of the acquisition.

Barnett Mineral Claims

On April 29th, 2022, Revival Gold paid the final US$250,000 option payment under the Barnett Agreement (announced June 30th, 2017 and amended April 9th, 2020) fulfilling all requirements to acquire a 100% interest in the Barnett mineral claims located at Beartrack-Arnett. The Barnett mineral claims host a portion of the Haidee Mineral Resource at Beartrack-Arnett and offer the potential to expand the Mineral Resource in that location. The Barnett mineral claims are central to Revival Gold’s potential future heap leach re-development plans for the project.

ACE Mineral Claims

Revival Gold currently holds a 75% interest in certain other mineral claims (known as the ACE mineral claims) located within the Beartrack-Arnett property. The ACE mineral claims are peripheral to the known Mineral Resources at Beartrack-Arnett. The holding of this property package and the exploration priority are under review.

“We are pleased to have extended the Beartrack property earn-in period and to have completed the acquisition of a 100% interest in the Barnett claims”, said Hugh Agro, President and CEO. “The Barnett claims offer exciting exploration potential and the added flexibility with the Beartrack property earn-in will allow Revival Gold to continue to build overall project value through the current turbulent market”, added Agro.

Figure 1 below illustrates the Beartrack-Arnett property interests referenced in this press release.

In addition to the update on Revival Gold’s Beartrack-Arnett property agreements, the Company announces that it has extended the expiry date for the agreement to vend its 51% non-core holding in the Diamond Mountain phosphate project located in Uintah County, Utah, USA to Xplore Resources Ltd. (TSXV: XPLR) to September 31st, 2022.

Qualified Persons

Steven T. Priesmeyer, C.P.G., Vice President Exploration, and John P.W. Meyer, P.Eng., Vice President Engineering and Development are the Company’s designated Qualified Persons for this news release within the meaning of National Instrument 43‑101 Standards of Disclosure for Mineral Projects and have reviewed and approved its scientific and technical content.

About Revival Gold Inc.

Revival Gold Inc. is a growth-focused gold exploration and development company. The Company is advancing the Beartrack-Arnett Gold Project located in Idaho, USA.

Beartrack-Arnett is the largest past-producing gold mine in Idaho. Engineering work has been initiated on a Preliminary Feasibility Study (“PFS”) for the potential restart of heap leach operations. Meanwhile, exploration continues, focused on expanding the 2022 Indicated Mineral Resource of 65.0 million tonnes at 1.01 g/t gold containing 2.11 million ounces of gold and Inferred Mineral Resource of 46.2 million tonnes at 1.31 g/t gold containing 1.94 million ounces of gold (see Revival Gold NI-43-101 Technical Report dated July 13th 2022 for further details). The mineralized trend at Beartrack extends for over five kilometers and is open on strike and at depth. Mineralization at Arnett is open in all directions.

Revival Gold has approximately 86.9 million shares outstanding and an estimated cash balance of C$7.1 million as of June 30th, 2022. All figures in this press release are in metric units and in $US unless stated otherwise. Additional disclosure including the Company’s financial statements, technical reports, news releases and other information can be obtained at www.revival-gold.com or on SEDAR at www.sedar.com.

Cautionary Statement

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This News Release includes certain "forward-looking statements" which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties, and other factors involved with forward-looking information could cause actual events, results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company’s objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

President & CEO or Melisa Armand, Investor Relations

Telefon: +1 (416) 366-4100

E-Mail: info@revival-gold.com

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()