Catch-up effects may conceal the economic impact

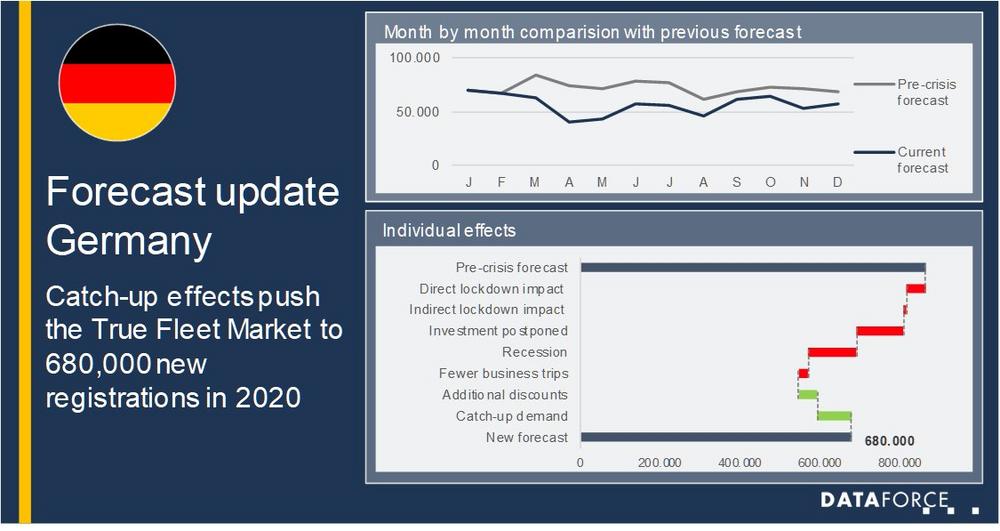

Catch-up effects will boost registrations, particularly between June and September. Many vehicles that were ordered at the turn of the year 2019/2020 are now rolling to customers somewhat delayed.

This also implies, that the full effect of the lockdown will only become visible once this special effect has subsided. The same applies to cancelled orders, which are usually reflected in new registrations only after a delay of three to six months.

Above all, the economic uncertainty continues to lead to a certain degree of reluctance. In April, up to 40 percent of companies have suspended their vehicle orders. Many fleet managers are also reporting higher cost pressure, which in some cases will even lead to a reduction in fleet size over the medium term.

The fleet business in particular can be stimulated by discounts

Then again, manufacturers and retailers have now responded to the demand shock. They introduced price promotions under the absence of government subsidies for pure combustion engines.

Fleet customers can also benefit from these programs. Leasing in particular offers potential. If a company can retain or even decrease the monthly rate for a new vehicle, it has a strong incentive to renew the car as initially planned.

Fleets need more flexibility

The impact of the pandemic on long-term mobility behaviour is currently still difficult to predict. The number of people commuting to work will probably continue to be down for the coming quarters. On the other hand, the importance of having your own car has increased. Especially in the winter months, this will lead to more crowded roads.

At the bottom line, such contrasts reinforce the trend towards more flexible usage concepts. Each fleet operator must individually decide whether this can be served by additional pool cars, medium-term rentals, or car sharing/short-term rental. According to a Dataforce survey, 42% of German fleet managers would use car subscriptions in the future, whereas the current rate is just 5%[1].

More details regarding the Dataforce forecast product can be found at https://www.dataforce.de/en/forecast/

[1] https://www.dataforce.de/news/infografik-car-sharing-auto-abo-in-deutschen-unternehmen/

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Junior Marketing Manager

Telefon: +49 (69) 95930-353

Fax: +49 (69) 95930-333

E-Mail: claudia.articek@dataforce.de

Kontakt für Presse

Telefon: +49 (69) 95930-232

Fax: +49 (69) 95930-333

E-Mail: Benjamin.Kibies@dataforce.de

![]()