Financial Highlights

- Earned 19,960 GEOs1 (Q1 2020 –18,159 GEOs)

- Record revenues from royalties and streams of $49.0 million (Q1 2020 – $37.8 million)

- Cash margin4 of 94% from royalty and stream interests (Q1 2020 – 91%)

- Consolidated cash flows from operating activities of $21.3 million (Q1 2020 – $23.8 million)

- Operating cash flows from the royalty and stream segment2 of $36.7 million

- Operating cash flows from the mining exploration and development segment3 (i.e. Osisko Development Corp. – TSX-V:ODV) of ($15.4) million

- Net earnings attributable to Osisko’s shareholders of $10.6 million, or $0.06 per basic share (Q1 2020 – net loss of $13.3 million, or $0.09 per basic share)

- Adjusted earnings5 of $18.4 million, or $0.11 per basic share3 (Q1 2020 – $7.5 million, or $0.05 per basic share)

- Adjusted earnings5 from the royalty and stream segment2 of $23.4 million, or $0.14 per basic share5

- Adjusted loss5 from the mining exploration and development segment4 of $5.0 million, or $0.03 per basic share5

Sandeep Singh, President and CEO of Osisko commented on the activities of the first quarter of 2021: “The first quarter saw our royalty and streaming business continue to generate record cash margins and strong operating cash flows. This bodes well as our operating assets continue to perform, ramp up and expand over the coming quarters. We were also able to, relatively cheaply, acquire medium and longer-term royalty exposure to some highly promising exploration and development properties while maintaining a disciplined approach to growth.

In Q1, we also progressed our ambition to be a leader in the Environmental, Social and Governance (“ESG”) space with the publication of our inaugural ESG report and by entering into an investment and strategic partnership with Carbon Streaming Corp. The partnership leverages our streaming expertise to fund capital projects that reduce greenhouse gas emissions.”

Financial Highlights by Operating Segment

(in thousands of dollars, except per share amounts)

As a result of its 75% ownership in Osisko Development, the assets, liabilities, results of operations and cash flows of the Company consolidate the activities of Osisko Development and its subsidiaries. The table below provides some financial highlights per operating segment. More information per operating segment can be found in the consolidated financial statements and management’s discussion analysis for the three months ended March 31, 2021.

Other Highlights

- Published Osisko’s inaugural ESG report and commitment to the United Nations Global Compact (“UN Global Compact”)

- Completed an initial investment and strategic partnership of $3.5 million with Carbon Streaming Corp. to promote global decarbonization and biodiversity efforts through carbon credit streaming transactions

- In February 2021, Osisko repaid a $50.0 million convertible debenture and drew its credit facility by the same amount, thereby reducing the interest payable by approximately 1.5% per annum

- In February 2021, Agnico Eagle Mines Limited (“Agnico Eagle”) and Yamana Gold Inc. (“Yamana”) announced a positive construction decision for the Odyssey underground project (the “Odyssey Project”) at the Canadian Malartic mine. The preliminary economic study shows a total of 7.29 million ounces of resources (6.18 million tonnes at 2.07 g/t Au indicated resources and 75.9 million tonnes at 2.82 g/t Au inferred resources). Underground mine production is planned to start in 2023 and is expected to ramp up to an average of 545,400 gold ounces per year from 2029 to 2039

- Acquired for cancellation 347,400 common shares for $4.5 million (average acquisition cost of $12.85 per share)

- In January and February 2021, Osisko Development Corp. (“Osisko Development”) closed a non-brokered private placement for gross proceeds of $79.8 million (of which $73.9 million were received in 2020)

- In March 2021, Osisko Development closed a brokered private placement of flow-through shares for gross proceeds of $33.6 million

- Declared a quarterly dividend of $0.05 per common share paid on April 15, 2021 to shareholders of record as of the close of business on March 31, 2021

Select Asset Updates

Canadian Malartic Underground Construction Progress

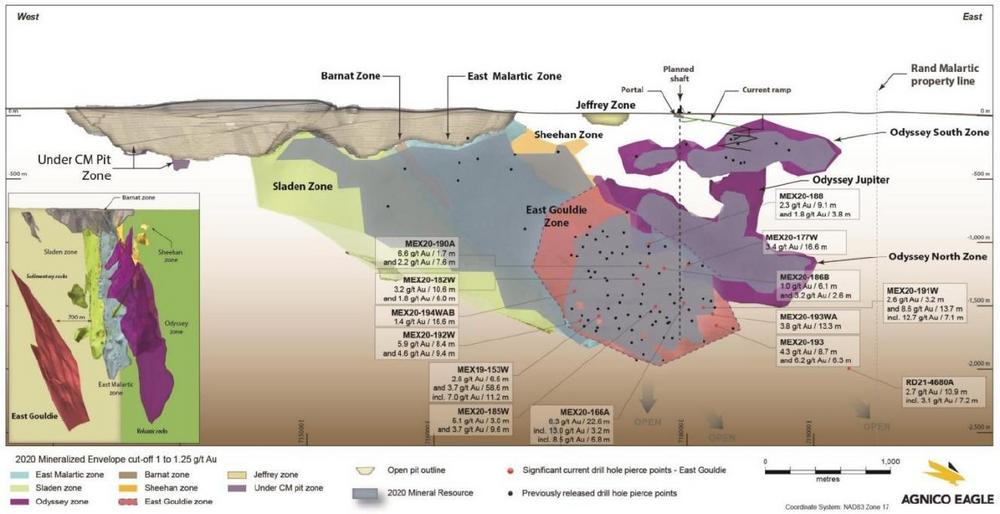

Agnico Eagle and Yamana have commenced construction of the Odyssey Project at the Canadian Malartic mine. The preliminary economic assessment published on SEDAR estimates 545,000 ounces of gold per annum from 2029 to 2039, thereby extending the life of mine of our cornerstone asset for decades to come. The ramp and underground project are on schedule with approximately 362 linear metres of development completed in the first quarter of 2021, reaching a depth of 74 metres below surface. Shaft preparation work is underway and construction on the headframe foundation is expected to start in the second quarter of 2021.

At the Odyssey Project, a 970-metre step-out drill hole has intersected the eastern down plunge extension of the East Gouldie Zone. This hole intersected 2.7 g/t gold over 10.9 metres, including 3.1 g/t gold over 7.2 metres at approximately 1,995 metres depth (Figure 1). This new intercept is located within the boundaries of Osisko’s 5% net smelter return (“NSR”) royalty and suggests that the current mineral resources at East Gouldie could be expanded significantly down-plunge towards the east. Drilling is also underway to infill the East Gouldie Zone to 75-metre spacing. Highlights from this program include: 6.3 g/t gold over 22.6 metres at 1,482 metres depth and 3.7 g/t gold over 58.6 metres at 1,580 metres depth.

Osisko holds a 5% NSR royalty on East Gouldie, Odyssey South and the western half of East Malartic and a 3% NSR royalty on Odyssey North and the eastern half of East Malartic. For more information, refer to Agnico Eagle’s press release dated April 29, 2021 entitled “Agnico Eagle Reports First Quarter 2021 Results – Record Quarterly Gold Production; Drilling Identifies Potentially Significant Extension to the East Gouldie Zone at Odyssey; Updated Climate Change Strategy Outlined in 2020 Sustainability Report” filed on www.sedar.com.

Upper Beaver/Kirkland Lake Exploration Success and Project Timing

In the first quarter of 2021, Agnico Eagle completed 67 drill holes (21,014 metres) at Upper Beaver focused on infill drilling and mineral resource conversion. Highlights from the drilling included 62.6 g/t gold (28.1 g/t capped at 90 g/t gold) and 0.97% copper over 16.8 metres at approximately 1,200 metres depth. This is the best intersection ever reported from Upper Beaver. An update on the drilling program is expected to be released in the second quarter of 2021 and an internal technical evaluation of the project is expected to be completed in late 2021.

On April 13, 2021, Agnico Eagle presented an overview of its project pipeline at the World Gold Forum, including the Upper Beaver/Kirkland Lake project. Current development concepts suggest annual production from Upper Beaver of 180-240koz gold at all-in sustaining costs of US$700-750 per ounce. Subject to permitting timelines, production could potentially commence in 2027. Osisko holds a 2% NSR royalty on Agnico Eagle’s Kirkland Lake project, including Upper Beaver.

Osisko Development Progress

In the first quarter of 2021, a total of approximately 48,000 metres were drilled as part of the exploration and resource conversion program on the Cariboo gold project. Up to ten diamond drill rigs were utilized. The drilling confirmed down dip extensions of mineralized veins and high grade intercepts within the current mineral resource estimate. Drill highlights included 22.76 g/t over 7 metres at Mosquito Creek and 6.97 g/t over 6.5 metres at Valley Zone. For more information, refer to Osisko Development’s press release dated April 27, 2021 entitled “Osisko Development Intersects 22.76 g/t Gold over 7 Meters and 7.73 g/t Gold over 14 Meters on Island and Cow Deposits Infill and Expansion Drilling” filed on www.sedar.com.

Osisko Development expects regulatory permitting approval to begin development of an underground access for a 10,000 tonne bulk sample in the second quarter of 2021. The bulk sample permit intends to replicate the Cariboo Gold Project’s mining conditions by mining two stopes and processing the mineralized material through an ore sorter on site. Recent ore sorter tests have shown excellent capability of excluding waste rock from the processing stream to save on costs and increase feed grade. A new ore sorter was purchased in the last quarter of 2020 and is expected to arrive in Wells during the third quarter of 2021 with test work beginning before year-end.

The Bonanza Ledge II mine located on the Cariboo gold project has made significant progress in the first quarter. A stockpile of mineralized material has been transported to the QR mill. The mill is being re-commissioned after conversion to carbon in leach (CIL) and several improved material handling systems. First gold pour from Bonanza Ledge II is expected in Q2.

Osisko holds a 5% NSR royalty on the Cariboo property, including the Bonanza Ledge II mine.

On the San Antonio project in Sonora Mexico, Osisko Development has initiated a drill campaign to confirm and expand on the Sapuchi gold deposit. They have also initiated metallurgical tests and engineering design to advance the treatment of the gold stockpile mined by the previous operator.

Osisko Bermuda Limited, a subsidiary of Osisko, holds a 15% gold and silver stream on the San Antonio project.

Mantos Update

The Mantos Blancos Concentrator Debottlenecking Project (“MB-CDP”) has achieved a total progress of 79%, in line with the targeted progress. The main project milestones are maintained, with construction scheduled to be completed in the second quarter of 2021, and the project completion date scheduled for the fourth quarter of 2021.

The expansion is expected to increase the throughput of the operation’s sulphide concentrator plant from 4.3 million tonnes per year to 7.3 million tonnes per year by the fourth quarter of 2021 and extend the life of the mine to 2035. Annual deliveries of refined silver to Osisko during the first five years following commissioning of the expansion are expected to average approximately 1.2 million ounces of silver per year.

Windfall PEA Update

In April 2021, Osisko Mining Inc. (“Osisko Mining”) released an updated preliminary economic assessment (“PEA”) for the Windfall gold project which estimates an after-tax internal rate of return of 39% and after-tax net present value of $1.5 billion, using a gold price of US$1,500 per ounce. The PEA highlights average gold production of 238,000 ounces per year for the 18 year mine life. The first seven years of full production will average 300,000 ounces per year at an average diluted grade of 8.1 g/t Au. For more information, refer to Osisko Mining’s press release dated April 7, 2021 entitled “Osisko Mining Delivers Positive PEA Update for Windfall”, filed on www.sedar.com.

Osisko Mining also announced it has placed an order for grinding equipment and ancillaries from FLSmidth for the Windfall project. The grinding mills have a capacity of processing up to 3,900 tonnes per day based on 92% availability. The equipment is expected to be delivered to the Windfall project in the second half of 2022. Installation will follow, pending successful receipt of all permits and authorizations. For more information, refer to Osisko Mining’s press release dated March 9, 2021 entitled “Osisko Mining Orders Milling Equipment for Windfall”, filed on www.sedar.com.

Osisko holds a 2% to 3% NSR royalty on the Windfall project.

Eagle Increased Production Plan

Victoria Gold Inc. (“Victoria Gold”) has announced the initiation of the “Project 250”, aimed at increasing the average annual gold production of the Eagle mine to 250,000 ounces gold by 2023. The two primary opportunities to increase production are the scalping of fine ore from the crushing circuit and adjusting the seasonal stacking plan. Early engineering on Project 250 is expected to be completed in the second half of 2021. For more information, refer to Victoria Gold’s press release dated April 6 2021 entitled “Eagle Gold Mine First Quarter 2021 Operational Highlights”, filed on www.sedar.com.

Osisko holds a 5.0% NSR royalty on the Dublin Gulch property which includes all reported reserves and resources of the Eagle gold mine as well as the Raven, Lynx, and Potato Hills exploration targets.

Conversion of Parral Offtake to a Stream

In April 2021, GoGold Resources Inc. (“GoGold”) and Osisko Bermuda Limited (“Osisko Bermuda”), a subsidiary of Osisko, entered into an agreement to convert the current capped Parral gold and silver offtake into a life-of-mine gold and silver stream. Under the stream, Osisko Bermuda will receive, effective April 29, 2021, 2.4% of the gold and silver produced from tailings piles currently owned or acquired by GoGold, with a transfer price of 30% of the gold and silver spot prices. Osisko currently has no other offtake agreements on producing assets, therefore, this conversion will streamline financial reporting for Osisko’s royalty and stream segment moving forward

Santana Construction Update

Minera Alamos Inc. (“Minera Alamos”) has indicated that initial gold production from the Santana project is expected by mid-year. The major construction activities related to the gold recovery plant are now complete and preparations are underway for testing. Final electrical and piping work will be finished in parallel with other site activities leading up to the start of mining operations. The initial heap leach pad area has also been completed and will continue to be expanded concurrently with the commencement of mining activities. For more information, refer to Minera Alamos’s press release dated March 31, 2021 entitled “Minera Alamos Selects Mining Contractor in Preparation for Start of Mining Operations”, filed on www.sedar.com.

Osisko holds a 3.0% NSR royalty on the Santana project.

Bald Mountain Shift Mines to Royalty Areas

Kinross Gold Corporation (“Kinross”) expects higher production over the next three years from the North area of the Bald Mountain mine, with a significant part of production shifting to mining the Winrock (1% Gross Sales Royalty “GSR”), Duke (4% GSR) and Royale (4% GSR) deposits. Kinross also expects to spend US$6.5 million at Bald Mountain in 2021 with an increased focus on drill testing targets identified in 2020 to explore for both intrusive-related and sediment-hosted type deposits that can be potentially converted to mineral resources in subsequent years. Near-mine targets in the North area of Bald Mountain – such as Duke, Galaxy, Bida and Royale – are expected to be explored during 2021. For more information, refer to Kinross’ press release dated February 10, 2021 entitled “Kinross provides update on development projects and full-year 2020 exploration results” and the World Gold Council presentation from April 17, 2021.

Falco Updates Horne 5 Feasibility

Falco Resources Ltd. (“Falco”) updated its feasibility study to reflect the improved commodity prices and updated costs on the Horne 5 gold project. The capital and operating costs were reviewed to reflect current market conditions for labour, supplies and services. At a gold price of US$1,600 per ounce, the updated feasibility study shows that the Horne 5 Project would generate an after-tax net present value, at a 5% discount rate, of $761 million and an after-tax internal rate of return of 18.9%. For more information, refer to Falco’s press release dated March 24, 2021 entitled: “Updated Feasibility Study Confirms Significant Value of the Horne 5 Project” and filed on www.sedar.com.

Osisko holds a silver stream on 90% of the future silver produced from the Horne 5 project, with an option to increase the stream to 100%.

Acquisition of New Royalties on Spring Valley, Moonlight and Almaden

In April 2021, Osisko completed the acquisition of a portfolio of royalties from two private sellers for cash consideration of US$26 million, including four royalties over the multi-million ounce Spring Valley project located in Pershing County, Nevada. Osisko now holds a 3.0% NSR royalty on claims overlying the core of the current Spring Valley deposit, a 2.0% NSR royalty on claims overlying the prospective high-grade northeastern part of the Spring Valley deposit, and a 0.5% NSR royalty over the broader Spring Valley property. In addition, Osisko acquired a 1.0% NSR royalty on the Moonlight exploration property immediately to the north of Spring Valley, and a 0.5% NSR royalty and 30% gold and silver offtake over the Almaden Project in western Idaho. For more information, refer to Osisko’s press release dated April 12th, 2021 entitled “Osisko Announces Preliminary Q1 2021 Deliveries and Agreement to Acquire Spring Valley Royalties” filed on www.sedar.com.

New Liontown Royalty

In March 2021, Osisko acquired a 0.8% NSR royalty covering three tenements owned by Red River Resources Limited (“Red River”) in Queensland, Australia for AUD $1.51 million.

The royalties were purchased from a third-party and cover the Liontown and Liontown East deposits, which together host a JORC 2012 compliant indicated resource of 1.1Mt of 8.3% Zn Eq and inferred resources of 3.1Mt of 10.2% Zn Eq (0.6% Cu, 1.9% Pb, 5.9% Zn, 1.1g/t Au and 29g/t Ag). All lode systems comprising the resources are open at depth and along strike. Liontown, a high grade, gold-rich polymetallic deposit, is set to be Red River’s third deposit developed for mining on the broader Thalanga property. The Liontown Project is located approximately 32km in a direct line from Red River’s Thalanga operations and 107km by road.

In Q1 2021, Red River continued mine design and scheduling activities for the Liontown Project, with the focus being on a combined open pit and underground development with a conceptual mine life of 10+ years. For more information, refer to Red River’s press release dated April 29, 2021 entitled “Quarterly Activities and Cash Flow Report for the period ending 31 March 2021”; and the press release dated March 11, 2020 titled “Red River increases Liontown contained gold by 125%”.

The third royalty tenement is an exploration licence containing prospective land adjacent to the Thalanga Project being explored by Red River. For more information, refer to Red River’s press release dated March 11, 2021 entitled “RVR survey targets copper-rich mineralisation at Thalanga”.

New Vulcan Gold Belt Royalty

In March 2021, Osisko acquired a 0.5% NSR royalty on PJX Resources Inc.’s (“PJX Resources”) Gold Shear, Eddy, Zinger and Dewdney Trail properties for $1 million. These properties represent the largest consolidated land package in the Vulcan Gold Belt, a potential new gold camp located near Cranbrook, British Columbia. The Vulcan Gold Belt occurs within the Sullivan base metal mining district. It is an area 60km long by 30km wide with gold in the creeks that has been mined as placer gold since the 1800’s. PJX Resources’ has identified 16 priority targets. For more information, refer to PJX Resources’ press release dated March 1, 2021 entitled “Osisko Gold Royalties and PJX Resources Complete Investment Agreement” filed on www.sedar.com.

New Hidden Valley Royalty

In February 2021, Osisko acquired a 1.5% NSR royalty as well as a 10% equity interest in relation to the Hidden Valley project for US$4.2 million. Hidden Valley is owned privately and located in the Solomon Islands. The royalty covers a prospecting license of approximately 98km2 that hosts a large copper-gold porphyry target with exposed mineralized outcroppings and extensive soil anomalies.

New Rouyn Royalty

In April 2021, Osisko purchased a portfolio of NSR royalties varying from 1% to 2% from Falco Resources for $0.7 million. Falco had acquired the portfolio from IAMGOLD Corporation pursuant to the exercise of a right of first refusal it held over the royalties. The portfolio relates to, among others, properties known as Flavrian and Central Camp and which are exploration properties surrounding Horne 5. The royalty portfolio covers an area of approximately 150km2, and contains several gold and base metal occurrences, including the historic Quesabe gold mine.

Gold Rock Exploration Results

In March 2021, Fiore Gold Ltd. (“Fiore Gold”) announced results from its resource expansion and exploration drilling program at its Gold Rock project in Nevada. The holes to the north of the North Pit shell include some of the highest-grade intercepts seen to date at Gold Rock, including 45.7m of 2.01 g/t gold in hole GR20-110. Fiore Gold plans to complete additional drilling in this area. For more information, refer to Fiore Gold’s press release dated March 30, 2021 entitled “Fiore Gold Drills 45.7 metres of 2.01g/t Gold and 42.7 metres of 1.17g/t Gold, Continues to Expand Mineralization at its Gold Rock Project, Nevada” filed on www.sedar.com.

Osisko has a 4% NSR royalty over the northern part of the proposed pit at Gold Rock and a large area to the north that has significant exploration potential.

Altar Resource Update

Osisko owns a 1% NSR royalty on the Altar project in western Argentina. Aldebaran Resources Inc. (“Aldebaran”) has a joint venture with Sibanye-Stillwater on the Altar property allowing them to earn up to an 80% interest by spending US$55 million. Aldebaran updated the geological model and published a new resource estimation utilizing a higher cut-off grade (0.30% CuEq) resulting in measured & indicated resource of 1,198 million tonnes grading 0.43% copper, 0.1 g/t gold and 1 g/t silver, inferred resource of 189 million tonnes grading 0.42% copper, 0.06 g/t gold and 0.8 g/t silver. It also resulted in a significant reduction in the arsenic grade, primarily through isolation of the arsenic enriched geological domains. Aldebaran is currently executing a drill program at Altar, targeting deeper extensions of known higher-grade mineralization. For more information, refer to Aldebaran’s press release dated March 22, 2021 entitled “Aldebaran Announces Updated Mineral Resource Estimate for the Altar Copper-Gold Project” filed on www.sedar.com.

Annual Meeting of Shareholders

The Company will hold its 2021 virtual annual meeting (the “Meeting“) on Wednesday, May 12, 2021 at 3:30 p.m. (Eastern Daylight Time). The Meeting will be held in a virtual format only, by way of a live-audio webcast at: https://web.lumiagm.com/495445383. Shareholders are encouraged to vote in advance of the Meeting by internet, facsimile, or mail, in the manner set out in the meeting materials that have been sent to shareholders, copies of which can be accessed on our website at http://www.osiskogr.com/en/2021-agm/.

Qualified Person

The scientific and technical content of this news release has been reviewed and approved by Guy Desharnais, Ph.D., P.Geo., Vice President, Project Evaluation at Osisko Gold Royalties Ltd, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

About Osisko Gold Royalties Ltd

Osisko Gold Royalties Ltd is an intermediate precious metal royalty company focused on the Americas that commenced activities in June 2014. Osisko holds a North American focused portfolio of over 150 royalties, streams and precious metal offtakes. Osisko’s portfolio is anchored by its cornerstone asset, a 5% net smelter return royalty on the Canadian Malartic mine, which is the largest gold mine in Canada.

Osisko’s head office is located at 1100 Avenue des Canadiens-de-Montréal, Suite 300, Montréal, Québec, H3B 2S2.

Forward-looking Statements

This news release contains forward-looking information and forward-looking statements (together, "forward‑looking statements") within the meaning of applicable Canadian securities laws and the United States Private Securities Litigation Reform Act of 1995. All statements in this release, other than statements of historical fact, that address future events, developments or performance that Osisko expects to occur including management’s expectations regarding Osisko’s growth, results of operations, estimated future revenue, requirements for additional capital, production estimates, production costs and revenue, business prospects and opportunities are forward-looking statements. In addition, statements relating to gold equivalent ounces ("GEOs"), especially as they relate to production guidance for 2021, are forward‑looking statements, as they involve implied assessment, based on certain estimates and assumptions, and no assurance can be given that the GEOs will be realized. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "is expected" "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential", "scheduled" and similar expressions or variations (including negative variations of such words and phrases), or may be identified by statements to the effect that certain actions, events or conditions "will", "would", "may", "could" or "should" occur including, without limitation, the performance of the assets of Osisko, the timely construction of and production from the Odyssey underground project, the potential to extend the East Gouldie Zone, the timely development of the Cariboo project and Bonanza Ledge Phase 2 project and results from the exploration work, the timely development and construction of the San Antonio project, the continued ramp up of the Eagle Mine, the projections in the PEA as well as the anticipated timeline for receipt of permits and key equipment for the Windfall project, production forecasts and exploration results at the Kirkland Lake property, timely production from Minera Alamos’ Santana project, production and exploration projections at Kinross’ Bald Mountain mine, the projections in the updated feasibility study for the Horne 5 project, exploration results from other properties over which Osisko holds an interest, and Osisko’s ability to seize future opportunities. Although Osisko believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements involve known and unknown risks, uncertainties and other factors and are not guarantees of future performance and actual results may accordingly differ materially from those in forward-looking statements. Factors that could cause the actual results deriving from Osisko’s royalties, streams and other interests to differ materially from those in forward-looking statements include, without limitation: the uncertainties related to the COVID-19 impacts, the influence of political or economic factors including fluctuations in the prices of the commodities and in value of the Canadian dollar relative to the U.S. dollar, continued availability of capital and financing and general economic, market or business conditions; regulations and regulatory changes in national and local government, including permitting and licensing regimes and taxation policies; whether or not Osisko is determined to have “passive foreign investment company” (“PFIC”) status as defined in Section 1297 of the United States Internal Revenue Code of 1986, as amended; potential changes in Canadian tax treatments of offshore streams or other interests, litigation, title, permit or license disputes; risks and hazards associated with the business of exploring, development and mining on the properties in which Osisko holds a royalty, stream or other interest including, but not limited to development, permitting, infrastructure, operating or technical difficulties, unusual or unexpected geological and metallurgical conditions, slope failures or cave-ins, flooding and other natural disasters or civil unrest, rate, grade and timing of production differences from mineral resource estimates or production forecasts or other uninsured risks; risk related to business opportunities that become available to, or are pursued by Osisko and exercise of third party rights affecting proposed investments. The forward-looking statements contained in this press release are based upon assumptions management believes to be reasonable, including, without limitation: the ongoing operation of the properties in which Osisko holds a royalty, stream or other interest by the owners or operators of such properties in a manner consistent with past practice; the accuracy of public statements and disclosures made by the owners or operators of such underlying properties; no material adverse change in the market price of the commodities that underlie the asset portfolio; Osisko’s ongoing income and assets relating to the determination of its PFIC status, no material changes to existing tax treatments; no adverse development in respect of any significant property in which Osisko holds a royalty, stream or other interest; the accuracy of publicly disclosed expectations for the development of underlying properties that are not yet in production; and the absence of any other factors that could cause actions, events or results to differ from those anticipated, estimated or intended. However, there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Investors are cautioned that forward-looking statements are not guarantees of future performance. Osisko cannot assure investors that actual results will be consistent with these forward-looking statements and investors should not place undue reliance on forward-looking statements due to the inherent uncertainty therein.

For additional information with respect to these and other factors and assumptions underlying the forward-looking statements made in this press release, see the section entitled "Risk Factors" in the most recent Annual Information Form of Osisko which is filed with the Canadian securities commissions and available electronically under Osisko’s issuer profile on SEDAR at www.sedar.com and with the U.S. Securities and Exchange Commission on EDGAR at www.sec.gov. The forward-looking information set forth herein reflects Osisko’s expectations as at the date of this press release and is subject to change after such date. Osisko disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than as required by law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()