Highlights

– CS-21-66: 115 metre step to the southwest:

- 3,374 grams per tonne (g/t) silver equivalent (AgEq) (2,607 g/t silver and 9.90 g/t gold) over 1.5 metres true width (mTW) from 348.3 m and;

- 793.9 g/t AgEq (599.7 g/t silver and 2.47 g/t gold) over 1.3 down hole width from 175.45m

– CS-21-77: 165 metre step to the northeast:

- 354 g/t AgEq (216 g/t silver and 1.62 g/t gold) over 4.95 mTW from 348.3 m and;

- 1,582 g/t AgEq (1,115 g/t silver and 5.73 g/t gold) over 0.7 down hole width from 159.7 m

– CS-21-37: 1,643 g/t AgEq (960 g/t silver and 7.94 g/t gold) over 1.34 mTW from 207.3 m

– CS-21-50: 807 g/t AgEq (615 g/t silver and 2.46 g/t gold) over 1.99 mTW from 251.4 m

Note: All numbers are rounded. Silver equivalent is calculated using the following formula: Silver-equivalent = ((Au_g/t x 52.48) + (Ag_g/t x 0.5289)) / 0.5627. Metal price assumptions are $17.50 ounce silver and $1,700 ounce gold, recoveries assumptions are 96% gold and 94% silver, based on similar deposit types.

Vizsla President and CEO Michael Konnert commented: “Tajitos continues to exceed our high expectations with large step out holes now expanding the target resource area to over 800 metres in total strike length. Mineralization remains open in both directions along strike and at depth, where elevated precious to base metal ratios continues to highlight significant potential for further expansion. The Company currently has three rigs focused on Tajitos and will continue to take bold step-outs ahead of declaring the Project’s maiden resource in Q1, 2022.”

Tajitos Drilling detail

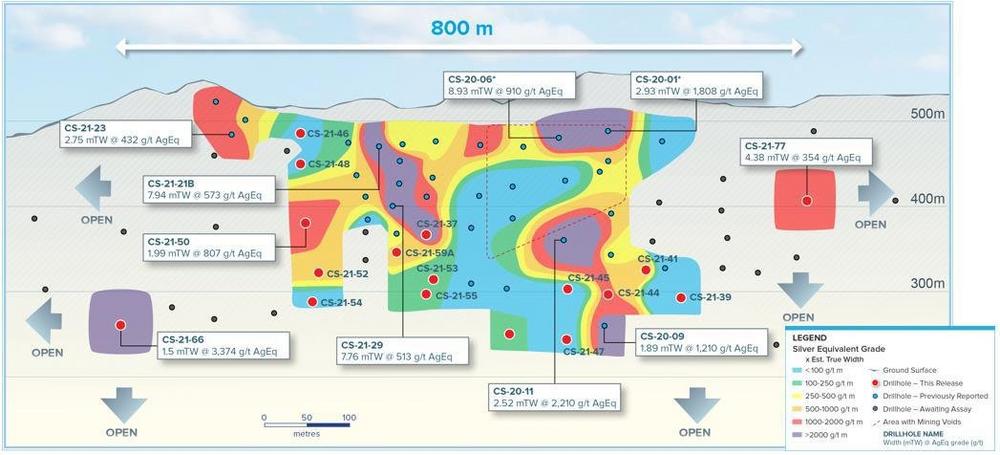

Resource drilling targeting the Tajitos Vein, located along the Cinco Senores Vein Corridor (Figures 1 & 2), approximately 500m east of the Napoleon Vein, has significantly expanded the Zone’s mineralized footprint, now measuring 800 metres along strike and to a depth of 300 metres below surface. Drilling will now progress using a grid pattern on 100-metre centers (previously 50-metre centers) due to increased confidence in local controls to mineralization and the potential to rapidly add tonnage ahead of the data cut-off for inclusion in the maiden project resource.

Step-out drilling to the southwest intersected 3,374 g/t silver equivalent over a true width of 1.4 metres in one of the deepest holes completed to date at Tajitos (CS-21-66). This intercept is located approximately 150 metres from the nearest drill hole (115 metres along strike) and remains open in all directions. Infill drilling between this intercept and the main panel of mineralization has been completed and assays remain pending.

To the northeast, step-out hole CS-21-77 was similarly successful, intersecting the vein with increased width; 4.9 metres true width grading 354 g/t silver equivalent. This intercept is open in all directions and the company interprets it to be part of another potential zone of dilation observed along the Tajitos Vein. Step outs to depth and further to the northeast continue to define a broad mineralized structure (assays remain pending for these holes).

Following the receipt of several outstanding assays surrounding the step-out holes detailed above, Vizsla intends to provide an updated average width and weighted average grade for the Tajitos Vein.

CS-21-77 has also identified an additional parallel vein in the hanging wall of Tajitos, marked by elevated precious metals grades (0.7 metres downhole width grading 1,582 g/t silver equivalent. This vein appears to be restricted to the northeast zone and has been intersected by all step-out holes to the northeast of, and vertically below hole CS-21-77.

Infill drilling centered on the core area of Tajitos has significantly improved the overall understanding of the Zone’s controls to mineralization. The high-grade body of mineralization first intercepted in hole CS-21-01 is observed to pinch to the southwest of holes CS-20-06 and CS-20-11, particularly as the host lithology changes from Andesite to Diorite. Here, average vein thickness and grade are observed to decrease before the vein widens and grade lifts again away from the contact.

Additionally, a notable change in dip direction observed in the southwest, with an axis from hole CS-21-48 to CS-21-47, may be responsible for local grade variability, with relatively higher grades intercepted above and below this change. Holes CS-21-23 and CS-21-50 are good examples of the mineralization returning to higher grades beneath and to the southwest of this change in orientation.

There are currently 10 drill rigs turning at Panuco: four centered on Napoleon resource drilling, three on Tajitos resource drilling, two focused on expanding the Josephine prospect and one testing EM geophysics targets.

About the Panuco project

The newly consolidated Panuco silver-gold project is an emerging high-grade discovery located in southern Sinaloa, Mexico, near the city of Mazatlán. The 6,754.1-hectare, past producing district benefits from over 75 kilometres of total vein extent, a 500 ton per day mill, 35 kilometres of underground mines, tailings facilities, roads, power and permits.

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

Note: Two new claims have been acquired adding 149.9 hectares of new area. 4,103.5 hectares previously reported as part of the Panuco project have been removed from the total hectares due to 4 claims being located at a significant distance from the project. These hectares remain as 100% owned by Vizsla Silver.

Quality Assurance / Quality Control

Drill core and rock samples were shipped to ALS Limited in Zacatecas, Zacatecas, Mexico and in North Vancouver, Canada for sample preparation and for analysis at the ALS laboratory in North Vancouver. The ALS Zacatecas and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Silver and base metals were analyzed using a four-acid digestion with an ICP finish and gold was assayed by 30-gram fire assay with atomic absorption (“AA”) spectroscopy finish. Over limit analyses for silver, lead and zinc were re-assayed using an ore-grade four-acid digestion with AA finish.

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s quality assurance / quality control protocol.

Qualified Person

The Company’s disclosure of technical or scientific information in this press release has been reviewed and approved by Martin Dupuis, P.Geo., Vice President of Technical Services for Vizsla Silver. Mr. Dupuis is a Qualified Person as defined under the terms of National Instrument 43-101.

Contact Information: For more information and to sign-up to the mailing list, please contact:

Michael Konnert, President and Chief Executive Officer

Tel: (604) 364-2215

Email: info@vizslasilver.ca

Website: www.vizslasilvercorp.ca

In Europe:

Swiss Resource Capital AG

Jochen Staiger

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain “Forward‐Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward‐looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward‐looking statements or information. These forward‐looking statements or information relate to, among other things: the development of Panuco, including drilling programs and mobilization of drill rigs; future mineral exploration, development and production; and completion of a maiden drilling program.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Vizsla, future growth potential for Vizsla and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Vizsla’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Vizsla’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and Vizsla has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company’s dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company’s mining activities in Mexico; regulatory, consent or permitting delays; risks relating to reliance on the Company’s management team and outside contractors; risks regarding mineral resources and reserves; the Company’s inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company’s interactions with surrounding communities and artisanal miners; the Company’s ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption “Risk Factors” in Vizsla’s management discussion and analysis. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although Vizsla has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Vizsla does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()