Swiss passenger car market in December 2020

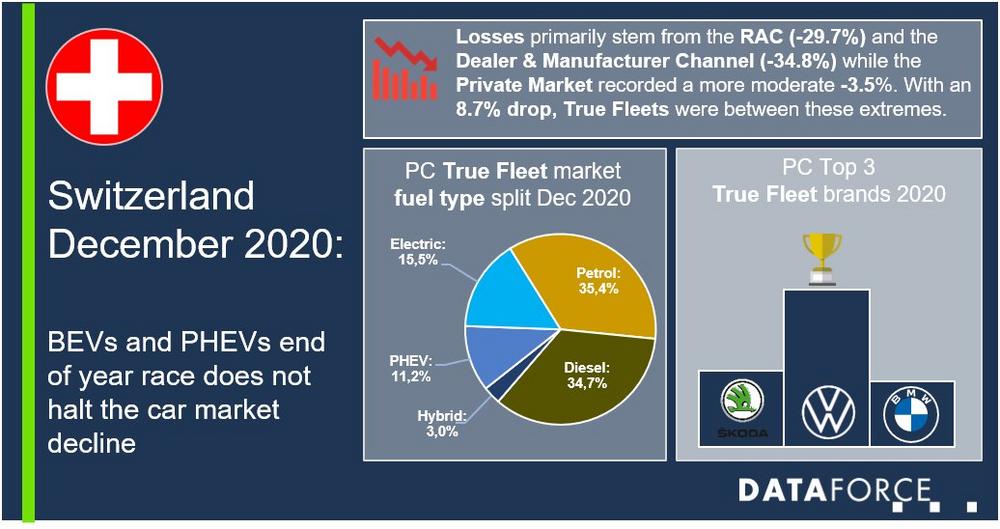

In the last month of the year, the downward trend in the Swiss passenger car market also continued(- 16,0%). Registrations in the Private market fell by 3.5%. Commercial registrations, on the other hand, were much more strongly affected, falling by 25.1% compared to the same month last year.

None of the detailed commercial channels was able to escape the previously mentioned negative developments in December, even if they differed significantly from one another in some cases: Registrations in the True Fleet market fell by 8.7%, while for car rental companies they were even 29.7% below the previous year’s level. The registrations of Dealers/Importer also slumped again in the last month of the year (- 34,8%), however, to correctly classify this, the high level of this channel in the previous year’s December 2019 should be taken into account. These can certainly be linked to the new CO2 limits that came into force from January 2020.

For 2020 the following picture for the Commercial Detail Channels emerges: Company registrations in the True Fleet market were ultimately a good fifth below the previous year’s level. Registrations of Dealer/Importer lost 30.6% and registrations by car rental companies even fell by 34.3% compared to the previous year.

True Fleet market: Volkswagen, Skoda and BMW are the top 3 importer brands 2020

Within the top 15 importers, some brands can look back on a successful December despite the difficult market environment. Among others, Opel (+ 91.7%), Fiat (+ 56.8%) and Tesla (+ 18.7%) were noteworthy.

Fleet vehicles with alternative powertrains continued to be the focus of Swiss fleet managers in December (+ 68.9%). In the last month of the year, 45.9% more electric vehicles were registered. The growth of plug-in hybrid models was even stronger (+ 248.5%). For 2020 as a whole, the registrations of plug-in hybrids within the True Fleet market were cumulatively 197.4% higher than for the same period last year. The Volvo XC60 was the most popular model, ahead of the BMW X1 and the Volvo V60.

Market development of light commercial vehicles up to 3.5t

After the positive developments in November, the market for light commercial vehicles up to 3.5 tonnes slipped significantly into the red again for December (- 21.9%). Once again, this was due to the tactical channels: Registrations of Dealer/Importer slumped by 66.9 percent and those of the car rental companies by as much as 68.1 percent compared to the same period last year. Again, in order to correctly classify these figures, the extremely high level of both channels from December 2019 should be considered.

Registrations in the private market, on the other hand, were 20.7% above the previous year’s level. The channel with the highest volume, the True Fleet market, also declined only slightly by 2.1% in the last month of the year. For the corporate vehicle channel, this means a cumulative minus of 11.6% for 2020.

Within the top 10 importer brands in the True Fleet market, Renault (+ 74.5%), Peugeot (+ 49.2%) and Citroen (+ 43.1%) stood out in particular with the highest growth rates over the previous December. With a cumulative market share of 22.8% in 2020, Volkswagen were the most sought-after importer brand among Swiss fleet managers, the same as seen in the passenger car segment.

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Telefon: +49 (69) 95930-265

Fax: +49 (69) 95930-333

E-Mail: christian.spahn@dataforce.de

![]()