Highlights

– To date, 105 holes drilled within the Napoleon Corridor highlight an average true width of 5 metres (mTW) with a weighted average grade of 482 g/t silver equivelant (AgEq) (161 g/t Ag, 3.11 g/t Au, 0.45% Pb and 1.3% Zn)

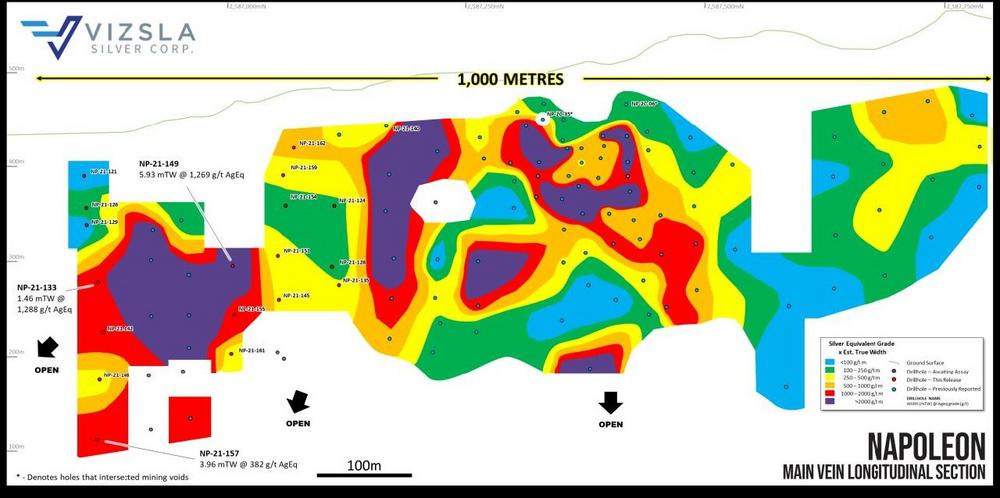

– Step-out drilling extends high-grade mineralization 50 metres to the south, while infill drilling further demonstrates a continuous panel of mineralization

Notable intercepts include:

– NP-21-149: 1,296 g/t AgEq (185 g/t Ag, 11.35 g/t Au, 0.49 % Pb and 2.25 % Zn) over 5.93 mTW including,

3,647 g/t AgEq (344 g/t Ag, 33.78 g/t Au, 1.17 % Pb and 6.30 % Zn) over 1.89 mTW

– NP-21-133: 1,288 g/t AgEq (188.0 g/t Ag 10.74 g/t Au 1.27 % Pb and 3.47 % Zn) over 1.46 mTW

– NP-21-148: 916 g/t AgEq (113.9 g/t Ag, 6.49 g/t Au, 0.78 % Pb and 8.02 % Zn) over 1.40 mTW

– Mineralization targeted for resource delineation now extends over 1,000 metres in length, 370 metres deep and remains open to the south and at depth

Note: All numbers are rounded. Silver equivalent is calculated using the following formula: AgEq = ((Au_g/t x 52.48) + (Ag_g/t x 0.5289) + (Pb_ppm x 0.0013) + (Zn_ppm x 0.0013)) / 0.5627. Metal price assumptions are $17.50 oz silver, $1,700 oz gold, $0.75 pound lead and $0.85 pound zinc, recoveries assumptions are 96% gold, 94% silver, 78% lead and 70% zinc based on similar deposit types.

Vizsla President and CEO Michael Konnert commented: “In only thirteen months since the discovery of the Napoleon Vein, the zone has grown considerably, now representing a large panel of continuous mineralization over 1,000m long with excellent grades over potentially minable widths. With increased grades and thickness developing down-plunge to the south, Napoleon continues to be the primary focus for resource delineation at Panuco and will no doubt form the backbone of the Company’s maiden resource estimate planned for Q1, 2022.”

Napoleon Drilling Detail

Recent drilling at Napoleon has locally extended the body of mineralization within an interpreted shallowly plunging panel to the south. Most of the newly reported holes are from the southern end of the mineralized zone and continue to show a wide vein with very high grades.

Step-out drill holes NP-21-133,142 and 157 were successful in extending the Napoleon Vein by 50 metres to the south along strike and down plunge from the previously reported fence of holes. Mineralization remains open to the south and at depth and continues to be the Company’s primary focus for resource drilling.

Additionally, systematic grid drilling on 50 metre centers has now largely infilled the remaining untested areas to the north, highlighting a continuous zone of mineralization. In total, mineralization is defined over a strike length of 1,000 metres and to a depth of 370 metres.

To date, 105 holes completed within the Napoleon resource area highlight an average vein width of 3.5 metres with a weighted average grade of 482g/t AgEq (161 g/t silver, 3.11 g/t gold, 0.45% lead and 1.3% zinc). This represents a 9% increase in weighted average grade and a 0.5 metre reduction in average width since the last update (see press release dated April 6, 2021). Average weighting does not include grade capping, total length and depths are estimations and all holes are included resulting in inclusion of potentially non-economic material.

An average specific gravity of 2.72 has been calculated from 49 samples after rejecting outliers.

Relative to the last update, both silver (155 to 161 g/t) and gold (2.74 to 3.11 g/t) grades have increased, with the later largely attributable to a significantly higher gold/silver ratio observed at the southern end of the resource drilling area.

Moving forward, Vizsla will complete wider, 100 metre step-out holes in this area to better define the potential edge of mineralization. This will allow for more spatial data to be incorporated into the Project’s resource database ahead of the drilling cut-off date for inclusion in the maiden resource estimate (planned for Q1, 2022).

Note: All numbers are rounded. Silver equivalent is calculated using the following formula: AgEq = ((Au_g/t x 52.48) + (Ag_g/t x 0.5289) + (Pb_ppm x 0.0013) + (Zn_ppm x 0.0013)) / 0.5627. Metal price assumptions are $17.50 oz silver, $1,700 oz gold, $0.75 pound lead and $0.85 pound zinc, recoveries assumptions are 96% gold, 94% silver, 78% lead and 70% zinc based on similar deposit types.

Webinar

Vizsla Silver would like to invite interested shareholders to join Michael Konnert, President and CEO, and Eric Coffin, HRA Advisories, for a webinar detailing the progress on resource/exploration drilling at its flagship Panuco silver-gold project.

The webinar will take place today at 11:00 am PDT / 2:00 pm EDT. Management will be available to answer questions following the presentation. Online registration and participation details may be found at the following link:

https://register.gotowebinar.com/register/8102399458831429901

About the Panuco project

The newly consolidated Panuco silver-gold project is an emerging high-grade discovery located in southern Sinaloa, Mexico, near the city of Mazatlán. The 9,386.5-hectare, past producing district benefits from over 75 kilometres of total vein extent, a 500 ton per day mill, 35 kilometres of underground mines, tailings facilities, roads, power and permits.

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

Quality Assurance / Quality Control

Drill core and rock samples were shipped to ALS Limited in Zacatecas, Zacatecas, Mexico and in North Vancouver, Canada for sample preparation and for analysis at the ALS laboratory in North Vancouver. The ALS Zacatecas and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Silver and base metals were analyzed using a four-acid digestion with an ICP finish and gold was assayed by 30-gram fire assay with atomic absorption (“AA”) spectroscopy finish. Over limit analyses for silver, lead and zinc were re-assayed using an ore-grade four-acid digestion with AA finish.

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s quality assurance / quality control protocol.

Qualified Person

The Company’s disclosure of technical or scientific information in this press release has been reviewed and approved by Martin Dupuis, P.Geo., Vice President of Technical Services for Vizsla Silver. Mr. Dupuis is a Qualified Person as defined under the terms of National Instrument 43-101.

Contact Information: For more information and to sign-up to the mailing list, please contact:

Michael Konnert, President and Chief Executive Officer

Tel: (604) 364-2215

Email: info@vizslasilver.ca

Website: www.vizslasilvercorp.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain “Forward‐Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward‐looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward‐looking statements or information. These forward‐looking statements or information relate to, among other things: the development of Panuco, including drilling programs and mobilization of drill rigs; future mineral exploration, development and production; and completion of a maiden drilling program.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Vizsla, future growth potential for Vizsla and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Vizsla’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Vizsla’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and Vizsla has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company’s dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company’s mining activities in Mexico; regulatory, consent or permitting delays; risks relating to reliance on the Company’s management team and outside contractors; risks regarding mineral resources and reserves; the Company’s inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company’s interactions with surrounding communities and artisanal miners; the Company’s ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption “Risk Factors” in Vizsla’s management discussion and analysis. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although Vizsla has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Vizsla does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()