Highlights

- Fixed loop electromagnetics (“FLEM” or “EM”) has been trialed and detects massive sulphide hosted mineralization on the Napoleon Vein. This mineralization contains very high grades of silver, gold and base metals and extends south beyond the current limits of drilling.

- Multiple new targets generated along the Napoleon and Cinco Senores Vein Corridors.

- Drill testing one target (Josephine Vein) hits massive sulphide in a new vein with three holes proving the success of the technique.

- Vizsla is planning a property wide airborne EM survey to generate targets that directly detect the best-known mineralization style in the district.

Vizsla President and CEO, Michael Konnert, commented: “The trial electromagnetic survey has proven to be extremely successful and adds the ability to directly target the best parts of veins within the district. The high grade, massive sulphide mineralization at Napoleon is not common in epithermal deposits and direct detection with electromagnetics is incredibly rare. Vizsla is currently drilling along four separate vein corridors, and adding this technique to our successful geological targeting, will help the Company demonstrate that Panuco can host a globally significant silver resource.”

Massive Sulphide Mineralization

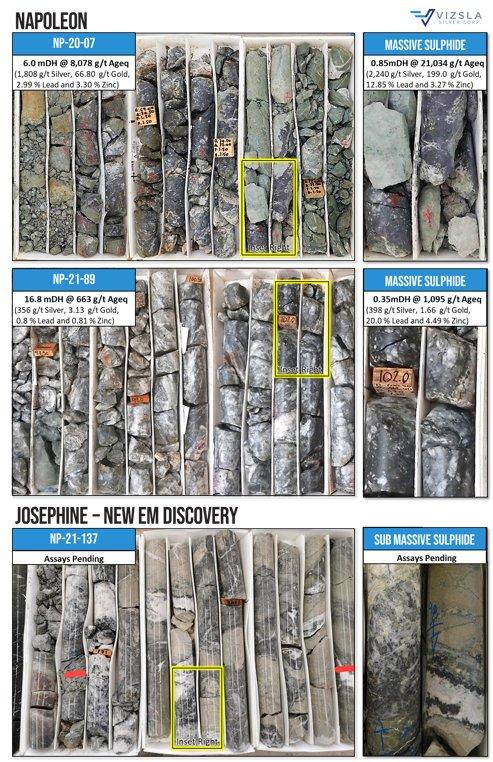

The Napoleon and Cinco Senores vein corridors host multi-episodic, quartz-carbonate veins that host multiple pulses of mineralization. One phase of this mineralization is a sub-massive to massive sulphide phase that contains up to 5,080 g/t silver, 199 g/t gold with up to 25% combined lead and zinc (Figure 1).

This style of mineralization is rare in epithermal deposits and represents a strongly metal rich fluid that has undergone very rapid precipitation to form bands of massive sulphides. The connected nature of the metal allows it to conduct electricity which in turn allows for direct detection using electromagnetic techniques.

Fixed Loop Electromagnetic Survey

FLEM detects massive sulphide mineralization by running a current through a large loop of wire laid on the ground to induce a magnetic field in the earth. As the weakening magnetic field moves through the earth it sets up a circulating electrical field in the shape of any massive sulphide bodies that it passes through. This new electrical field in turn weakens, setting up a secondary magnetic field that is measured on surface. Geophysicists with modern computer programs can back calculate the shape of the conducting massive sulphide and model a 3D “plate” representing the source of the anomaly.

A test survey was completed by Zonge International was undertaken in April and May at Panuco and the results showed EM plates fit with mineralization drilled at the Napoleon discovery (Figure 2). In addition, five new priority conductive trends were modelled along with many more subtle anomalies.

Mineralization at Tajitos is not related to massive sulphides and was not detected with FLEM.

Drilling has been completed on one of the new EM targets and three holes have intersected massive sulphide mineralization in holes NP-21-132, NP-21-137 and NP-21-139. This vein has no known surface expression and represents a new vein, named the Josephine Vein, that runs parallel to the west of the main Napoleon trend.

The remaining targets will be tested in the coming weeks. Targets exist parallel to the Napoleon vein and at Cinco Seniors they coincide with an area of known workings where Vizsla has sampled high grades trend to the north and south of the historic resource defined by Silverstone on the flat lying La Colorada Vein.

Based on this success the Company has commenced planning for a property wide airborne electromagnetic survey to detect additional anomalies across Panuco. Any newly generated anomalies will allow the Company to recognise new veins across the district and aid prioritizing the best zones along known veins for drilling.

Drone Magnetic Survey

In April, a drone magnetic survey was also completed over the Napoleon and Cinco Senores Corridors. The Napoleon vein is clearly shown as a linear magnetic low due to the epithermal fluids demagnetising the host rocks while the Tajitos vein occurs on a linear break between magnetic host rocks in the footwall and non-magnetic host rocks in the hangingwall (Figure 2).

The technique shows multiple similar linear features, some coinciding with mapped veins and a structural geological interpretation is underway to support mapping and to generate and prioritize new drill targets. The planned airborne EM survey will also extend the magnetic survey across the entire Panuco district.

Unlocking the Greater District

Drilling is currently underway on four vein corridors, Napoleon, Cinco Senores, Cordon del Oro and Animas. The current resource drilling areas of Napoleon and Tajitos represent a very small subset of the known veins at Panuco and exploration is continuing in conjunction with resource drilling to find new orebodies.

Strong drilling results have been returned from each vein corridor (Figure 3) and the Company continues to explore for both virgin zones of mineralization and continuations of known mineralization beneath mine workings. With over 123 know recorded mines and prospects, the Company prioritizes larger volume targets to most efficiently define resources across the district (see news release dated December 17th, 2021 for more details on the exploration strategy).

Adding direct detection of massive sulphides with geophysical techniques to a systematic geological ranking approach makes for a powerful combination to unlock one of Mexico’s largest epithermal districts.

Note: All numbers are rounded. Silver equivalent is calculated using the following formula: Silver-equivalent = ((Au_g/t x 52.48) + (Ag_g/t x 0.5289) + (Pb_ppm x 0.0013) + (Zn_ppm x 0.0013)) / 0.5627. Metal price assumptions are $17.50 oz silver, $1,700 oz gold, $0.75 pound lead and $0.85 pound zinc, recoveries assumptions are 96% gold, 94% silver, 78% lead and 70% zinc based on similar deposit types.

About the Panuco project

Vizsla has an option to acquire 100% of the newly consolidated 9,386.5-hectare Panuco district in southern Sinaloa, Mexico, near the city of Mazatlán. The option allows for the acquisition of over 75 kilometres of total vein extent, a 500 ton per day mill, 35 kilometres of underground mines, tailings facilities, roads, power and permits.

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

Quality Assurance / Quality Control

Drill core and rock samples were shipped to ALS Limited in Zacatecas, Zacatecas, Mexico and in North Vancouver, Canada for sample preparation and for analysis at the ALS laboratory in North Vancouver. The ALS Zacatecas and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Silver and base metals were analyzed using a four-acid digestion with an ICP finish and gold was assayed by 30-gram fire assay with atomic absorption (“AA”) spectroscopy finish. Over limit analyses for silver, lead and zinc were re-assayed using an ore-grade four-acid digestion with AA finish.

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s quality assurance / quality control protocol.

Qualified Person

The Company’s disclosure of technical or scientific information in this press release has been reviewed and approved by Martin Dupuis, P.Geo., Vice President of Technical Services for Vizsla Silver. Mr. Dupuis is a Qualified Person as defined under the terms of National Instrument 43-101.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain “Forward‐Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward‐looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward‐looking statements or information. These forward‐looking statements or information relate to, among other things: the development of Panuco, including drilling programs and mobilization of drill rigs; future mineral exploration, development and production; and completion of a maiden drilling program.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Vizsla, future growth potential for Vizsla and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Vizsla’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Vizsla’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and Vizsla has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company’s dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company’s mining activities in Mexico; regulatory, consent or permitting delays; risks relating to reliance on the Company’s management team and outside contractors; risks regarding mineral resources and reserves; the Company’s inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company’s interactions with surrounding communities and artisanal miners; the Company’s ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption “Risk Factors” in Vizsla’s management discussion and analysis. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although Vizsla has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Vizsla does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()