- Resource Drilling Focused on Shallow Mineralization Proximal to Bethania Mine Workings

- 63% of Indicated Silver Equivalent* Resource Estimate Located Above Historical Production Adit (4670 Level)

Vancouver, BC, January 6, 2022 – Kuya Silver Corporation (CSE: KUYA) (OTCQB: KUYAF) (Frankfurt: 6MR1) (the “Company” or “Kuya Silver” – https://www.commodity-tv.com/ondemand/companies/profil/kuya-silver-corp/)) is pleased to announce its first-ever mineral resource estimate on the Bethania Silver Project (the “Project”), focused on the historical mine area where most of the Company’s shallow diamond drilling took place during the 2021 Phase 1 exploration program. The resource estimate consists of 18 different veins all located within the original mine area and includes data collected from the 2021 (“Phase One”) 5,000 metre diamond drilling program as well as previously collected underground rock chip samples. The mineral resource estimate is reported in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards (2014) incorporated by reference in National Instrument 43-101 – Standards of Disclosure for Mineral Projects. The mineral resource estimate is solely focused on the main Bethania Mine area, with no mineral resource estimates for the newly identified and proximal Hilltop Zone.

Highlights of the initial mineral resource estimate include:

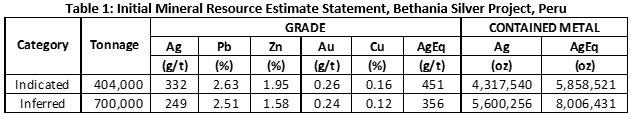

- Indicated resources of 5,858,521 oz silver equivalent* at an average grade of 451 g/t silver equivalent contained in 404,000 tonnes.

- Inferred resources of 8,006,431 oz silver equivalent* at an average grade of 356 g/t silver equivalent contained in 700,000 tonnes.

- Silver represents 74% of the gross metal value* in the Indicated resource and 70% of the gross metal value* in the Inferred resource.

- Approximately 63% of the Indicated silver equivalent ounces are located above the main historical production adit level (4670 Level).

- Significant resources contained above the 4670 Level, including approximately 56% of the Indicated tonnes and 34% of the Inferred tonnes.

- Identified three main mineralized structures that control the 18 veins included in the mineral resource estimate.

- The resource model extends to a maximum depth of 230 m from surface in the 12 de Mayo vein, 200 m in the Española vein and 180 m in the Victoria vein. All three vein systems appear to be similarly important in controlling silver mineralization and remain open along strike and at depth.

- Average diamond drill hole length in the 2021 drilling program was approximately 140 metres.

*for AgEq or silver equivalent calculations and other critical assumptions see “Mineral Resource Estimation Methodology” section.

David Stein, President and CEO of Kuya Silver stated, “We are very excited to have our first-ever mineral resource estimate which has exceeded our expectations for the initial Phase One drilling program. The data collected to date will help guide the exploration strategy as well as the design for the underground development of Bethania. This is a great start to our growing silver project. The quality of our understanding of the Bethania resource potential has increased considerably as we have now identified numerous other veins and their spatial relationship to one another. This understanding will be hugely important as we continue to explore these veins at depth and along strike towards the northeast.”

Christian Aramayo, Kuya Silver’s COO added, “The amount of mineralized material estimated to be above the current mine workings is a pleasant surprise. While this initial mineral resource estimate confirmed our understanding of the mine geology, our drilling to date has been relatively shallow and we look forward to exploring the Bethania vein system at depth in the next campaign while ramping up development in preparation for planned future production.”

Mineral Resource Estimate Methodology

- The independent Qualified Person for the Mineral Resource Estimate, as defined by NI 43-101, is Mr. Simon Mortimer (FAIG #7795) of Atticus Geoscience Peru. The effective date of the Mineral Resource Estimate is December 10, 2021.

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability. The quantity and grade of reported Inferred and Indicated Resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred and Indicated Resources as Measured, however it is reasonably expected that the majority of Inferred and Indicated Mineral Resources could be upgraded to Measured Mineral Resources with continued exploration.

- A cut-off grade of 100 g/t silver equivalent (“AgEq”) was applied in the reporting of the resource model, which used a minimum block size of 0.60 metres to reflect the minimum mining width applied at this deposit. The cut-off was determined as an approximate break-even cost calculated from known historical mining and recovery costs.

- Geological and block models for the Mineral Resource Estimate used data from a total of 33 surface drill holes, completed by the Company, and historical underground sampling collected by previous operators. The drill hole database was validated prior to resource estimation and QA/QC checks were made using industry-standard control charts for blanks, core duplicates and commercial certified reference material inserted into assay batches by Kuya.

- Mineral resource estimates in Table 1, Table 2, and Table 3 have been rounded to two significant figures.

- The Mineral Resource Estimate was calculated on the basis of 18 modelled veins which were grouped into three vein systems based on the current understanding of the major structures controlling silver mineralization. The Mineral Resource Estimate statement excludes material that has been mined out and the material in the upper levels of the mine that may not be extracted based on expected requirements for mine safety.

- Silver equivalent (AgEq) was calculated using the following commodity prices: Au (USD/oz) $1,849.78, Ag (USD/oz) $25.44, Pb (USD/t) $1,981.79, Zn (USD/t) $2,658.62, and Cu (USD/t) $7,971.

- The recovery factors (%) used in the calculation of the Mineral Resource Estimate were: Au at 0.4439; Ag at 0.9324; Pb at 0.9449; Zn at 0.9265; Cu at 0.8829.

- The Mineral Resource Estimate was prepared following the CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines (November 29, 2019).

- The development of the Mineral Resources that are the subject of the Mineral Resource Estimate may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, and other relevant risks. For additional information on risks and uncertainties that could affect the Company and the development of its mineral projects, please refer to the “Risk Factors” section in the Company’s Amended and Restated Annual Information Form dated October 15, 2021 for the year ended December 31, 2020 (“AIF”), which is available on SEDAR at sedar.com. The risk factors identified in the AIF are not intended to represent a complete list of factors that could affect the Company or the development of its mineral projects.

Eighteen veins were modelled in the mineral resource estimate (“MRE”), which have been grouped into three vein systems based on the current understanding of the major structures controlling mineralization (Table 2).

The three vein systems, which comprise 18 resource-hosting veins and 2 vein structures, appear to have strong structural controls along the broadly NE-SW trend of the concession, with various veins locally branching off the main structures. The Española Vein system includes eight veins: Española, Española Footwall Branch (RFW), Carolina, Carolina II, Betsaida, Maria, Maria Footwall Branch (RFW), and Maria Footwall Branch 1 (RFW1), as well as the Carolina Footwall Branch (RFW) which is identified as a structure but currently contains no resources. The 12 de Mayo Vein system includes eight veins: 12 de Mayo, 12 de Mayo South, 12 de Mayo Footwall Branch (RFW), 12 de Mayo Footwall Branch 1 (RFW1), 12 de Mayo Hangingwall Branch (RHW), 12 de Mayo South Footwall Branch (RFW), 12 de Mayo South Hangingwall Branch (RHW), and New Vein, as well as the New Vein Footwall Branch (RFW) which is identified as a structure but currently contains no resources. The Victoria Vein system includes two veins: Victoria and Yolanda.

By analyzing the current MRE by elevation, approximately 56% of the indicated tonnes and approximately 63% of the Indicated silver equivalent ounces are located above the mine’s 4670 Level (Table 3). Approximately 66% of the Inferred tonnes and 65% of the Inferred silver equivalent ounces are located below the mine’s 4670 Level. The 4670 Level was the main production adit level prior to the mine suspending operations in 2016, with minimal development and production occurring below that level. A significant portion of the current MRE is located in the upper levels of the historical mine (above the 4670 Level) while the mineral resources remain open at depth.

Data Verification

Dr. Scott Jobin-Bevans (P.Geo., APGO #1083), Principal Author, visited the Bethania Silver Project on 15 June 2019. The purpose of the site visit was to observe mine and general Property conditions, surficial geology, underground geology and mining procedures, proposed sites for the processing plant and related equipment, and sites for any exploration work including historical surface trenching and excavation (past mining), inclusive of associated quality assurance/quality control. During the 2019 site visit by Dr. Jobin-Bevans, a total of five rock samples were collected from five of the main veins, either from surface exposures or from underground workings.

Mr. Simon Mortimer (MAusIMM, FAIG), consulting geologist (Atticus Consulting S.A.C.) visited the Bethania Silver Project from the 24 to 27 May 2021. The purpose of the site visit was to observe the processes and protocols in place for the collection of geological data – the geological logging, the capture of data in digital format, the selection, taking, and registering of samples, the associated quality assurance/quality control and the transport and storage of the samples; to visit the drill pads and observe the procedures in place for the extraction of the core and delivery to the logging shed; and to review the drill core, the surface geology and map some of the principal structures, contacts and outcropping veins.

The QPs have reviewed the historical data and information regarding past exploration, development work, and historical mining on the Property as provided by Kuya. Kuya was entirely cooperative in supplying the QPs with all the information and data requested and there were no limitations or failures to conduct the verification and so it was concluded that information in the database is suitable for mineral resource estimation.

Past mine production data as reported to the Ministry of Energy and Mines during the period 2013-2016 is evidence that the mine was worked to accepted standards, and although it should be recognised that geological data relating this last period of mine working lacks QA/QC support, mine mapping and sampling is noted to be of a high standard, and the QPs are confident that this data can be used for guidance in the planning of future work programs and for the purposes of geological modelling and inclusion in the current MRE.

The sampling of, and assay data from, the drill core was monitored through the implementation of a quality assurance/quality control ("QA/QC") program designed to follow industry best practice. See the technical report titled, “Independent Technical Report on the Bethania Silver Project, Department of Huancavelica, Province of Huancavelica, District of Acobambilla, Peru”, dated 29 September 2021, for additional information on the QA/QC program and results.

National Instrument 43-101 Disclosure

Mr. Simon Mortimer (FAIG #7795) of Atticus Geoscience Peru, has reviewed and approved the contents of this news release pertaining to the Bethania Silver Project mineral resource estimate. The scientific and technical content of this news release has been reviewed and approved by Scott Jobin-Bevans, PhD, PMP, P.Geo. Both persons are independent Qualified Persons as defined by National Instrument 43-101.

About Kuya Silver Corporation

Kuya Silver is a Canadian‐based mineral exploration and development company with a focus on acquiring, exploring, and advancing precious metals assets in Peru and Canada.

For more information, please contact the Company at:

Kuya Silver Corporation

Telephone: (604) 398‐4493

info@kuyasilver.com

www.kuyasilver.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Reader Advisory

This news release contains statements that constitute “forward-looking information,” including statements regarding the plans, intentions, beliefs and current expectations of the Company, its directors, or its officers with respect to the future business activities of the Company. The words “may,” “would,” “could,” “will,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “expect,” “must,” “next,” “potential,” “progress,” and similar expressions, as they relate to the Company or its management, are intended to identify such forward-looking information. Investors are cautioned that statements including forward-looking information are not guarantees of future business activities and involve risks and uncertainties, and that the Company’s future business activities may differ materially from those described in the forward-looking information as a result of various factors, including but not limited to fluctuations in market prices, successes of the operations of the Company, continued availability of capital and financing, and general economic, market and business conditions. There can be no assurances that such forward-looking information will prove accurate, and therefore, readers are advised to rely on their own evaluation of the risks and uncertainties. The Company does not assume any obligation to update any forward-looking information except as required under the applicable securities laws.

Neither the Canadian Securities Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()