What are tactical registrations?

In many cases, all cars registered in the name of a company are considered fleet cars. However, these commercial registrations also include cars registered by dealerships, manufacturers, and short-term rental companies. Each of these channels has an intrinsic demand and need to register cars for a variety of reasons. Car manufacturers provide company cars to their employees just as most other companies do, the difference being that holding times are often very short and a larger part of the staff is eligible for company cars. With regard to dealerships, they certainly need a wide selection of demonstration vehicles for test drives and to equip their showrooms. And most obviously, the rental companies register cars to provide to their customers.

What each of these channels have in common is the processes and capacities to register large quantities of new cars at once, which also allows them to make tactical registrations on top of the intrinsic demand. These cars are registered to be sold as discounted young used cars – being advertised as zero-kilometre, pre-registrations, daily registrations, executive driven – and help to balance car production with demand fluctuations in a build-to-stock strategy, make price adjustments without touching list prices, compete for market shares or improve sales statistics.

Increasing trend 2010-2019

While registration statistics do not reveal whether a vehicle should serve as demonstration car or tactical registration, our figures for 16 European countries[1] show an upward trend in the share of dealerships and manufacturers in new car registrations. Starting from 14.6% in 2010, 2019 saw 18.2% of all new passenger car registered under the name of a dealership or a car manufacturer.

Particularly the Eastern European markets, the Czech Republic, Poland and Slovakia and to a lesser extent the Western European countries (exception being Spain) recorded a growing share of tactical registrations.

Rapid fall from 2020

The Coronavirus led to a massive disruption in the car market. Following the supply chain disruptions, car production could no longer provide the previously seen volumes of vehicles. Given the nature of tactical registrations, this was one of the first areas affected and the volume the market had become used to was impacted. Later on, as production pressure eased, both dealerships and manufacturers remained cautious as new showrooms closures would leave them with their lots full of unsellable cars.

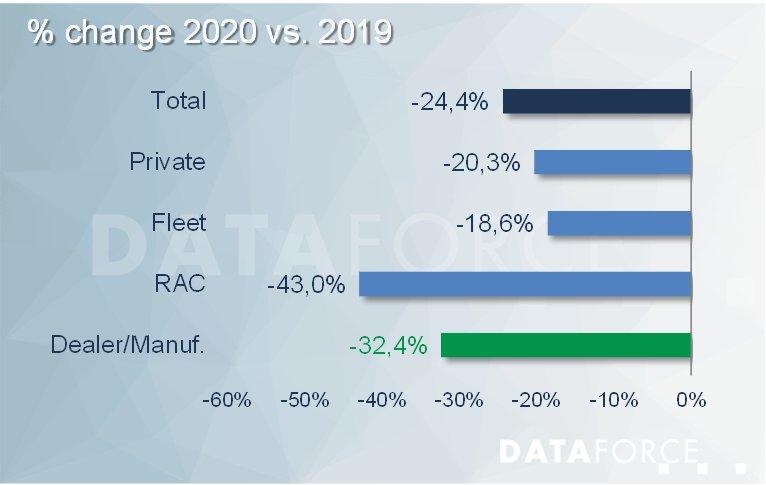

While the total market shrank by 24.4% compared between 2019 and 2020, the contraction in the dealership and manufacturer channel amounted to 32.4% and Rent-A-Car registrations dropped by even 43.0%. As a result, the share of dealership and manufacturer registrations dropped by almost 2 percentage points and reached 16.3%.

…continues in 2021

Compared to previous drops in new car market like during the 2012/2013 Eurozone debt crisis, this is a completely different behaviour of market channels, witnessing the uniqueness of the current situation. In some markets the semiconductor shortage will cause larger shortfalls than Covid-19. Meanwhile, the demand side has recovered, driven by pent-up demand and customers turning their back on public transportation.

This has transformed the automotive market into a sellers’ market where new car orders are widely exceeding car production. With this the focus of OEMs shifts from volume into margin with higher car prices and less need for dealership activity. Normally, a decrease in the total market leads to a higher share of dealership and manufacturer registrations which help to cushion the fall. However, until end of August 2021, the share of dealership and manufacturer registrations has decreased to 15.7%.

Brand strategies

On brand level, the decrease in the dealership and manufacturer share is larger for those manufacturers who had an increased usage of tactical registration before. However, six brands, namely Ford, Jeep, Kia, Mazda, Seat and Toyota had already started to cut their tactical registrations in 2016. For them, the developments in the last two years are just the continuation of a longer trend.

Future role of tactical registrations

Car supply will remain constrained at least in the first half of 2022 and even then, manufacturers will focus on their order backlog rather than tactical registrations. In the medium-term perspective, another aspect comes into play. With the widening share of BEVs, brands switch to an agency sales model where the dealerships no longer sell the cars in their own account but get a sales provision from the OEM, bringing a change from the previous/current volume driven bonuses for franchises.

Moreover, buyer/user behaviour is evolving. Car ownership is becoming less popular among the former new car buyers. Instead, both private and fleet customers resort to leasing or car subscription models and besides, an increasing car production costs will also leave less scope to sell discounted cars as nearly new. As a result, the times of high tactical registrations are probably gone for good.

[1] Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Italy, Latvia, Lithuania, Netherlands, Poland, Slovakia, Spain, Sweden, United Kingdom

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Kontakt für Presse

Telefon: +49 (69) 95930-232

Fax: +49 (69) 95930-333

E-Mail: Benjamin.Kibies@dataforce.de

Junior Marketing Manager

Telefon: +49 (69) 95930-353

Fax: +49 (69) 95930-333

E-Mail: claudia.articek@dataforce.de

![]()