- Revenue for the first nine months increases by 15.9 percent at constant currency compared to prior year (3rd quarter 2021 down 3 percent compared to prior year quarter)

- Strong EBIT margin before special items of 9.6 percent (prior year: 4.2 percent) for the first nine months (3rd quarter 2021 8.2 percent)

- Strong Industrial business (3rd quarter EBIT margin before special items 12.4 percent) offsets revenue-driven decline in Automotive Technologies 3rd quarter margin (3rd quarter EBIT margin before special items 4.6 percent)

- Free cash flow before cash in- and outflows for M&A activities of 468 million euros considerably ahead of prior year (185 million euros)

- Guidance confirmed for EBIT margin before special items (8 to 9.5 percent) and free cash flow, market-driven adjustment to expected revenue

- Sustainability targets announced

Global automotive and industrial supplier Schaeffler presented its interim statement for the first nine months of 2021 today. The Schaeffler Group’s revenue for the reporting period amounted to 10,346 million euros (prior year: 8,964 million euros). The 15.9 percent increase at constant-currency is primarily due to the considerable recovery during the first half of the year. The Schaeffler Group’s revenue for the third quarter of 2021 decreased by 3.0 percent at constant currency as a result of a significant decline in customers’ call-offs setting in the Automotive Technologies division during this period. Revenue declined in all regions except Asia/Pacific. Contrary to developments at the Automotive Technologies division, the Schaeffler Group’s remaining two divisions reported revenue growth. Automotive Aftermarket and Industrial division revenue rose by 8.7 percent and 15.8 percent at constant currency, respectively, compared to the prior year quarter. Rising commodities prices in the procurement markets, whose impact had still remained limited in the first six months of 2021, increasingly hampered earnings in the third quarter of 2021, particularly those of the Automotive Technologies and Industrial divisions.

The Schaeffler Group earned 994 million euros (prior year: 376 million euros) in EBIT before special items in the first nine months of 2021. This represents an EBIT margin before special items of 9.6 percent (prior year: 4.2 percent). Reasons for the improvement over the prior year included economies of scale. The decline in EBIT margin before special items in the third quarter of 2021 was primarily attributable to a market-driven decrease in volumes in the Automotive Technologies division. The EBIT margin before special items for the third quarter fell to 8.2 percent (prior year period: 9.5 percent); EBIT before special items amounted to 272 million euros (prior year period: 322 million euros).

Earnings before financial result, income (loss) from equity-accounted investees, and income taxes (EBIT) for the reporting period was favorably impacted by 27 million euros (prior year: ‑798 million euros) in special items that include the partial reversal of a provision recognized for structural measures in Europe under the Roadmap 2025 divisional subprograms. The targets communicated in September 2020 with respect to downsizing the workforce and sustainably lowering costs remain in place unchanged nevertheless. Negotiations with employee representatives have now been concluded at all locations affected in Germany except one.

Claus Bauer, CFO of Schaeffler AG, said: “The Schaeffler Group has proven its resilience in a challenging market environment in the third quarter of 2021. We will maintain our strict discipline with respect to capital and costs and review additional measures in order to address the challenges persistently growing in the fourth quarter, primarily those relating to materials prices.”

Market-driven decline in Automotive Technologies revenue in Q3

The Automotive Technologies division generated 6,286 million euros in revenue for the first nine months (prior year: 5,425 million euros). At constant currency, revenue increased by 16.1 percent from the prior year driven by volumes, mainly due to the low basis for comparison in the first half of the year. Revenue increased across all business divisions and regions during the first nine months, with the E-Mobility business division generating the highest constant-currency growth rate at 22.4 percent. In the third quarter, growing bottlenecks in global supply chains, particularly those for semiconductors, significantly reduced customers’ call-offs and decreased revenue by a considerable 12.2 percent at constant currency. Market expectations for full-year automobile production for 2021 were adjusted downward considerably, particularly during the third quarter.

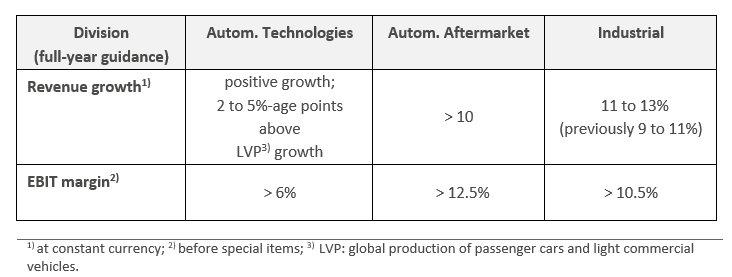

The Automotive Technologies division outperformed global automobile production by 6.6 percentage points during the first nine months, exceeding the full-year guidance of 2 to 5 percentage points. Outperformance represents the number of percentage points by which the growth of the Automotive Technologies division exceeds the growth in global production of passenger cars and light commercial vehicles. This result was driven by the Europe region’s unusually strong outperformance of 10.9 percent.

The division reported 467 million euros (prior year: ‑16 million euros) in EBIT before special items for the first nine months. The EBIT margin before special items for the same period was 7.4 percent, considerably ahead of the ‑0.3 percent reported in the prior year. The considerable improvement in the EBIT margin before special items for the reporting period was largely driven by economies of scale during the first six months. The cost reduction measures expanded in the prior year made a positive impact as well.

Automotive Aftermarket with double-digit revenue growth

The Automotive Aftermarket division reported 1,411 million euros (prior year: 1,204 million euros) in revenue for the reporting period, representing constant-currency revenue growth of 18.3 percent.

Revenue rose considerably in all regions. The increase in revenue was primarily driven by considerably higher volumes in the Europe and Americas regions. The Greater China region expanded its e-commerce business which contributed the majority of the region’s growth. The growth reported by the Asia/Pacific region resulted mainly from the recovery of the Independent Aftermarket and OES business in India, partly due to the low basis for comparison, especially in the second quarter of 2020.

These developments resulted in EBIT before special items of 206 million euros (prior year: 190 million euros). This represents an EBIT margin before special items of 14.6 percent (prior year: 15.8 percent). The decline from the prior year was primarily due to higher product expenses.

Industrial increases revenue and EBIT margin

The Industrial division reported 2,649 million euros (prior year: 2,335 million euros) in revenue for the first nine months, representing constant-currency revenue growth of 14.2 percent.

The considerable growth in revenue during the first nine months was mainly the result of increased demand in the wind, power transmission, and industrial automation sector clusters in the Greater China region. Additionally, demand in Industrial Distribution and the offroad sector cluster in the Europe region led to considerable growth rates from the low basis for comparison. Markets in the remaining regions recovered considerably as well. Growth in the Asia/Pacific region resulted primarily from increased volumes in India and was mainly due to the wind, two-wheelers, and offroad sector clusters as well as Industrial Distribution. The Americas region’s revenue trend was largely attributable to growth in Industrial Distribution.

The Industrial division generated 321 million euros (prior year: 202 million euros) in EBIT before special items for the first nine months, representing an EBIT margin before special items of 12.1 percent (prior year: 8.6 percent). The higher EBIT margin before special items compared to the prior year period was largely driven by economies of scale. The cost reduction measures expanded in the prior year proved effective as well.

Strong growth in free cash flow

Free cash flow rose despite an increase in working capital as a result of business growth. Free cash flow before cash in- and outflows for M&A activities for the first nine months was 468 million euros, considerably exceeding the prior year level (185 million euros). Capital expenditures (capex) on property, plant and equipment and intangible assets for the reporting period amounted to 482 million euros (prior year: 481 million euros), representing a capex ratio of 4.7 percent of revenue (prior year: 5.0 percent).

Net income attributable to shareholders of the parent company before special items increased considerably during the first nine months of 2021 compared to the prior year period, amounting to 583 million euros (prior year: 132 million euros). Earnings per common non-voting share for the same period were 0.92 euros (prior year: ‑0.79 euros). The group employed a workforce of 83,935 as at September 30, 2021 (September 30, 2020: 83.711).

Full-year guidance confirmed for EBIT margin before special items and free cash flow

The Schaeffler Group still expects to generate an EBIT margin before special items of 8 to 9.5 percent in 2021. The company also anticipates free cash flow before cash in- and outflows for M&A activities for 2021 of more than 400 million euros.

The Schaeffler Group’s revenue is now expected to grow by more than 7 percent at constant currency in 2021, following growth of more than 11 percent expected in the outlook issued on July 26, 2021. This decrease is due to a significant decline in the market volume of global production of passenger cars and light commercial vehicles. The October 2021 base scenario by IHS Markit currently reflects expected full-year growth of 0.3 percent in 2021. The guidance for Automotive Technologies outperformance remains unchanged at 2 to 5 percentage points. Market estimates for the Automotive Aftermarket division are largely unchanged. The revenue guidance for the Industrial division was raised from 9 to 11 percent in revenue growth to 11 to 13 percent.

Focus on sustainability

The Schaeffler Group announced its sustainability targets on October 26, 2021. The group will be operating as a climate-neutral company from 2040. This objective covers the entire supply chain and is underpinned by ambitious mid-term sustainability targets. The company’s own production facilities will already be climate neutral from 2030.

Using steel from climate-neutral production is particularly important to this process. The long-term partnership with Swedish start up H2greensteel announced in a separate communication on November 9, 2021, represents one step taken toward making Schaeffler’s supply chain climate neutral by 2040.

Klaus Rosenfeld, CEO of Schaeffler AG, stated: “After a strong first half of the year, the Schaeffler Group was unable to avoid the sharp decline in growth in global automobile production in the third quarter. The Automotive Technologies division nevertheless achieved a solid outperformance for the first nine months of 2021 and grew faster than the market. The strong operating profit of the Industrial division and the positive contribution of the Automotive Aftermarket division are particularly encouraging. The results for the third quarter show how essential it is for us to be both an automotive and an industrial supplier.”

Forward-looking statements and projections

Certain statements in this press release are forward-looking statements. By their nature, forward-looking statements involve a number of risks, uncertainties and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. These risks, uncertainties and assumptions could adversely affect the outcome and financial consequences of the plans and events described herein. No one undertakes any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. You should not place any undue reliance on forward-looking statements which speak only as of the date of this press release. Statements contained in this press release regarding past trends or events should not be taken as representation that such trends or events will continue in the future. The cautionary statements set out above should be considered in connection with any subsequent written or oral forward-looking statements that Schaeffler, or persons acting on its behalf, may issue.

We pioneer motion

As a leading global supplier to the automotive and industrial sectors, the Schaeffler Group has been driving forward groundbreaking inventions and developments in the fields of motion and mobility for over 70 years. With innovative technologies, products, and services for CO₂-efficient drives, electric mobility, Industry 4.0, digitalization, and renewable energies, the company is a reliable partner for making motion and mobility more efficient, intelligent, and sustainable. The technology company manufactures high-precision components and systems for powertrain and chassis applications as well as rolling and plain bearing solutions for a large number of industrial applications. The Schaeffler Group generated sales of approximately 12.6 billion euros in 2020. With around 83,900 employees, Schaeffler is one of the world’s largest family companies. With over 1,900 patent applications in 2020, Schaeffler is Germany’s second most innovative company according to the DPMA (German Patent and Trademark Office).

Schaeffler AG

Industriestraße 1-3

91074 Herzogenaurach

Telefon: +49 (9132) 82-0

Telefax: +49 (9132) 82-3584

http://www.schaeffler-group.com

Leiter Finanzkommunikation und Öffentlichkeitsarbeit

Telefon: +49 (9132) 82-8901

E-Mail: axel.luedeke@schaeffler.com

Leiter Kommunikation Finanzen

Telefon: +49 (9132) 82-37314

E-Mail: matthias.herms@schaeffler.com

Leiterin Investor Relations

Telefon: +49 (9132) 82-4440

E-Mail: ir@schaeffler.com

Investor Relations

Telefon: +49 (9132) 82-4440

E-Mail: ir@schaeffler.com

![]()