Alternative fuel types able to shine amidst the downturn

The start into 2021 was certainly challenging. Due to the difficulties emanating from Corona pandemic the situation across Europe is still complicated. The effects were clearly visible on the Passenger Car registrations which dropped by a massive -27% in January in the Top-5 European Markets.

With – 18.7% True Fleets performed significantly better that the Private Market (- 22.6%) with Italy being the only exception. Within the customer group of company car drivers, it is interesting to analyse the development of the different fuel types in the big five markets. As in real life, there are many similarities but also differences across the countries.

Plug-Ins up, Diesel down

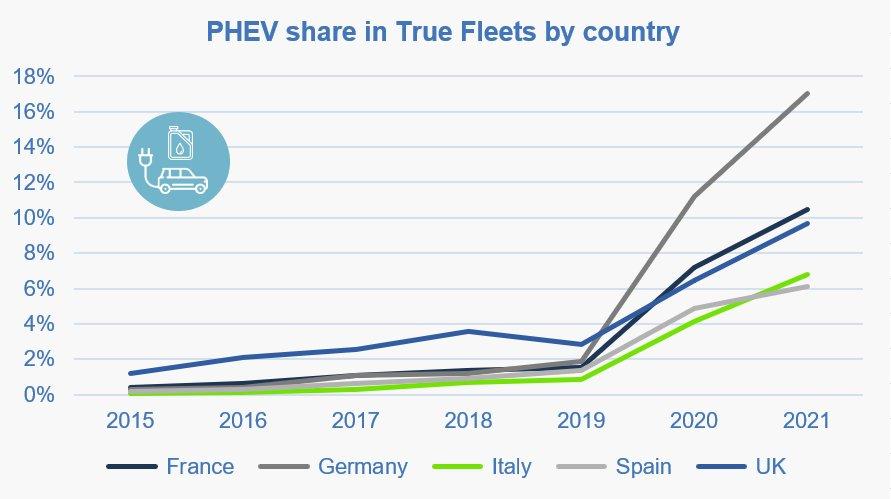

There are two major trends that can be observed in True Fleets: the rise of Plug-In Hybrids on one hand and the downturn of Diesel powertrains on the other. With 11.7% the PHEV share in all five markets reached a new record in January 2021. This is almost three times as high as seen in the Private sector and while it certainly isn’t the only reason for the attractiveness of this fuel type, the current support and appealing taxation for company car drivers is surely helpful. France, UK, Italy and Spain all show increases in the share of this fuel type but Germany in particular stands out. After an already huge growth over the last two years, January 2021 showed a remarkable share of no less than 17% of all the True Fleet registrations as coming with a PHEV powertrain!

The performance of German manufacturers in their home market is plainly visible as they absolutely dominate the market. Mercedes, BMW, Audi and Volkswagen represent a share of almost 70% of all PHEVs registrations from the Fleet Market followed by Skoda and Volvo, as most successful importer brands.

On the other hand, the diesel share of 42% in EU-5 is lower than ever before and declined in all five countries. Again, Italy is slightly departing from his norm with a stable Diesel share of 59.9% which is by far the highest of these five markets.

From 2015 to today, the share of diesel in the EU-5 Fleet Market decreased by 30 percentage points overall (from 72.5% to 42.0%). This decline was particularly strong in Spain and the UK where Diesel share has more than halved during this period. In some vehicle segments – especially Minis and Small Cars – diesel powertrains are already in the minority or have completely disappeared. Elsewhere, the downward trend is also visible from the high-volume segments, where this fuel type is massively losing ground, dropping to a share of only 40%.

Outlook? Go(ing) Alternative!

10 years ago, only few market observers would have thought that pure petrol and diesel vehicles would no longer play a dominant role in the future. This has certainly changed. In 2021 there will be a huge bunch of new fully electric cars entering the European market and in addition the product range of PHEVs will continue to expand significantly. Given this influx of new models and model drivetrains it will certainly contribute to a further shift from Petrol/Diesel towards EV and Hybrid passenger cars. How far? This is still unclear at this stage but as always, we will keep a close an eye on the figures and certainly the development of the Fueltypes from the European marketplaces.

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Telefon: +49 (69) 95930-231

Fax: +49 (69) 95930-333

E-Mail: michael.gergen@dataforce.de

![]()