The EU-8

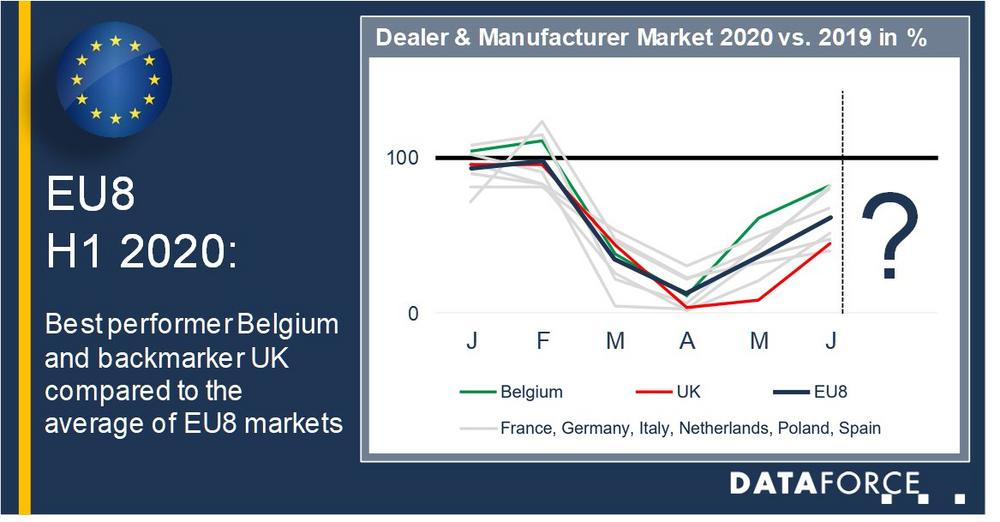

The countries of the EU-8 could be deemed the core of the automotive market in Europe, making up approximately 80% of all the new car registrations. Those countries have seen some 660,000 Dealer & Manufacturer registrations for June YTD 2020 down from the about 1,160,000 seen in same time period of 2019 or a drop of 43.2%. However, the monthly comparison for June 2020/2019 shows a drop of only 36.4% which in comparison to May’s contraction of 59.7% or April’s reduction of even 82.1% certainly shows it is moving once again in the right direction.

Now what is deemed a healthy mix number for those Dealer & Manufacturer registrations is certainly open to conjecture given the sometime tactical nature of these registrations, but in an industry needing a jump start the registrations from this channel are a welcome sight.

Fast (est) bounce back markets

When looking at the recovery of the Dealer and Manufacturer registrations it came as quite a surprise that the quickest market was in fact Belgium. In April this channel was showing a – 88.9% in comparison to 2019. However, for June it was down by just 18.1% and at the half year mark it showed a year to date drop of just 33.2%.

Now as Belgium has no home grown OEMs, the expectation here was that either Germany or France would see the quickest recovery of the demo/manufacturer registrations, especially the German market which is the most prolific market for this channel in Europe, with over half a million cars for Jan-June 2019. And indeed, year-to-date the German and French markets are next in the recovery line down by 37.9% and 38.8% respectively while Italy, the UK and Spain are each still – 50% below 2019’s YTD totals.

Now some questions remain: Will vehicle production continue to ramp up to last year levels or will the OEMs keep it somewhat muted? If production levels return will this translate to a push in the Dealer & Manufacturer channels towards the end of the year, especially as the RAC channel remains muted in comparison?

At this time, what is certain is that the channel mix movements and their pace, or lack of, will become more and more interesting especially as the first steps of the recovery are laid out and national or European stimulus plans are decided on or put into place.

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Kontakt für Presse

Telefon: +49 (69) 95930-232

Fax: +49 (69) 95930-333

E-Mail: Benjamin.Kibies@dataforce.de

![]()