EnWave’s interim consolidated financial statements and MD&As are available on SEDAR at www.sedar.com and on the Company’s website www.enwave.net.

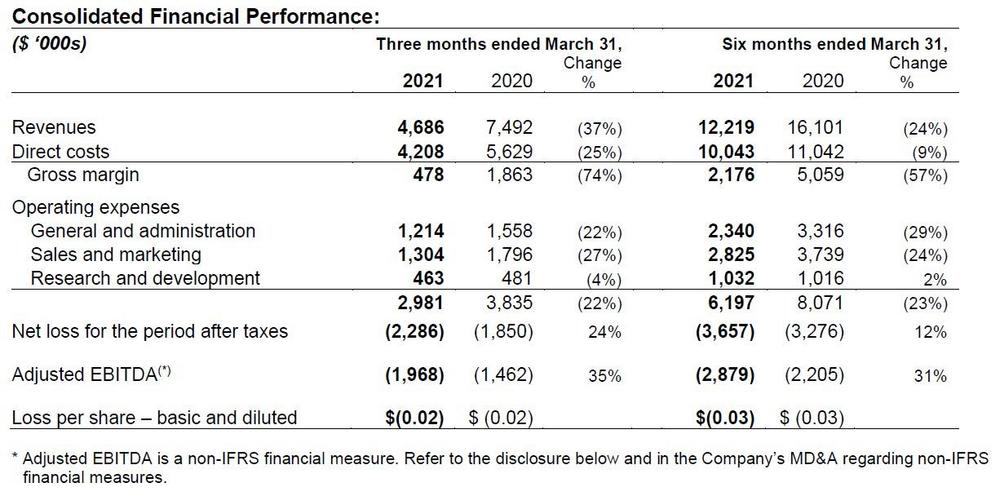

Key Financial Highlights for Q2 (expressed in ‘000s):

- Reported consolidated revenue for Q2 2021 of $4,686 compared to $7,492 for Q2 2020, a decrease of $2,806 or 37%.

- Revenue from EnWave in Q2 2021 was $2,348 compared to $2,169 in Q2 2020, an increase of $179 or 8%. The increase in revenue was due to higher Radiant Energy Vacuum (“REVTM”) machine rentals for technology evaluation purposes and higher customized REVTM” machinery sales in the food and cannabis verticals.

- Revenue from NutraDried in Q2 2021 was $2,338 compared to $5,323 in Q2 2020, a decrease of $2,985 or 56%. NutraDried revenues were downwardly impacted by fewer rotations with Costco, partially offset by some growth in the online channels.

- Gross margin for Q2 2021 was 10% compared to 25% for Q2 2020. The margin compression in Q2 2021 was due to lower manufacturing cost absorption at NutraDried with manufacturing overhead being allocated over reduced production volume. NutraDried also recorded an inventory write-off provision of $213 during the period. EnWave’s segment gross margin improved to 40% during the quarter as the REV™ business continued to benefit from a more variable cost structure while reducing fixed manufacturing overhead expenses.

- Consolidated net loss after taxes was $2,286 for Q2 2021 compared to a net loss $1,850 for Q2 2020.

- EnWave reported positive segment net income of $42 for Q2 2021 compared to a segment loss of $1,134 for Q2 2020, an improvement of $1,176. The improvement in EnWave’s segment results is attributed to the growth in REV™ machinery orders paired with measures implemented to reduce costs in all areas of the business.

- NutraDried reported a segment loss of $2,328 for Q2 2021 compared to a segment loss of $716 for Q2 2020. This increase is primarily due to the one-time severance charge of $691 for the restructuring of NutraDried, as well as lower gross margins due to not having Costco rotations during the period. In February 2021, the Company announced a restructuring of NutraDried and has taken significant steps to reduce NutraDried’s expenses and increase manufacturing output.

- Adjusted EBITDA(*) was a loss of $1,968 for Q2 2021 compared to a loss of $1,462 for Q2 2020, an increase of $506.

- SG&A expenses (inclusive of R&D expenses) for Q2 2021 were a combined $2,981 compared to $3,835 for Q2 2020 and $3,216 for Q1 2021. The Company reduced SG&A expenses by reducing non-essential spending and discretionary expenses while remaining focused on the core competencies of the business and planning for future growth.

- Continue to maintain a strong balance sheet with a working capital surplus of $19,275 and a cash position of $15,403. We are in a strong position to pursue further growth in the expansion of the global deployment of REVTM technology, which includes the build-out of the REVworx™ toll manufacturing facility which is expected to be operational by the end of the fiscal year.

Significant Corporate Accomplishments in Q2 2021:

Significant accomplishments made during Q2 2021 and to the date of this report include:

- Signed a royalty-bearing commercial license agreement with a leading Illinois-based cannabis company to produce cannabis products and received a purchase order for both a large-scale 120kW machine and a 10kW pilot-scale REVTM

- Signed a royalty-bearing commercial license agreement with AvoLov, LLC (d.b.a. “BranchOut”) and sold a 60kW large-scale REVTM machine to initiate production of a line of “better-for-you” avocado and fruit products.

- Completed the sale of a 10kW REVTM machine to NuWave Foods, Inc., who was previously on a Technology Evaluation and License Option Agreement, for the commercial launch of new and innovative shelf-stable bakery products.

- Received a purchase order to deliver a 10kW REVTM machine to Dairy Concepts IRL (“DCI”) for the development of a portfolio of natural, sweet and savoury, shelf-stable, hand-held dairy snacks.

- The US Army submitted a purchase order for the delivery of a second 10kW REV™ machine for the accelerated development of unique, lighter and nutrient-dense food ration products for soldiers. The machine will be placed at the Bridgford Foods Corporation (NASDAQ: BRID) manufacturing facility for the joint development of commercially viable military ration components.

- Natural Nutrition, the Company’s royalty partner in Chile, purchased two additional 10kW REV™ machines for installation in the agriculturally rich Northern Patagonia region of Chile to increase its royalty-bearing processing capacity for premium dried fruit and vegetable products.

- Received a purchase order for a 10kW REV™ machine from Responsible Foods, a royalty partner of the Company producing premium dried snacks using healthy Icelandic ingredients. The purchase of the 10kW machine doubles Responsible Foods’ royalty-bearing manufacturing capacity in Iceland.

- Completed the installation and start-up of two 100kW REVTM machines for Pitalia and Consulting Fresh Business S.L. in Costa Rica and Peru, respectively. Both companies began commercial production during fiscal Q2 and pays EnWave a royalty based on a percentage of revenue generated from REVTM product sales.

- Signed three new Technology Evaluation and License Option Agreements with companies conducting intensive product development and evaluation on the use of REV™ technology to bring innovative new products to market.

- NutraDried launched a new Protein Blitz Mix product in three flavours (Gouda Pecan Zesty Ranch, Almond Crazy Cheesy, Sweet Heat) which is available in various package sizes ranging from 1oz to 15oz that have been customized to suit specific channels of distribution.

- Completed a material restructuring at NutraDried with the objective to restore the operating subsidiary to sustainable profitability. The Company parted ways with the former CEO of NutraDried and took significant steps to remove excess staffing, marketing and SG&A expenses from the business, the benefit of which will be realized in the second half of 2021. Starting in Q3, NutraDried has successfully started to build a co-manufacturing business for the sale of shelf-stable cheese as ingredients in other snack products and mixes, and current management plan to leverage the installed REV™ capacity to bring additional products to market.

- Announced that Merck published a research paper citing the Company’s freezeREV® process as a viable manufacturing alternative to vial-based lyophilization for vaccines and biologics, while emphasizing the need for accelerated vaccine development and on-demand, flexible manufacturing options especially in this global pandemic environment.

- Repurchased and cancelled 40,000 common shares under the normal course issuer bid for a total cost of $53 at a volume weighted average price of $1.32 per common share.

Conference Call Details:

Date: May 27, 2021

Time: 7:00am PST / 10:00am EST

Participant Access: 1-877-407-2988 (toll free number)

Webcast: https://78449.themediaframe.com/dataconf/productusers/enw/mediaframe/45178/indexl.html

(*) Non-IFRS Financial Measures:

Adjusted EBITDA is not a measure of financial performance under IFRS. We define Adjusted EBITDA as earnings before deducting amortization and depreciation, stock-based compensation, foreign exchange gain or loss, finance expense or income, income tax expense or recovery and non-recurring impairment, restructuring and severance charges and government assistance. This measure is not necessarily comparable to similarly titled measures used by other companies and should not be construed as an alternative to net income or cash flow from operating activities as determined in accordance with IFRS. Please refer to the discussion included in the Company’s interim MD&A for the six months ended March 31, 2021.

About EnWave

EnWave Corporation, a Vancouver-based advanced technology company, has developed Radiant Energy Vacuum (“REV™”) – an innovative, proprietary method for the precise dehydration of organic materials. EnWave has further developed patented methods for uniformly drying and decontaminating cannabis through the use of REV™ technology, shortening the time from harvest to marketable cannabis products.

REV™ technology’s commercial viability has been demonstrated and is growing rapidly across several market verticals in the food, and pharmaceutical sectors, including legal cannabis. EnWave’s strategy is to sign royalty-bearing commercial licenses with innovative, disruptive companies in multiple verticals for the use of REV™ technology. The company has signed over forty royalty-bearing licenses to date spanning twenty countries and five continents. In addition to these licenses, EnWave established a Limited Liability Corporation, NutraDried Food Company, LLC, to manufacture, market and sell all-natural dairy snack products in the United States, including the Moon Cheese® brand, as well as co-manufacture for third parties.

EnWave has introduced REV™ as a disruptive dehydration platform in the food and cannabis sectors: faster and cheaper than freeze drying, with better end product quality than air drying or spray drying. EnWave currently offers two distinct commercial REV™ platforms:

- nutraREV® which is a drum-based system that dehydrates organic materials quickly and at low-cost, while maintaining high levels of nutrition, taste, texture and colour; and,

- quantaREV® which is a tray-based system used for continuous, high-volume low-temperature drying.

EnWave is also active in the pharmaceutical industry through a joint development agreement with GEA Lyophil, a leader in GMP drying machinery.

More information about EnWave is available at www.enwave.net.

EnWave Corporation

Mr. Brent Charleton, CFA

President and CEO

For further information:

Brent Charleton, CFA, President and CEO at +1 (778) 378-9616

E-mail: bcharleton@enwave.net

Dan Henriques, CFO at +1 (604) 835-5212

E-mail: dhenriques@enwave.net

Safe Harbour for Forward-Looking Information Statements: This press release may contain forward-looking information based on management’s expectations, estimates and projections. All statements that address expectations or projections about the future, including statements about the Company’s strategy for growth, product development, market position, expected expenditures, and the expected synergies following the closing are forward-looking statements. All third party claims referred to in this release are not guaranteed to be accurate. All third party references to market information in this release are not guaranteed to be accurate as the Company did not conduct the original primary research. These statements are not a guarantee of future performance and involve a number of risks, uncertainties and assumptions. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()